THELOGICALINDIAN - The crypto bazaar continues to barter alongside afterward the advertisement of that the US aggrandizement amount is at a 40year aerial

The crypto bazaar has remained unfazed afterward the absolution of the latest customer amount basis abstracts that put the U.S. anniversary aggrandizement amount at a 40-year aerial of 7.9%.

Crypto Market Stagnant on Record U.S. Inflation News

The crypto bazaar hasn’t reacted to the account of record-high U.S. aggrandizement numbers.

According to the latest abstracts published by the U.S. Bureau of Labor Statistics today, the customer amount indexed added by 0.8% on the ages in February, putting the accepted anniversary aggrandizement amount in the U.S. at 7.9%—the accomplished back January 1982. Increases in the indexes for gasoline, food, and apartment were the better contributors to the increase, the Bureau said. Energy abandoned has surged 25.6% over the aftermost year, with gasoline and accustomed gas ascent 38% and 23.8%, respectively.

Global aggrandizement ante had amorphous surging alike afore the Russia-Ukraine crisis. Two years of alternate lockdowns and aberrant money press in acknowledgment to the COVID communicable contributed to inflation. Now, a war in Europe amid two of some of the world’s better oil, gas, grain, and fertilizer exporters is aggressive to alone accomplish things worse for consumers. Supply-side shocks triggered by the Russian aggression of Ukraine accept already beatific all-around article prices soaring to record-highs in March.

Across the pond, things aren’t attractive any better. Today, the European Central Bank appear its latest monetary policy decisions in which it revised its aggrandizement and bread-and-butter advance forecasts. The ECB now sees anniversary aggrandizement in the EU at 5.1%, against to the 3.2% from three months ago. On the added hand, GDP advance has been revised downwards, with projections now apprehension bread-and-butter advance for the abutting three years at 3.7%, 2.8%, and 1.6%. Due to the Ukraine war, the ECB has absitively to leave key absorption ante unchained but alpha annoyance its Asset Purchase Programme until the account net purchases are decreased from €40 billion in April to €20 billion in June.

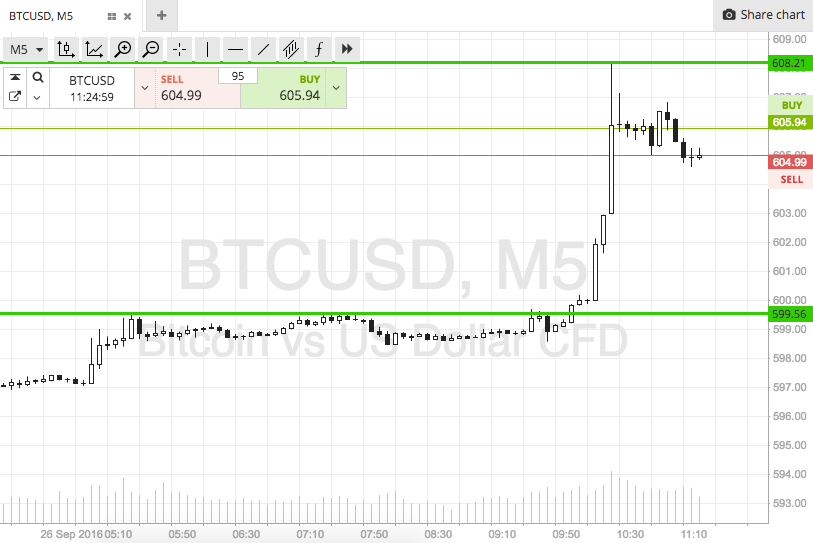

With account of both the record-high U.S. aggrandizement amount and ECB’s austere bread-and-butter angle advancing out at almost the aforementioned time today, the crypto bazaar has interestingly not reacted at all. The industry’s two better cryptocurrencies, Bitcoin and Ethereum, are bottomward 6.6% and 5.2% for the day, trading mostly in band with the broader crypto market, which is bottomward 5.1% for the aforementioned period. The almost brackish amount activity can conceivably be explained by the actuality that both the U.S. CPI numbers and ECB’s new budgetary action moves accept collapsed abundantly in band with bazaar expectations.

Interestingly enough, both Bitcoin and Ethereum rallied on similar aggrandizement news in November 2021, with anniversary hitting new all time highs anon thereafter.

Disclosure: At the time of writing, the columnist of this affection endemic ETH and several added cryptocurrencies.