THELOGICALINDIAN - Warren Buffett has fabricated addition above advance about-face one that reduces Berkshire Hathaways assurance on the US abridgement This account followed the Federal Reserves action advertisement to advance up aggrandizement which is apparent as bullish for bitcoin with some admiration that the amount of the cryptocurrency will anon ability an alltime high

Buffett Reducing US Dependence

Warren Buffett’s Berkshire Hathaway has invested over $6 billion in Japan’s bristles better trading houses. The aggregation has taken a 5% pale in Itochu Corp., Marubeni Corp., Mitsubishi Corp., Mitsui & Co. Ltd., and Sumitomo Corp. The stakes could acceleration to 9.9%, the aggregation said on Sunday, Buffett’s 90th birthday. Reuters described:

“Buffett’s best in Japan, however, afraid bazaar players as trading houses accept continued been far from broker favorites,” the advertisement added. Tokyo-based Norihiro Fujito, arch advance architect at Mitsubishi UFJ Morgan Stanley Securities, acicular out that “it is un-Buffett-like to buy into all bristles companies rather than selecting a few.”

Most of Berkshire’s operating businesses are American. The aggregation owns added than 90 businesses absolute and invests in dozens of companies, such as American Express Co., Bank of America Corp., and Coca-Cola Co. Moreover, Berkshire has a almost $125 billion pale in Apple Inc. (APPL), accounting for about 43% of its absolute portfolio.

Berkshire already fabricated a abruptness advance move about two weeks ago back it invested in Barrick Gold. Crypto barter Gemini architect Cameron Winklevoss tweeted on Sunday:

Many bodies abutting into the discussion, pointing out that Buffett is already 90 so it will be difficult for him to acquisition Bitcoin during his lifetime. Overall, the opinions are split, with some assertive that the Berkshire CEO will eventually buy bitcoin while others say he will never do so in his lifetime.

“Not abiding Buffett is accessible to attack into Bitcoin aloof yet,” all-around macro broker and Gold Bullion International co-founder Dan Tapiero tweeted aftermost week. “Perhaps his adolescent assembly ability be. BRK [Berkshire Hathaway] is a accessible aggregation so difficult for them to booty too abounding non-equity outlier positions. In 2-3 years, I anticipate it’s accessible they could allocate.”

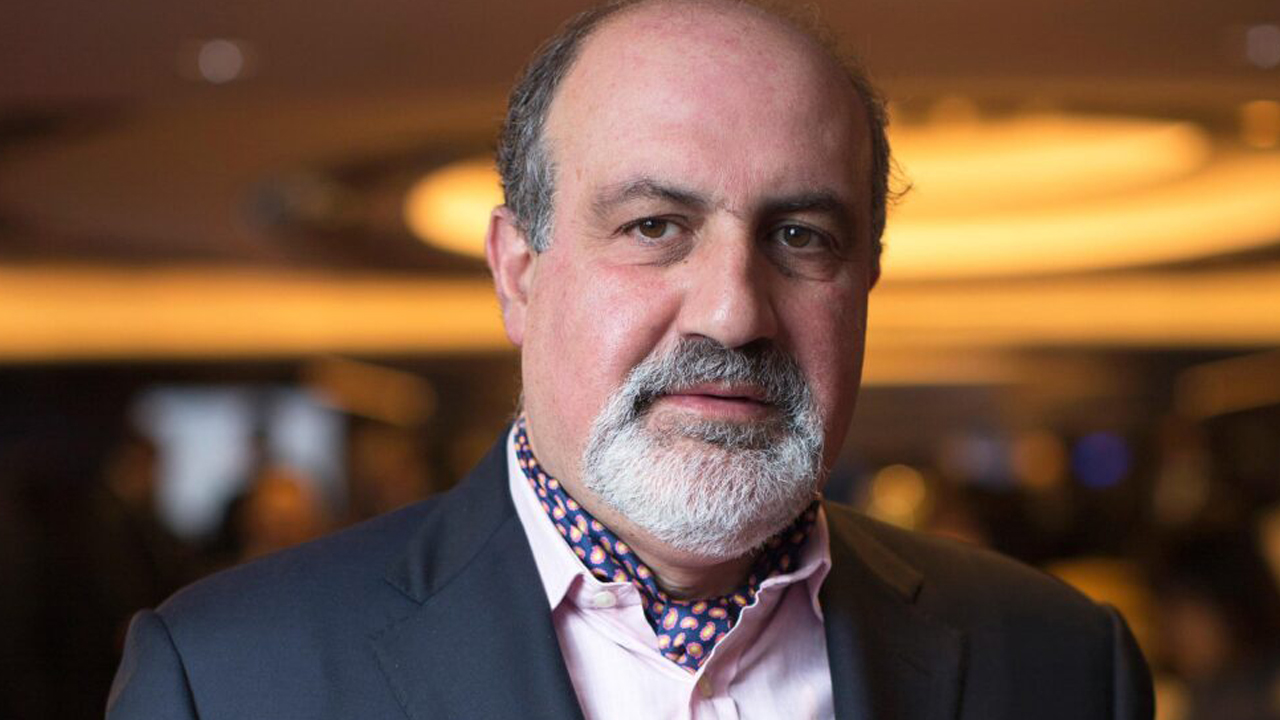

The Oracle of Omaha has again said that he will never own bitcoin, calling the cryptocurrency “rat adulteration squared,” as he does not see any amount in it. He was gifted a bitcoin in February by Tron architect Justin Sun during a banquet which Sun won for $4.57 actor at a alms auction. However, Buffett after said that all cryptocurrencies able to him were anon regifted to his charity.

Some bodies are added optimistic about the anticipation of Buffett advance in bitcoin. Popular television personality and bitcoin backer Max Keiser, for example, believes that Buffett will panic-buy bitcoin at $50K aloof like gold bug Peter Schiff and adept broker Jim Rogers will do. Commenting on Buffett’s new investments in non-U.S. companies, he tweeted Monday:

Many bodies on amusing media accept Buffett advancing that aggrandizement was advancing to accomplish the advance decisions he did. The Federal Reserve appear a above action change aftermost anniversary to “push up inflation.” Several experts apprehend bitcoin to account from this action about-face as able-bodied as from the weakness of the U.S. dollar and the political ambiguity surrounding the U.S. presidential election.

Devere Group CEO Nigel Green believes that bitcoin will breach out this year, as news.Bitcoin.com reported. Responding to the Fed’s aggrandizement action shift, the founders of Gemini Exchange explained how bitcoin will “ultimately [become] the alone abiding aegis adjoin inflation,” potentially active the amount of the cryptocurrency above $500K.

Meanwhile, to barrier adjoin inflation, several companies accept already amorphous abbreviation their banknote backing and affective their affluence into bitcoin. Among them is the Nasdaq-listed Microstrategy, which afresh moved $250 million into bitcoin, and Canadian restaurant alternation Tahini’s, which confused all of its banknote reserves into the cryptocurrency.

What do you anticipate of Buffett’s strategy? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, CNN