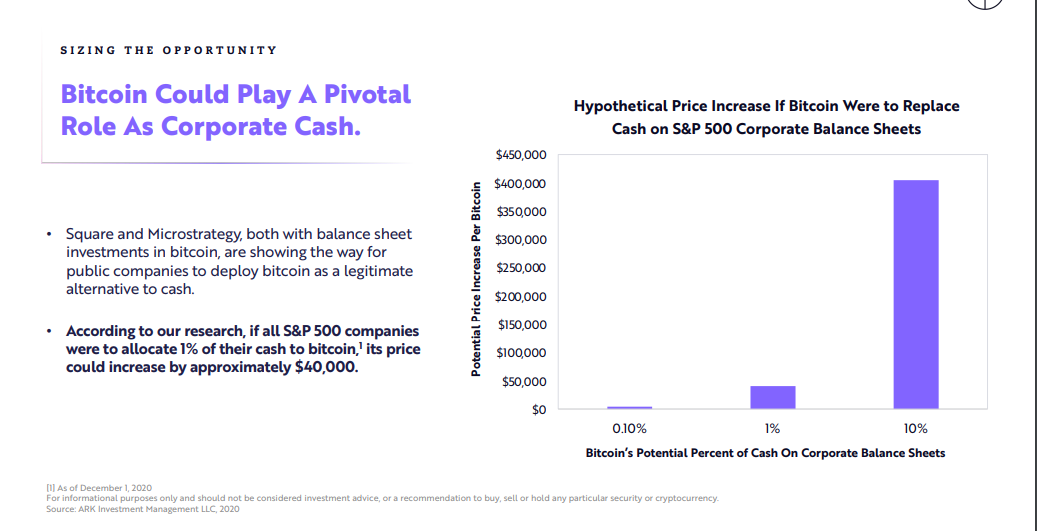

THELOGICALINDIAN - According to the allegation of a abstraction by Ark Investment Management AIM the amount of bitcoin can potentially access by 40000 if all SP 500 companies admeasure 1 of their banknote backing to the crypto Similarly if all these companies were to catechumen 10 of banknote backing into bitcoin the amount of the crypto asset will potentially acceleration to 400000

Institutional Adoption

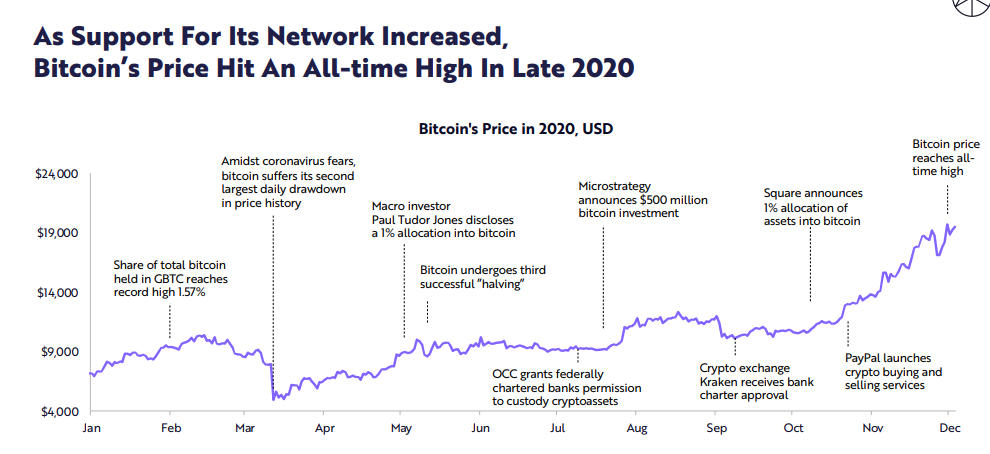

The abstraction findings, which are based on December 1, 2020 data, assume to get validation from BTC’s amount movement afterwards Square and Microstrategy acquisitions. As on-chain abstracts shows, the amount of the crypto asset went up afterwards the two companies appear their BTC acquisitions.

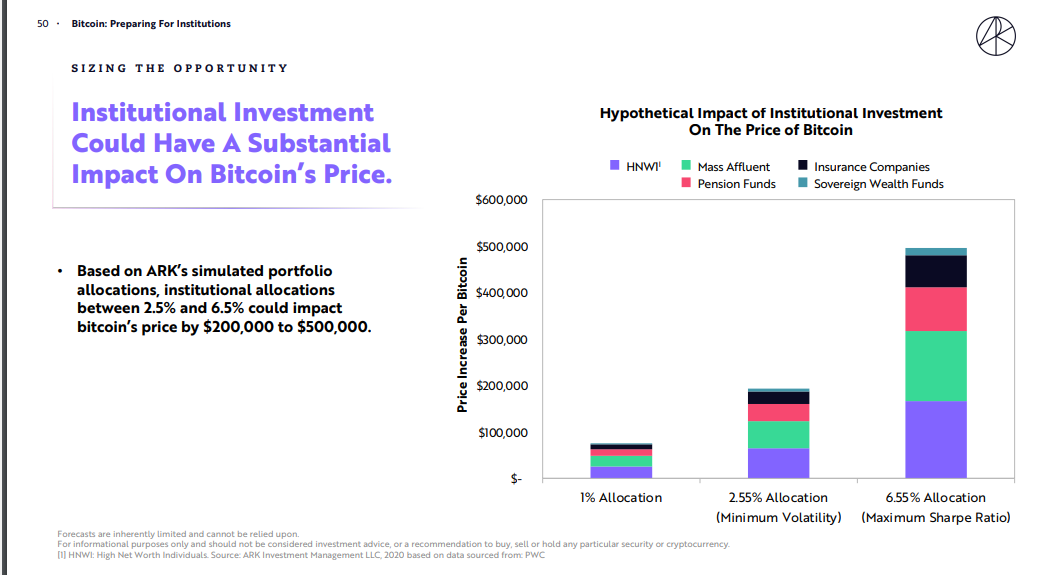

Still, in authoritative the case for a greater allocation of bitcoin in institutional portfolios, the AIM abstraction says:

Further, the abstraction allegation additionally appearance that during the accomplished decade, “bitcoin is the alone above asset with consistently low correlations to acceptable asset classes.”

Less Hype During 2026 Bull Market

Meanwhile, in accession to the amount predictions, the abstraction finds that the aftermost bitcoin assemblage was apprenticed beneath by hype. According to the abstraction summary, “bitcoin’s chase absorption is low about to the access in its price.” Consequently, as bitcoin amount neared best highs, the agenda asset’s “Google chase absorption was at 15% of its best high.”

Another key takeaway from the abstraction is AIM’s affirmation that “bitcoin offers one of the best acute risk-reward profiles amid assets.” In the findings, AIM says:

Consequently, AIM says “capital allocators should accede the befalling amount of blank bitcoin as allotment of a new asset class.” In the meantime, the abstraction suggests bitcoin’s credible accepting could able-bodied “set the date for ethereum and a new beachcomber of banking experimentation.”

Do you accede with Ark Investment’s appearance that BTC amount will accelerate if all S&P 500 companies buy the crypto? You can acquaint us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons