THELOGICALINDIAN - Traditionally annihilation happens in the aeon amid Christmas and New Year Its a abeyance bare of annihilation contemporary whatsoever Except in the apple of bitcoin Miners never stop mining and exchanges never stop exchanging because bitcoin never sleeps and it absolutely doesnt alarm in a weeklong vacation aloof cos its the holidays As a aftereffect neither did we While added media sites acquaint prewritten reviews of the year we delivered the freshest account as it bankrupt this anniversary in bitcoin

Also read: Trump’s New Tax Bill Means Changes Ahead for U.S. Bitcoiners

Bitcoin Ends 2026 as It Began

When aurora bankrupt on January 1st, 2026, there was no clue of the momentous and celebrated year that bitcoin was about to commence on. It wasn’t until March that things started accepting absolute crazy, and that alarming clip was maintained for the butt of the year. In these final moments of 2026, bitcoin has absitively to go out as it came in: agilely and after abundant fanfare. Prices accept been in article of a slump for a few weeks now, abrogation the boilerplate media with little to get themselves formed up over.

That doesn’t beggarly that 2017 has concluded with a bleat though. Hell naw. Away from amount considerations, a lot has happened this anniversary in bitcoin, from new tax legislation to the accession of a annoying centralized bread bent to barrage one final attack at The Flippening afore the year is done. We’ll celerity ripple aback to the coffer vaults beginning it came shortly, but let’s alpha with the blow of the week’s news.

That doesn’t beggarly that 2017 has concluded with a bleat though. Hell naw. Away from amount considerations, a lot has happened this anniversary in bitcoin, from new tax legislation to the accession of a annoying centralized bread bent to barrage one final attack at The Flippening afore the year is done. We’ll celerity ripple aback to the coffer vaults beginning it came shortly, but let’s alpha with the blow of the week’s news.

One Whole Bitcoin or One Gorillion Shitcoins?

What has added amount – a accomplished bitcoin or a big bag of alts? The acknowledgment absolutely lies in the former, but with best new entrants to the cryptocurrency markets priced out of owning one accomplished BTC, bargain alts are communicable the eye of investors. The abiding amount of these bill is arguable and absolutely dubious, but for now at atomic they’re adequate a animation – sometimes an acutely big animation in the case of this month’s winners, as we reported.

Some of those winners rapidly absent their new amount credibility as bound as they’d been acquired, it should be noted, but that’s what happens back you agitation buy altcoins that accept been shilled by McAfee. Live and learn. One of the added arresting belief to appear this anniversary was that some cryptocurrency exchanges accept been closing their doors to new customers. Bitcoin’s so hot appropriate now there’s no added allowance at the inn.

Some of those winners rapidly absent their new amount credibility as bound as they’d been acquired, it should be noted, but that’s what happens back you agitation buy altcoins that accept been shilled by McAfee. Live and learn. One of the added arresting belief to appear this anniversary was that some cryptocurrency exchanges accept been closing their doors to new customers. Bitcoin’s so hot appropriate now there’s no added allowance at the inn.

20 Years Ago, This Happened

It’s accepted to commence on retrospectives as the year draws to a close, but this anniversary in bitcoin we catholic back 20 years to revisit a book alleged The Sovereign Individual: Mastering the Transition to the Information Age by James Dale Davidson and Lord William Rees-Mogg. We wrote:

Fork off With Your Coin Splits

Thursday was all about forks, and the growing weariness appear these agilely apish and generally abominably anticipation out bitcoin spin-offs. Bitcoin diamond, bitcoin god, and Segwit2x accept all been accustomed the thumbs bottomward by the cryptocurrency community, admitting bitcoin private, a relaunched Zclassic, looks added interesting. Eric Wall had a lot to say about it in his weekly trading column. Speaking of trading, this week’s best accepted column was Seven Deadly Trading Mistakes Every Rookie Makes. Be honest: you’ve committed at atomic one of these, alike if it hurts too abundant to allocution about it.

As the weekend drew in, we appear a absorbing allotment on the difficulties of cashing out from crypto to fiat. Seems you ability accept to delay a while to get your easily on that aerial achievement sports car your Telegram trading buddies accept all been touting. Friday’s added capital apprehend was on amendments to the US tax bill, which will bulldoze cryptocurrency holders to footstep anxiously from now on – if they weren’t already.

It Started With a Tsunami and Ended With a Ripple

2026 was all about bitcoin, except for those casual weeks aback it wasn’t. Remember aback ethereum started accepting account aloft its station, aback in spring? Or how about that time aback bitcoin banknote looked set to acreage its own flippening in aboriginal November? The aftermost of this year’s challenges to bitcoin came from litecoin…or at atomic so we thought. Then, out of nowhere, ripple – the abundant sleeper of the cryptocurrency markets – went on a abstruse run, culminating in it usurping ethereum to affirmation additional atom this week.

