THELOGICALINDIAN - n-a

Yahoo Finance is partnering with CoinMarketCap to accommodate cryptocurrency advice and account to the broader market. With over 3.5 billion account visitors this may abundantly access the afterimage of Bitcoin and added another cryptocurrencies.

CoinMarketCap, the arch cryptocurrency bazaar abstracts website, will accommodate its cryptocurrency indices and educational advice on Yahoo Finance, Verizon Media’s account outlet. The indices accommodate real-time appraisement from over 200 exchanges and accord acknowledgment to the broader cryptocurrency bazaar by including it alongside metrics for assets that represent added than 90% of the all-around bazaar capitalization.

In addition, CoinMarketCap’s newsletter and blog agreeable will be chip into Yahoo’s cryptocurrency account stream, as able-bodied as on Yahoo’s afresh added cryptocurrency screener landing folio — about authoritative Yahoo an abundance of the CoinMarketCap website.

The affiliation will added access CoinMarketCap’s ascendancy as able-bodied as accommodate acknowledgment to readers who ability not accept ahead been complex in cryptocurrency. Despite Yahoo’s abatement from preeminence, Yahoo.com is still one of the best trafficked sites in the apple with an estimated 3.5 billion visitors per month. Yahoo’s Joanna Lambert said of the partnership:

“As cryptocurrencies abide to accretion attention, it’s capital that we aggrandize our crypto account and abstracts for millions of Yahoo Finance users beyond the globe. By partnering with CoinMarketCap, we can accommodate appropriate and reliable crypto advice to accommodated our admirers demand.”

As cryptocurrencies attempt to accretion validation in the apperception of the accepted public, the move could be a footfall appear authoritative cryptocurrencies added attainable and could comedy a allotment in greater adoption. For now, at least, it is a advance for greater assimilation of crypto in the boilerplate advance portfolio.

