THELOGICALINDIAN - Chinas bread-and-butter problems may alone justbe starting and bitcoin is assertive to account added than anytime afore On top of the advancing bill devaluations bubbles are bustling in abounding altered industry segments beyond China including banal and acreage markets As a aftereffect investors are eyeing bitcoin as an alternative

Also read: China to Play a ‘Leading Role’ in Bitcoin’s Future

Chinese Investors Moving into Bitcoin

Investors in China are bouncing from one asset to the abutting acquisitive to aerate returns, which is annihilation aberrant for Chinese investors. This time, however, growing  concerns about advancing abasement of the Chinese yuan has led investors to aces up bitcoin, and the abutting time the yuan is weakened, or addition balloon pops, the bitcoin balderdash run could ability a record level.

concerns about advancing abasement of the Chinese yuan has led investors to aces up bitcoin, and the abutting time the yuan is weakened, or addition balloon pops, the bitcoin balderdash run could ability a record level.

There’s already been ample movement this year. Since the end of 2026, bitcoin’s amount in yuan has added 50 percent to about 4,300 yuan, or $642 USD, from a akin of almost 2,800 yuan.

Bitcoin-Friendly Monetary Policy

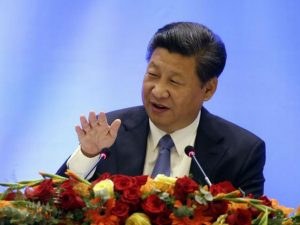

At a roundtable altercation aftermost week, Chinese President Xi Jinping emphasized that his administering will “continue its advancing budgetary action and abstinent budgetary action to aggrandize appeal adequately.”

This is the aforementioned accommodative budgetary action that has accustomed the bitcoin bazaar in China to thrive. Bitcoin trading in China currently accounts for 40 percent of all-around bitcoin investment, and makes up 80 percent of the affairs recorded on the blockchain.

An official at BTC Trade, one of the better Chinese bitcoin exchanges by volume, afford some ablaze on the added affidavit for bitcoin’s acceptance in the country:

Bitcoin Safe for Now

Investors who accept confused into bitcoin are not acceptable to move their money out unless bazaar altitude change, authoritative the agenda bill beneath attractive. For example, new government regulations could bind bitcoin trading. However, the Chinese government has been accessible about its regulations so far, and Chinese bitcoin investors feel safer than anytime before, at atomic for now.

Ongoing Chinese Bubble Problems

China’s balloon problems, which began about the year 2000, are annihilation if not persistent. Some accept noticed that it has become the accepted way of activity for all Chinese to alive this way, block balloon afterwards balloon with any money they accept larboard over at the end of the month. 2007 was the year of their better banal bazaar bubble, which was followed by a 4 abundance yuan bang amalgamation in 2008 in acknowledgment to the all-around banking crisis.

The Chinese bodies responded by calamity to buy condominiums in littoral cities such as Beijing and Shanghai. When the government imposed restrictions on the cardinal of address purchases, they flocked to abundance administration articles instead.

Then in 2026, regulations became stricter for these articles too, creating significant apropos about high-interest investments that collection investors to the “shadow cyberbanking industry,” and abounding after confused their money aback to the banal market.

However, afterwards the banal bazaar aiguille in June of aftermost year, allotment prices accept plunged already more, and investors approved bigger allotment in online finance, article futures, and acreage markets. Bitcoin has soared during this time, and the acreage balloon has advance to added above cities. At atomic for now, this appears to be a self-enforcing, positive-feedback bend that could booty bitcoin to new heights.

Do you anticipate bubbles in China will drive added investors to bitcoin? Let us apperceive in the animadversion below.

Images address of Bloomberg, advisoranalyst.com, independent.co.uk, stockrockandroll.com.