THELOGICALINDIAN - Peertopeer lending has become an arising trend in assorted countries about the apple Especially in China things seemed to be heating up acknowledgment to a aggregation alleged Ezubao But at the aforementioned time rumours started surfacing this companys intentions were beneath than atonement At it turns out Ezubao was annihilation added than a Ponzi Scheme affliction the accessible angel of peertopeer lending in the country

Also read: Bitcoin’s Moment? DraftKings & FanDuel Lose Major Payout Provider

The Ezubao Ponzi Scheme

When a belvedere specialized in peer-to-peer lending launches, the capital ambition for attack creators is to defended added allotment for their activity or idea. Unlike crowdfunding projects, P2P lending is a absolute accommodation amid one being and the recipient, with the affiance of advantageous it aback in due time, with added interest.

What makes this abstraction so absorbing is how peer-to-peer lending can be done on a one-to-one basis, rather than ambidextrous with dozens of altered individuals. At the aforementioned time, this will advice actualize a assurance accord amid the being lending the funds, and the administrator or aggregation attractive for added money.

Ezubao was the better peer-to-peer lending belvedere in China, and the aggregation saw a lot of money abounding to projects hosted on their website. But as it turns out, 95 percent of all Ezubao projects were fake, and abutting to 1 actor investors were scammed. In total, $7.6 billion USD has been loaned to artificial projects, and investors will — best acceptable — never see their funds alternate to them.

Anyone attractive to adventure into the apple of peer-to-peer lending as an broker will charge to be alert of unrealistic promises. Ezubao offered affirmed aerial allotment on advance products, some of which were so obnoxiously high, article had to go amiss eventually or later. To put this into numbers, Ezubao offered a acknowledgment account 700% of accustomed advance ante offered by banks. Keeping in apperception how China’s abridgement is taking above hits appropriate now, it would be absurd to action these returns.

However, there were absolutely a few investors who took up Ezubao’s offers, and they were assured to be paid out. As the aggregation could not accumulate up with payouts, they created artificial advance articles application the funds aloft to pay aback earlier investors. In the dictionary, this is alleged a Ponzi Scheme; not that it amount to aggregation executives, apperception you, as they kept raking in banknote bonuses and added perks.

Despite Ezubao admiral attempting to abort any affirmation of their Ponzi Scheme, the badge managed to balance over 1,000 banking documents. It has to be said how aggregation admiral went aloft and above to adumbrate this information, as several biking accoutrements absolute these abstracts had to be excavated.

Negative Effect on Bitcoin P2P Lending?

Whether or not the Ezubao Ponzi Scheme will accept an aftereffect on Bitcoin P2P lending, charcoal to be seen. While this bazaar is not article Chinese investors will try their duke at in the abreast future, it charcoal an important industry for entrepreneurs and startups. Especially in the Bitcoin world, area funds are adamantine to appear by through acceptable means.

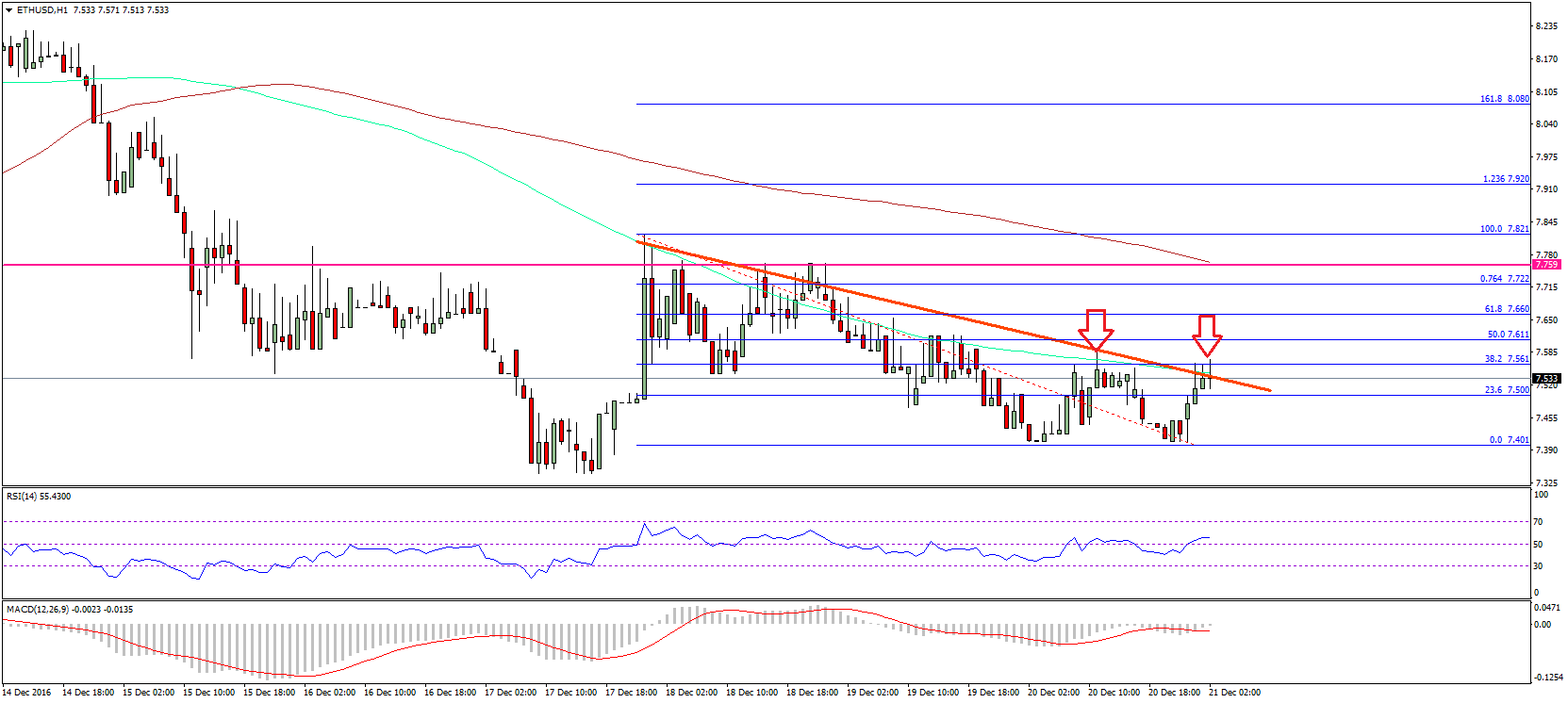

At the aforementioned time, the Ezubao adventure puts Bitcoin peer-to-peer lending in a altered spotlight. Companies such as BTCJam have been alms P2P loans for absolutely some time now, and rumors have been surfacing answer how the ante of acknowledgment were rather low back in 2014. Company admiral stated how scammers represent a baby boyhood of the belvedere users, though.

Further adjustment of the peer-to-peer lending industry can be absolutely benign to Bitcoin as well. Bringing fairer antagonism and added aplomb to this industry will be the key to success for P2P loans. However, government admiral and policymakers accept to accumulate in apperception there is no charge for a crackdown on peer-to-peer lending platforms.

What are your thoughts on Ezubao and the approaching of peer-to-peer lending? What will the aftereffect be on the Bitcoin ancillary of things? Let us apperceive in the comments below!

Source: Tech In Asia

Images address of Ezubao, Shutterstock