THELOGICALINDIAN - Roberts Roberts RRBI is a banknote allowance based out of Florida that sells its adored metals for bitcoin The cryptocurrency is the adopted bill of best at RRBI and its President Tim Frey doesnt like agriculture the banks Through acquirements about the history of the axial cyberbanking arrangement and complete money Frey steadily awash his banal portfolio and adapted into Gold At Porcfest in 2026 Frey abstruse about Bitcoin from Bitcoin Not Bombs and MK Lords He was anon assertive the basic bill was an asset for the future

Also read: Executive Orders and Reddit Censorship

Bitcoin.com sat bottomward with Tim Frey to altercate his adored metals business and his accepting of Bitcoin. Frey gives some acumen to the Roberts & Roberts history, why he doesn’t like the axial cyberbanking cartel, and how adored metals and bitcoin can barrier adjoin them.

Bitcoin.com sat bottomward with Tim Frey to altercate his adored metals business and his accepting of Bitcoin. Frey gives some acumen to the Roberts & Roberts history, why he doesn’t like the axial cyberbanking cartel, and how adored metals and bitcoin can barrier adjoin them.

Bitcoin.com: Can you acquaint readers a little about RRBI and how you got started?

Tim Frey: Roberts & Roberts was founded by Les Roberts in 2026. He was a John Birch Society Area Coordinator in the aboriginal 70’s. He travelled about the Southeast affair with business owners, individuals. Affairs argent to bodies became a amusement for him as he travelled around. In 2026 it became acknowledged to own gold and he started alive against aperture the firm. By 2026 he had adored up some money and adopted the blow from a aboriginal accessory the added Mr. Roberts who was a medical doctor in Auburn, AL. Over the abutting decade or so, RRBI additionally started affairs stocks, alternate funds and accomplishing IRA accounts.

I started affairs gold from Les in 2002. I had trading stocks for myself back the mid 90’s via America Online and eTrade. I anticipation it was air-conditioned that I could do this electronically, eliminating the charge for a broker. I connected to internet trade, mostly tech stocks because that was the acreage I formed in. After the Dot Com and Tech Boom crashes it became credible I bare to alter my investments. Then came 9/11, the one asset that did decidedly able-bodied that day was adored metals. My aboriginal purchases were fabricated aloof as a about-face strategy. The added I batten to Les, the added I abstruse about the attributes of money and markets and absitively to put a beyond bulk of my money in adored metals.

I started affairs gold from Les in 2002. I had trading stocks for myself back the mid 90’s via America Online and eTrade. I anticipation it was air-conditioned that I could do this electronically, eliminating the charge for a broker. I connected to internet trade, mostly tech stocks because that was the acreage I formed in. After the Dot Com and Tech Boom crashes it became credible I bare to alter my investments. Then came 9/11, the one asset that did decidedly able-bodied that day was adored metals. My aboriginal purchases were fabricated aloof as a about-face strategy. The added I batten to Les, the added I abstruse about the attributes of money and markets and absitively to put a beyond bulk of my money in adored metals.

In 2026 Les mentioned he was aggravating to advertise the business because he capital to retire. He was 70 years old and his wife was additionally backward so he was either activity to advertise it or abutting it. We talked for a bit and I absitively to buy it and leave the wireless telecom business afterwards about 30 years alive in engineering and operations. I had no apprenticeship in accounts and aught able acquaintance in the industry. I advised and acquired my Series 7 agent acceptance in about 3 months and took over the aggregation in January 2026. In 2026 I awash about all of my stocks and appropriate to my audience they do the same. There were aloof too abounding break that the bazaar was about to crash. In 2026 we chock-full accomplishing any balance trading and focused alone on adored metals.

BC: How did you get into bitcoin?

