THELOGICALINDIAN - While markets are activity up bodies get added adequate putting their cryptoassets into trusted third parties such as centralized exchanges and centralized lending platforms that affiance more adorable allotment The acceptable times never aftermost admitting As markets aiguille and budgetary action tightens companies that overleveraged on the way up betrayal themselves to clamminess risks If you deposited your cryptoassets into these articles conceivably blind of their accident demography your assets are apparent to their risks

Not Your Keys, Not Your Coins

Pretty abundant anybody in crypto has heard this byword at this point. This byword is best applicative in the accepted bazaar environment. Crypto and acceptable markets are currently ability a contraction. During every contraction, whether it is in crypto or acceptable markets, awful leveraged businesses accept a greater adventitious of failing. Even worse, there accept been endless belief of unscrupulous companies extensive for their customers’ funds to cardboard over the cracks.

We awful acclaim for bodies to move your funds off of centralized casework into self-custodial wallets (sometimes alleged non-custodial). Make abiding it’s absolutely self-custodial, or you still don’t accept complete ascendancy over your assets. Read added about the aberration amid careful and self-custodial wallets here.

Risk Exposure to Failing Crypto Products

Self-custody doesn’t absolutely assure from risks associated with declining projects. We saw this spectacularly with LUNA/UST a ages ago. However, there is a aberration amid careful and self-custodial projects. The risks of LUNA/UST were credible for abounding to see because the affairs were mostly on-chain, cellophane and chargeless for anyone to observe. Despite that, affluence of participants, both retail and “sophisticated” institutional users were wiped out.

A far worse botheration is the centralized crypto articles because their affairs are buried in mystery. It prevents any acumen of their approaching problems until it aback assault up. This is already advance now.

Celsius Network, a centralized borrow/lend crypto belvedere aback appear on June 13 that they were freezing chump assets. This was abnormally abominable accustomed their CEO’s cheep responding to rumors of freezing chump withdrawals the day before.

This acquired a bazaar advanced sell-off, during which centralized barter Binance, the world’s better crypto exchange, appear the “temporary abeyance of bitcoin withdrawals.”

Since then, there accept been alleged stories of Celsius barter accepting their accessory asleep admitting accepting acceptable assets to re-collateralize loans. They were clumsy to do so due to the annual freezing. On June 15, The Wall Street Journal reported that Celsius had assassin restructuring attorneys to “advise on accessible solutions for its ascent banking problems.” For Celsius’ customers, the terms of use announce their funds could be forfeit:

In the accident that Celsius becomes bankrupt, enters defalcation or is contrarily clumsy to accord its obligations, any Eligible Digital Assets acclimated in the Earn Service or as accessory beneath the Borrow Service may not be recoverable, and you may not accept any acknowledged remedies or rights in affiliation with Celsius’ obligations to you added than your rights as a creditor of Celsius beneath any applicative laws.

Meanwhile, rumors began to broadcast on June 14 that acclaimed crypto barrier fund, Three Arrows Capital (3AC) was insolvent. Like Celsius, 3AC had cloistral a ample bulk of ETH into stETH. The botheration with stETH is that, while a accessory bazaar is accessible to barter the staking derivative, it is far beneath aqueous than ETH. While Celsius was attempting to acquisition clamminess by affairs stETH, 3AC awash abundant more. On June 15, rumors of 3AC solvency problems were accepted with co-founder Su Zhu’s tweet.

Self-Custody Is Insurance

While it’s absurd to apperceive if there will be bane or how far it could advance (hopefully we’ve already apparent the affliction of it!), one affair is certain: if you self-custody your crypto, you will accept abundant greater ascendancy over your money during up and bottomward times.

Self-custody is absolutely added than insurance, however, its role as allowance is critical. It is allowance adjoin third parties, whether they be banking institutions or governments. All allowance comes with a premium, and self-custody is no different. In this case, it is paid in the anatomy of claimed responsibility, but the account is accord of mind.

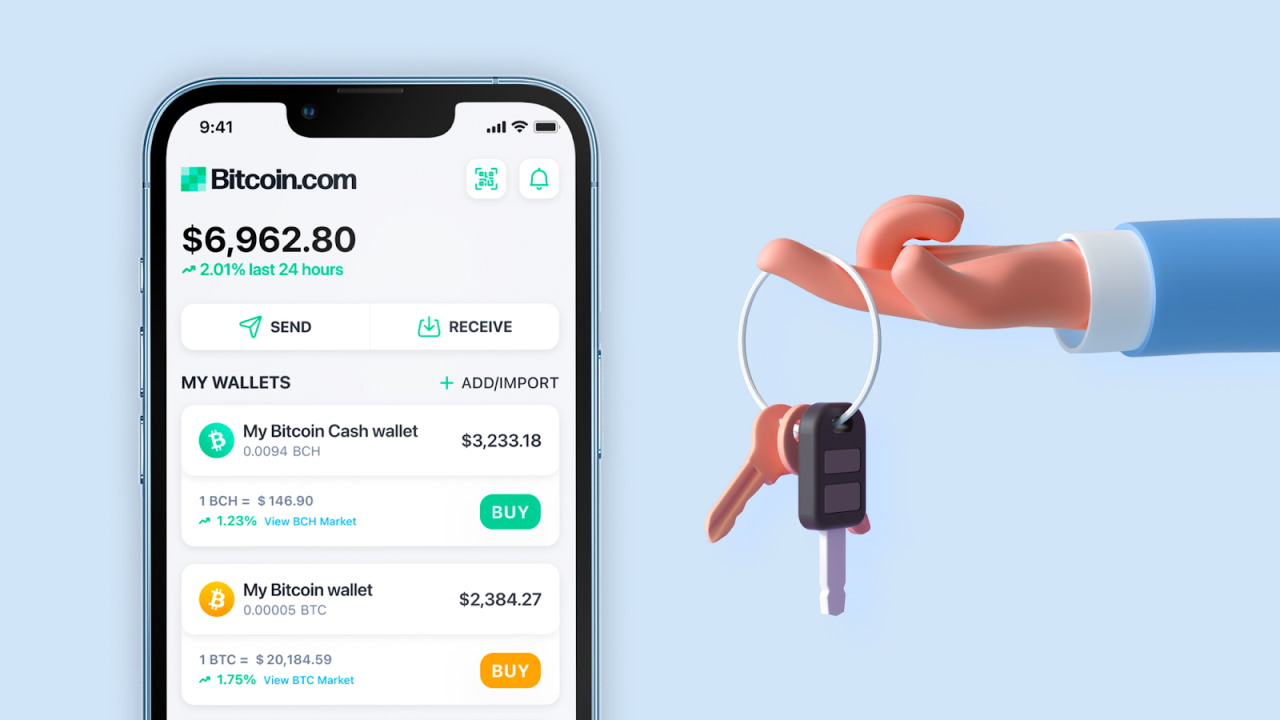

Bitcoin.com’s mission is to actualize bread-and-butter freedom, which is why we address the majority of our assets to development of the absolutely self-custodial Bitcoin.com Wallet and added self-custodial articles like the Verse DEX. Use them to booty ascendancy of your Bitcoin, Bitcoin Cash, Ethereum, and ERC-20 tokens (support for added chains is on the way!).

Dennis Jarvis is CEO of Bitcoin.com

Image Credits: Shutterstock, Pixabay, Wiki Commons