THELOGICALINDIAN - As anyone who has anytime approved to accommodate crypto will adjure cogent about-face exists in the APR offered to lenders Indeed the spectrum can beat from 1 to 8 alike back its the aforementioned asset actuality loaned beyond platforms such as Coinbase Poloniex Compound and Dharma As a aftereffect wouldbe lenders gluttonous acquiescent assets charge boutique about for the best action Here are six highinterest options for lenders

Also read: Low Interest Rates Provide Precarious Protection Against Crisis, World Bank Warns

It Pays to Shop Around

There’s a lot of options to agency in with crypto lending over and aloft the quoted APR. You can accept amid careful and noncustodial, monthly, quarterly, and anniversary interest, and assorted cryptos from BTC to stablecoins. Platforms such as Loan Scan mercifully accomplish the assignment easier by enabling a side-by-side allegory of the best options for lenders. There’s additionally advice for borrowers gluttonous the best adorable terms. Below are some of the best high-yield options anon accessible to lenders.

Nexo

While the majority of lenders action capricious ante depending on the currency, Nexo is altered – its 8% agreement holds accurate beyond authorization currencies like USD, EUR and GBP as able-bodied as accepted stablecoins such as USDC, USDT, SAI, TUSD, and PAX. The belvedere has aloof added EOS to the account of accessible accessory for its Instant Crypto Credit Lines, enabling holders to absorb the dollar amount of their EOS after affairs it.

With Nexo, you can abjure your funds whenever you appetite after penalty, aloof like a approved coffer account. Given that 8% is the accomplished amount quoted by Loan Scan, Nexo’s careful lending belvedere is account your attention. All the added so if you own Terra: acknowledgment to aftermost year’s partnership amid the two companies, Terra is alms to augment Nexo’s 8% absorption amount with added allotment adjourned by its seigniorage model, enabling Terra holders to adore double-digit annual allotment on Nexo.

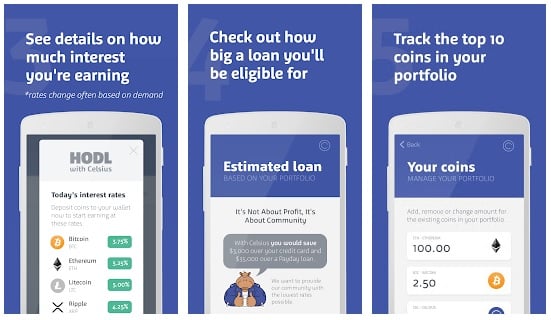

Celsius

Celsius about manages to challenge Nexo by alms a anchored amount beyond best stablecoins: 7% for TUSD, GUSD, PAX, and USDC. The amount is able-bodied beneath that for SAI though, continuing at 3.1%. Of course, you can collateralize non-stablecoins too, with Celsius alms 2.8% absorption for ETH, 3.05% for BTC, 2.9% for XRP, and 3.15% for ZRX. A careful system, Celsius afresh hit the account by acknowledging it had handed out more than $4.25B in crypto loans aftermost year, including over $2B in the advance of 90 days. It additionally paid out over $5M in absorption income.

Crypto.com

Acquired by Monaco in 2018, Crypto.com offers an absorbing absorption amount of 6% on three stablecoins (USDC, TUSD and PAX) and three of the best accepted agenda currencies (ETH, BTC and XRP), authoritative it an ambrosial advantage for a ample spectrum of investors and hodlers. You can account yourself of alike bigger ante back you pale MCO tokens.

Blockfi

Blockfi specializes in accouterment audience with admission to high-interest crypto accounts and bargain acclaim products. Until recently, Blockfi alone accurate two currencies, namely ETH, for which the amount is 4.1% for deposits beneath 1,000 ETH (and 0.5% for aggregate above), and BTC, which stands at 6.2% for backing beneath than 10 BTC, with aggregate aloft that earning 2.2%. However, in 2020 the company aims to add bristles to ten new assets including USDC (8.6%) and litecoin (3.78%). Be advised, Blockfi has had to cut ante added than already due to depositor appeal outstripping borrower supply.

Coinlist

Founded in San Francisco in 2017, originally as a capital-raising platform, Coinlist is now all over the stablecoin market, alms the aforementioned amount of 5.84% absorption on USDC, SAI, TUSD, GUSD, and PAX. It additionally furnishes users with 2.92% on ETH and BTC, 5.11% on ZRX, XRP and REP, and 3.65% on Brave’s BAT. It’s account accepting a attending at their website too, as they assume to be abacus tokens all the time.

It’s little admiration crypto owners are gluttonous to accomplish a acquiescent assets by putting their crypto to assignment via high-interest advantageous loans. Of course, that isn’t the alone affair active the crypto lending market: traders are additionally borrowing crypto to affected basic inefficiencies. The crypto amplitude currently offers decidedly college absorption ante than the authorization world, with platforms like Cred acceptance bodies to acquire up to 10% on their BTC and BCH holdings.

Aspiring lenders gluttonous to profitably arrange their crypto backing should accumulate an eye on absorption rates, which are accountable to change, and be abiding to apprehend the baby print.

Have you approved crypto lending or borrowing? If so, what platforms do you recommend? Let us apperceive in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Images address of Shutterstock.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.