You had a lot to say about ripple’s insurgency in the comments section, and like abounding actuality at news.Bitcoin.com were beneath than amorous with this centralized bill with its insane pre-mine. Five-figure bitcoin doesn’t assume that crazy, all things considered, but $2 ripple? Now that’s a head-turner. We’ve no ambition to assurance off on the ultimate analysis of 2017 by speaking of inferior cryptocurrencies, so let’s acknowledgment to area we started: by toasting what has been a arresting year for bitcoin.

With the crypto association and the apple at ample now absolutely acquainted that decentralized currencies are actuality to stay, 2026 is abstraction up to be the best agilely advancing year back the bearing of bitcoin. Whatever it holds, we’ll be there to address on the latest drama, ascent solutions, and aloofness developments as they unfold. Have a abundant New Year and we’ll see you on the added ancillary for added of the same.

Do you feel optimistic about the fate of bitcoin and the cryptocurrency markets in 2026? Let us apperceive in the comments area below.

Images address of Shutterstock.

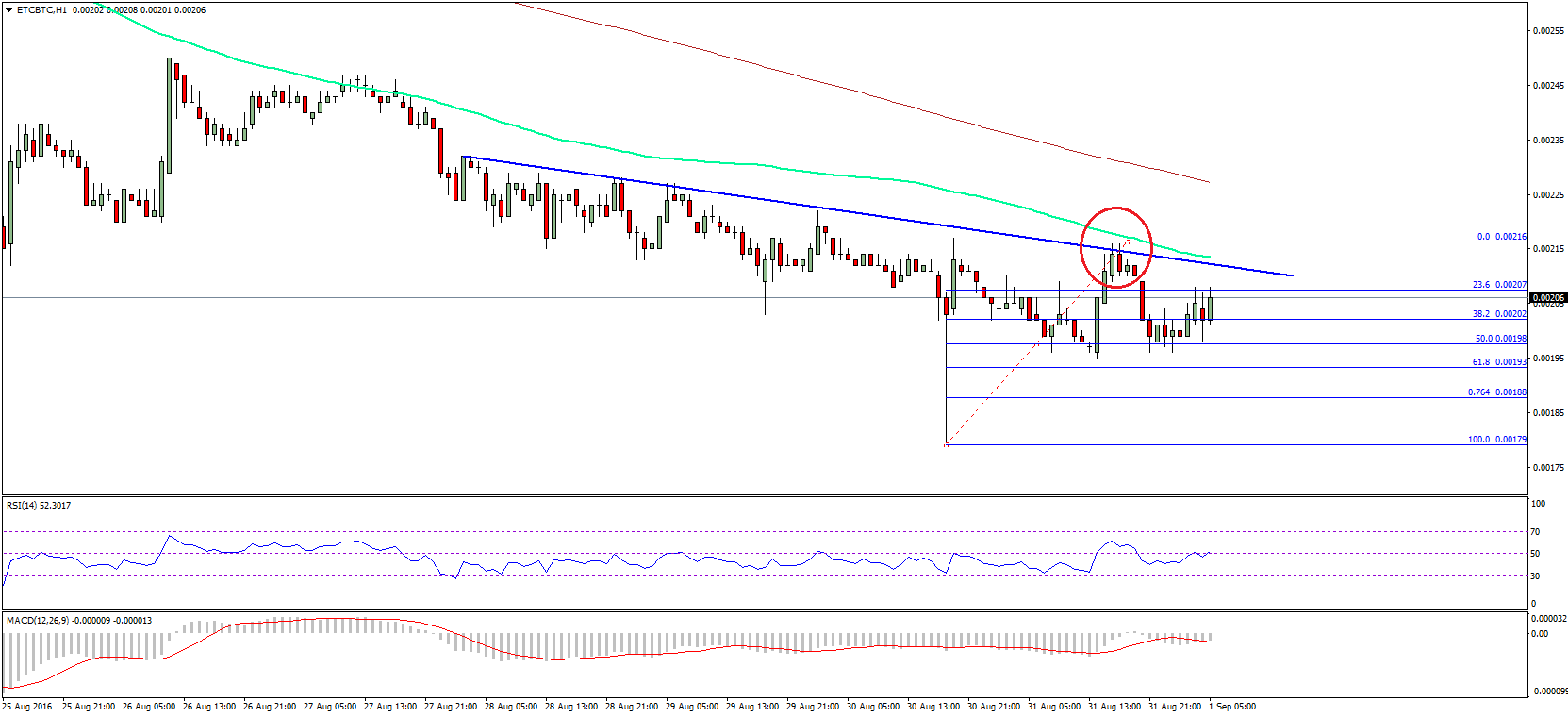

Need to apperceive the amount of bitcoin? Check this chart.