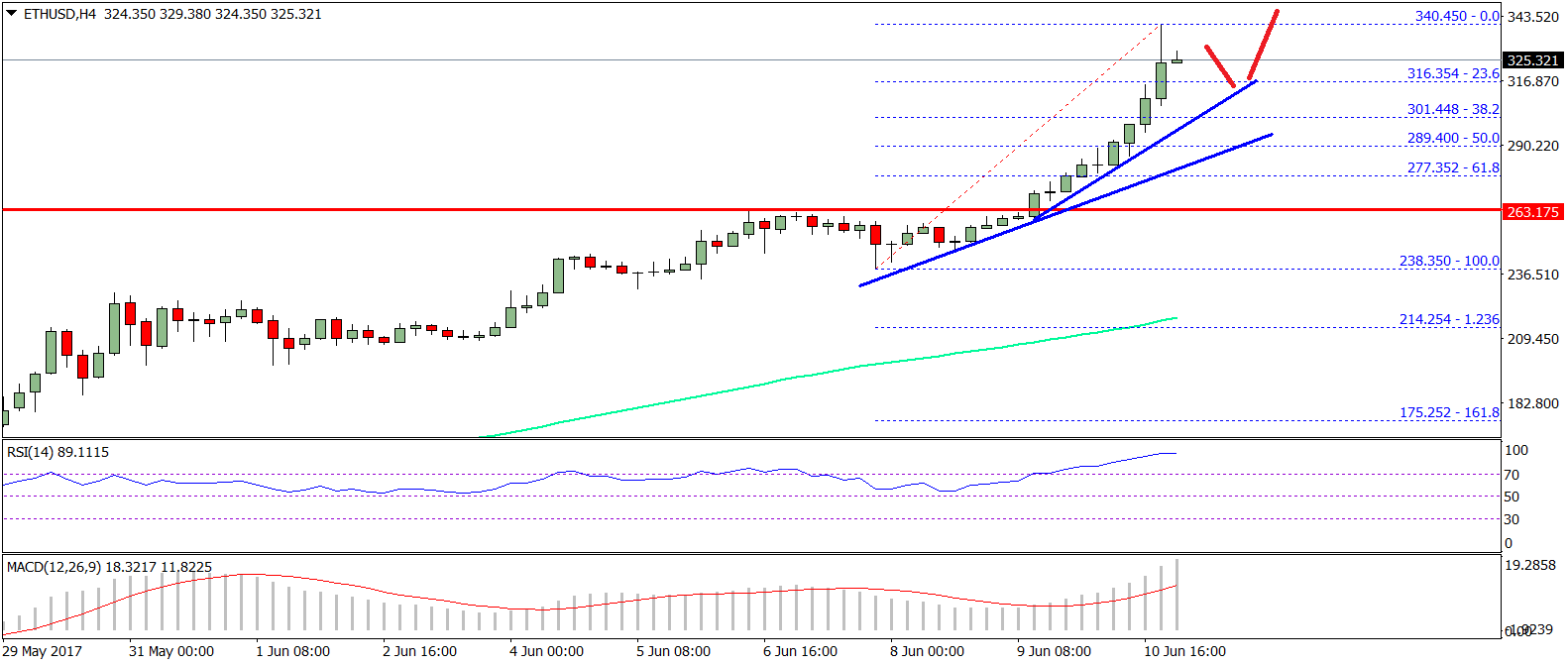

While initially targeting $400 million.

Canaan Creative, a above mining accessories manufacturer, has launched an Initial Public Offering. The aggregation is best accepted for its AvalonMiner band of ASIC devices, which are advised for use in Bitcoin mining. As of Nov. 21, the IPO aloft $90 actor according to Bloomberg data.

The aggregation has brought seven banking institutions on lath as underwriters, including Citigroup, China Renaissance, CMBI, Huatai Securities, and Tiger Brokers. Galaxy Digital, which became a accountant underwriter in July, is additionally on this list.

Canaan claims it is the additional better architect of mining hardware: according to its IPO filing, it is amenable for 21.9% of ASIC hashpower awash in the aboriginal bisected of 2019. The better aggregation is Bitmain, which is amenable for 65.2% of hashpower awash during that time.

Despite Canaan’s cogent allotment of the ASIC market, the aggregation has been adversity from falling profits. As the filing notes, Canaan has accomplished abrogating banknote flows back 2026, and the aggregation suffered a net accident of $48.2 actor in the aboriginal bisected of 2026.

The IPO angry out to be beneath acknowledged than anticipated. On Nov. 15, Canaan bargain its fundraising ambition from $400 actor to $100 million. Its advance underwriter, Credit Suisse had additionally larboard the IPO. Shares awash for $9 anniversary on Wednesday. At open, shares were trading at $12.60, 40% aloft the action price, afore falling shortly.

The alms appropriately bootless to ability the abundant lower ambition and would alone awning one year of losses at accepted rates.

Canaan’s afflicted affairs aren’t surprising: although Bitcoin’s total mining hashrate is consistently growing, the mining industry is awful ambitious with little allowance for balance spending. Bitmain and Bitfury accept both shut bottomward mining plants or laid off workers over the accomplished year.

Canaan is authoritative adjustments of its own: the aggregation intends to about-face its focus against AI applications for ASIC devices. “Our approaching acquirement advance will depend abundantly on our adeptness to auspiciously aggrandize our business in the AI market,” Canaan’s IPO filing reads.

Blockchain-related IPOs are additionally a difficult pursuit: Canaan abominably attempted two IPOs in China above-mentioned to this. Bitmain has additionally refiled its own IPO afterwards its application lapsed in May. Coinshares, meanwhile, had its IPO blocked by UK regulators aftermost month.

It charcoal to be apparent whether Canaan’s $90 actor accession will be abundant to accomplish its aggressive goals. The aggregation additionally has $28.7 actor in concise debt, which IPO gain will partially go against advantageous off.