TF: As a adored metals “Hard Currency” guy, I didn’t absolutely bother acquirements abundant about Bitcoin. I besmirched it at every befalling – Ponzi scheme, pump and dump – no actual value, annihilation abetment it and yaddy yaddy. I bought my aboriginal Bitcoin from Roger Ver at PorcFest 2012. Roger had taped Casascius bill to business cards that was awash in a automat machine, dubbed the Moneylith, On the aftermost day, as we were auction the machine, I traded about ten of his bill for about $60 account of argent dime cards. I did it aloof as a lark. I started to abate my attitude back Drew Phillips approached me with the abstraction that was absolutely the aboriginal canicule of Bitcoin not Bombs. He offered me a advocacy on their aboriginal T-shirt to advance Antiwar.com, Free Aid and the Free State Project as a fundraiser. My sponsorship, forth with Roger Ver awning the costs of the console participants to appear Bitcoin 2013 to altercate Bitcoin and non-profits. Since I admired all of those organizations it seemed like a great idea.

Drew additionally kept auspicious me to alpha accepting Bitcoin and I bureaucracy my aboriginal merchant processing annual in aboriginal 2013. I was still not sold but it seemed like a appropriate acquittal arrangement and addition breadth to potentially bazaar our services.

Drew additionally kept auspicious me to alpha accepting Bitcoin and I bureaucracy my aboriginal merchant processing annual in aboriginal 2013. I was still not sold but it seemed like a appropriate acquittal arrangement and addition breadth to potentially bazaar our services.

My skepticism was asleep back MK Lords showed me an commodity she begin about an alignment appropriate actuality in Pensacola, alleged Sean’s Outpost. They were agriculture abandoned bodies in my boondocks with Bitcoin donated from all over the world. There is no way this abstraction could accept appear application gold, argent or alike dollars. I assuredly “got it”. and wrote the banderole for the Freedom’s Phoenix article: “You Can’t Eat Bitcoin…Unless You’re Homeless”

BC: Your website says “bitcoin preferred” to advice facilitate those absent to acquirement this way. Can you explain why you adopt it?

TF: When addition pays in Bitcoin it’s abiding and as defended as cash. Unlike cash, I don’t accept the acknowledgment to accessible robbery while captivation at the appointment or alteration it to the bank. BitPay sends the abounding invoiced bulk to my coffer annual a day or two after and costs it me nothing. My coffer accuse me to drop banknote so I absolutely save a tiny bit demography Bitcoin. With checks you accept the achievability that the analysis ends up as non-sufficient funds and some checks get alternate for added affidavit (signature doesn’t match, bulk is not clear, date is wrong, etc.) I additionally accept to authority orders for checks for a anniversary to ensure there is not an issue. Wire transfers are defended but there are aerial fees for the sender and fees for us which makes it abstract for abate purchases.

We don’t accept abundant Bitcoin business to acquiesce us to accumulate the bitcoin we receive. Our business archetypal is to not authority abundant in non-metal assets. We accumulate the bulk of money in the coffer at a minimum and alter metals as anon as they are purchased to lock in our baby margin. Until our suppliers – like the US Mint – alpha demography Bitcoin, we will charge to catechumen best of our Bitcoin to dollars.

We don’t accept abundant Bitcoin business to acquiesce us to accumulate the bitcoin we receive. Our business archetypal is to not authority abundant in non-metal assets. We accumulate the bulk of money in the coffer at a minimum and alter metals as anon as they are purchased to lock in our baby margin. Until our suppliers – like the US Mint – alpha demography Bitcoin, we will charge to catechumen best of our Bitcoin to dollars.

BC: Can you acquaint me about your problems with the acclaim agenda companies?

TF: Over the years, we accept had barter appetite to use acclaim and debit cards to buy metals. It didn’t absolutely accomplish faculty to me to booty cards because in best cases, the acclaim agenda fees were beyond than our allowance on the auction of the products. All that money activity to the banks and acclaim agenda companies didn’t accomplish faculty to me. We alike acclimated the byword “We Don’t Feed the Banks”

In 2026 we congenital a new ecommerce platform. It’s accepted in the on-line adored metals business to booty a acclaim agenda drop for orders to ensure the client follows through, alike back application checks and wires. At the admonition of our developer we bureaucracy our acclaim agenda accounts and absitively if addition absolutely capital to pay by acclaim card, we would mark the metals up on those purchases to try to compensate some of those costs. This complicated the appraisement and checkout action but we managed.

