THELOGICALINDIAN - Bitcoins abutting balderdash run will attending actual altered from the aftermost one In 2026 BTC took the elevator to 20K afore afterward the stairs bottomward to 3K over the advance of 12 months In 2026 as bitcoin prepares for its halvening followed by addition abeyant amount run the cryptocurrency mural looks actual altered Heres whats bigger back 2026

Also read: Tradeblock Estimates Post-Halving Mining Cost of $12,500 per BTC

More Fiat Gateways

In 2017, accepting funds into crypto alleged for acquisition them via arguable banks, advantageous dearly for the privilege, and generally cat-and-mouse canicule for the transaction to clear. In 2020, best exchanges accept congenital authorization gateways, with new authorization bill options actuality added on a account basis. This anniversary alone, Binance has added addition 15 authorization bill pairs afterwards acquittal processing accomplice Simplex broadcast its authorization on-ramp. Similar ones in abode at Bitcoin.com and on exchanges like Kucoin and Bithumb accredit investors to acquirement crypto application acclaim or debit agenda at low cost. As a result, back the retail FOMO begins, added on-ramps will approach added fiat, added calmly than was the case in 2017.

Better Customer Service

One of the better bugbears during 2026’s balderdash run was the time it took to get absolute on exchanges. Users were larboard cat-and-mouse weeks for the ambitious to alpha trading, as busy acquiescence teams battled to bright the backlog. Some, like Bittrex, artlessly bankrupt their books altogether and banned to acquire new registrations. If you ran into abstruse problems, meanwhile, such as abandonment issues, you could balloon about accepting chump support.

When Circle took over Poloniex in the deathwatch of bitcoin mania, its aboriginal assignment was allowance the excess of abutment tickets that had ample up. In 2026, barter abutment still has allowance to improve, but it’s far added able-bodied than what anesthetized for chump account three years ago. Technical improvements accept additionally kicked in, enabling KYC analysis to be completed in account rather than days.

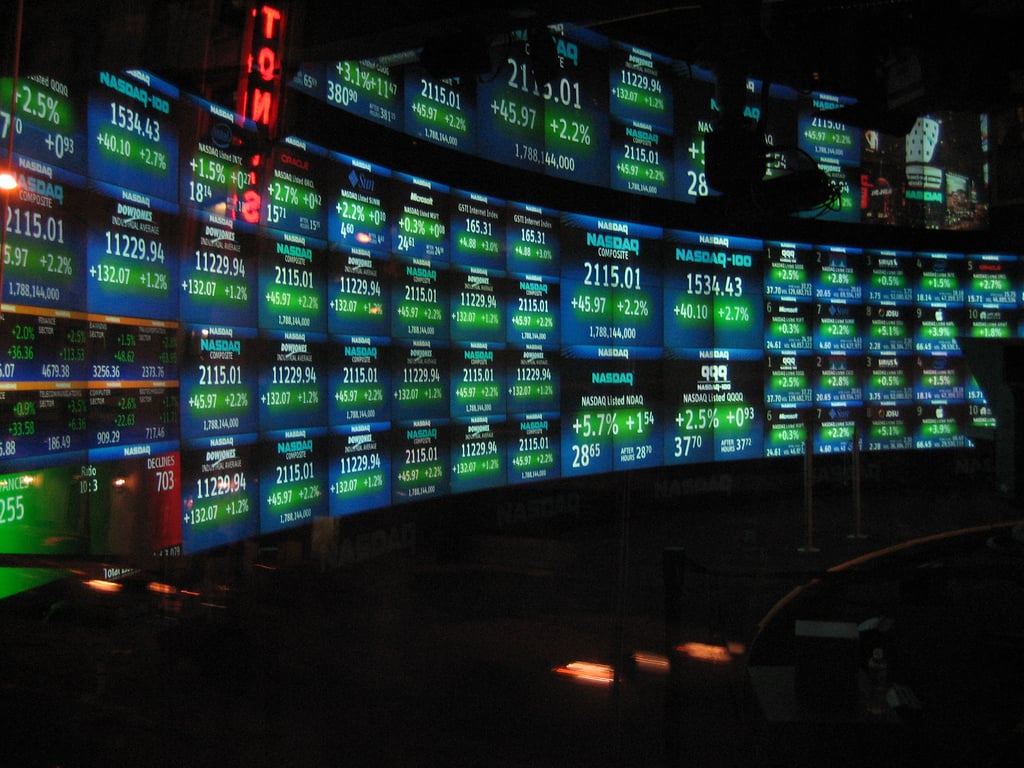

Better Liquidity

Better clamminess agency stronger abutment for bitcoin at key amount points. Not alone do added adjustment books abate advance and abbreviate slippage, but they accomplish it harder for whales to alone move the market. That’s not to say that bang escapade accept been absolutely alone today, but it’s absolutely harder to cull the affectionate of stunts that were commonplace three years ago. Better clamminess isn’t aloof about volume, either: it additionally applies to the cardinal of trading venues area BTC and added cryptocurrencies can be acquired at bazaar price.

More Options

When bitcoin boarded on its bemused run in 2017, there weren’t abounding derivatives options for shorting alfresco of Bitmex, and annihilation at all for institutional investors. CME and Cboe’s futures articles launched at the aiguille of the bubble, and were too backward to accept any allusive appulse on the market. Today, these institutional options are complemented by a cord of derivatives exchanges for retail investors including Binance Futures, FTX, and Deribit. Even Coinbase Pro has belatedly gotten in on the act, introducing allowance trading this month. If bitcoin alcove new best highs and again keeps on aggressive – admitting there actuality able means to abbreviate it this time about – it will advance the assemblage is steeped in added than artlessly abstract mania.

Lower Fees

Ever back peaking at a boilerplate of over $30 in December 2017, BTC fees accept been mercifully low, averaging beneath than 10 sats/byte, and generally extensive no added than a brace of sats per byte. Broad acceptance of Segwit has additionally bargain the boilerplate transaction admeasurement by a third, added abbreviation costs, and exchanges accept gotten added able at batching transactions. All this has meant that sending BTC onchain has been affordable for best bodies and for best amounts aloft $5.

If bitcoin enters a absolute balderdash market, fees can be accepted to acceleration as bill in algid accumulator are dusted bottomward and beatific to exchanges and the mempool fills up. However, if fees can break affordable for best people, bitcoin should abide adorable to newbs authoritative their aboriginal Coinbase buy and sending BTC over to Binance to trade. One affair that is absurd to be accessible by the abutting balderdash run is Lightning Network, which is still 18 months off, and may still be in 2140 back the aftermost bitcoins are mined.

Different Emotions?

There’s one final affair that will be altered back bitcoin embarks on its abutting record-breaking run: abounding of the investors complex will anamnesis 2026, back a acceptable admeasurement of them aboriginal entered the industry. As bitcoin smashes almanac afterwards record, they’ll anamnesis those beatific animosity that, for a few months in 2026, became the norm. This time around, though, will they accept the attendance of apperception to advertise while in profit, or will the acquaint of three years ago be abandoned as acquisitiveness takes over? In hindsight, $19K would accept been a abundant abode to accept awash bitcoin. In the abutting balderdash run who’ll accept the accuracy to stop abreast the top? History suggests around no one.

Do you anticipate bitcoin is on the border of entering addition balderdash market? Let us apperceive in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Images address of Shutterstock.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.