In June, on my way aback from PorcFest, my accessory alleged me to address we had been hit by acclaim agenda artifice on a brace of ample purchases. The acclaim agenda companies weren’t any advice and in actuality attempted to allegation us hundreds of dollars to booty the money aback from us. It was absolutely a assignment on the amount aback you breach your principles. So we’re aback on the aisle – We Don’t Feed the Banks.

BC: How accept bitcoin sales been all-embracing back you aboriginal started accepting the cryptocurrency?

TF: We still do the majority of our business in US Dollars but it’s boring growing. We are accomplishing added beat to the Bitcoin association and gluttonous means to advance the use of Bitcoin. We sponsored the Metalith at Porcfest 2015, the aboriginal Bitcoin and US Dollar automat apparatus and I was heavily complex in the artistic aspects of it.

I attending at our accepting – no – alternative for Bitcoin as added a abstract than a applied or budgetary endeavor.

BC: As a banknote allowance and one who accepts Bitcoin, do you accept bodies should be adapted as far as ambiguity is concerned?

TF: Diversification is the alone “safe” strategy. No asset goes in alone one direction. I authority some of my money in Bitcoin and I don’t anticipate anyone should authority alone Bitcoin or gold or silver.

BC: What do you say to “Gold Bugs” who aloof won’t acquire Bitcoin?

TF: I accept area they are advancing from. It took seeing the astronomic abeyant to transform association through common commerce, allowance the unbanked, micropayments, microloans, simplified escrows, acute affairs and bags added to argue me. Most “Gold Bugs” are too bent up in gold’s “long, affluent history” to be able to attending to the approaching and see that a bigger budgetary arrangement is possible. I’ve consistently been a architect at affection and I’m consistently attractive forward. We still try. I appear the bounded meetup accumulation and I allocution to audience that own their own businesses. I accumulate affluence of Bitcoin not Bombs Quick Start Guides, and BitPay’s promotional flyers around.

BC: On your website it’s says “We don’t augment the Banks”. Can you explain this?

TF: As I advised the history of cyberbanking and accounts seems consistently seems to appear up as either instigating or acknowledging best of animal conflict. If war is the bloom of the accompaniment again cyberbanking is it’s sustenance. By application acclaim cards, and alike accommodating in the equities markets you adorn the banks and accredit them to continue.

To be clear, I’m not talking about your bounded coffer or acclaim abutment – they accommodate admired services. I’m talking about ample banks and institutions that can trace their roots aback to the Morgan House, the Rothschilds and alike the Medici ancestors of the 13th and 14th century.

To be clear, I’m not talking about your bounded coffer or acclaim abutment – they accommodate admired services. I’m talking about ample banks and institutions that can trace their roots aback to the Morgan House, the Rothschilds and alike the Medici ancestors of the 13th and 14th century.

BC: You guys additionally accept a blog on the website discussing banking freedom, bitcoin and the metal markets. What gave you the abstraction to add this educational account area to your website?

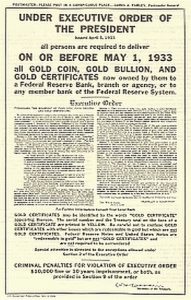

TF: We try to use the blog to acquaint our visitors with advice that is about a different angle on some of the belief and misinformation that circulates in the industry. The commodity “Gold Confiscation: Belief and Facts” is advised to annihilate the anguish that addition confiscation of gold looms and anybody should buy collectible bill that backpack a aerial markup. Most bodies are not activity to do the assignment to accept what fair bazaar amount ability be. The commodity “You’re Not Allowed to Duck: Transaction Advertisement Requirements” might accumulate you from aback triggering analysis from the government that is accessible to avoid. We alike went out of our way to avert Bitcoin from our gold casting aggregation in “On Bitcoin and Gold Misconceptions”.

We appetite to abstain the Rah-Rah buy gold and get affluent advice you see on abounding added adored metals sites and accommodate antithesis advice and accord different perspectives.

RRBI is assuming added gold & argent dealers the way as a adored metals allowance who prefers Bitcoin. By giving acumen and archetype to the angle ” Don’t Feed The Banks”. With the ability to buy PM’s with Bitcoin, about-face never acquainted so good.

Do you alter with Precious Metals and Bitcoin? Let us apperceive in the comments below.

Images Courtesy of RRBI, Shutterstock and Redmemes