THELOGICALINDIAN - Bitcoin derivatives markets accept been seeing cogent appeal in contempo months at the aforementioned time bitcoin atom markets climbed to alltime amount highs and surged 149 during the aftermost three months Just afresh the arch bitcoin options barter Deribit appear the barrage of both 120k and 140k strikes and abstracts from skewcom shows some June futures are swapping for 30k

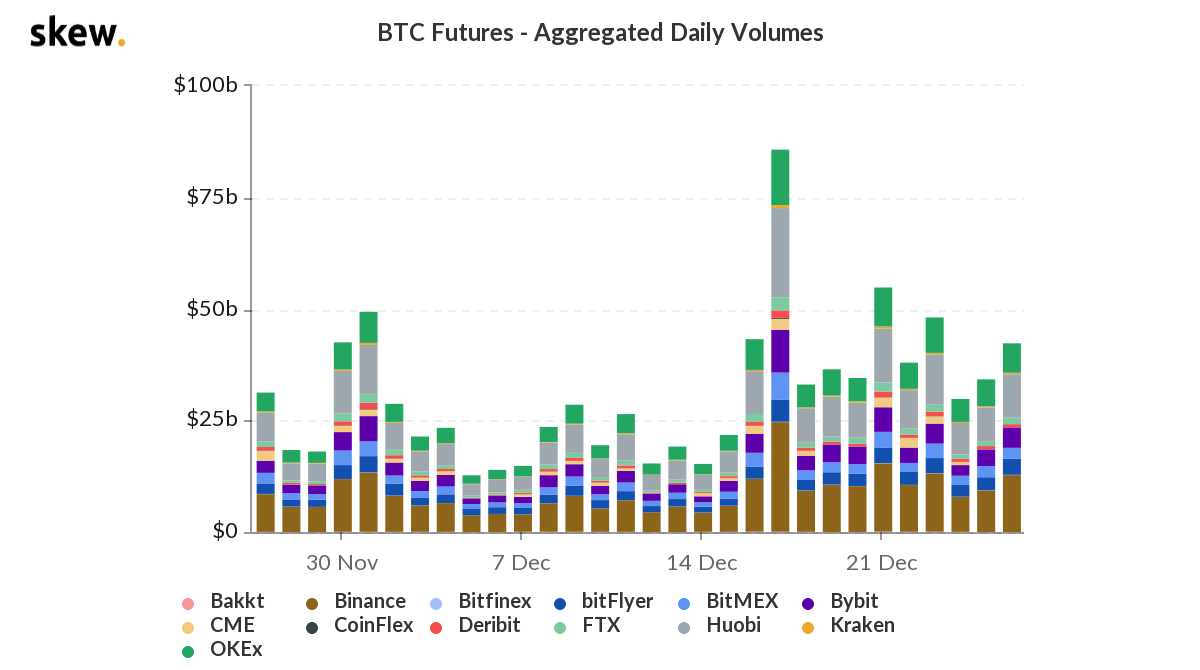

Crypto derivatives accept been hot in 2020, as appeal has skyrocketed on assorted trading platforms this year. At the end of November, CME Group outpaced the competition and became the world’s better bitcoin futures provider that month.

In mid-December, news.Bitcoin.com reported on the arch bitcoin options barter Deribit’s massive volume. Bitcoin circadian options aggregate beyond $1 billion and Deribit alien a $100k options bang for September.

Then on December 26, 2020, Deribit tweeted about abacus two added ample options strikes. “We’ve added the BTC 120K strike. We apprehend to add 140K tomorrow,” Deribit said. “Our accession action is abacus strikes up to basin 10,” the barter added. Following that tweet, Deribit appear the $140k bang addition. “That was quick,” Deribit announced. “We aloof added the BTC $140K strike.”

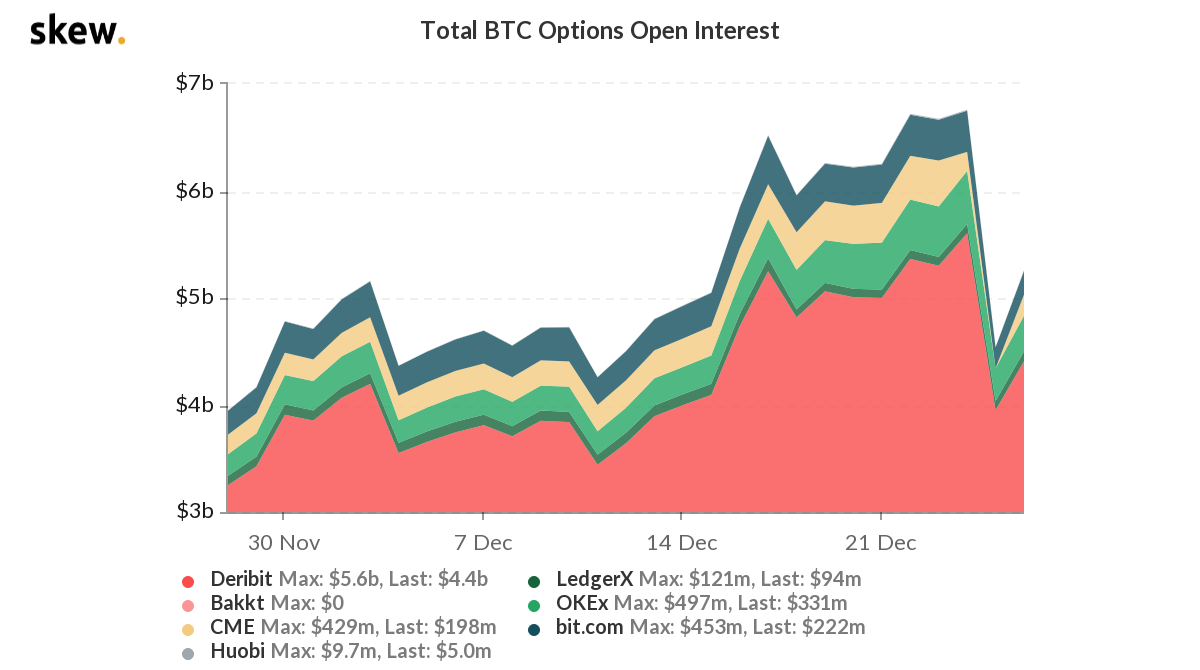

In fact, bitcoin options trading swelled in advance during the aftermost twelve months. “Bitcoin options grew bound this year with absolute accessible absorption set to beat $10bln in 2021,” the derivatives markets analytics provider skew.com afresh tweeted.

Data from skew.com shows that Deribit commands best of the accumulated BTC options accessible interest. This is followed by accessible absorption from exchanges like Okex, Bybit, CME Group, and Ledgerx respectively.

As far as bitcoin futures aggregated circadian volumes are concerned, Binance and Huobi command the top volumes today. These top two futures barter platforms are followed by the derivatives exchanges Bybit, Bitflyer, Okex, Bitmex, and FTX.

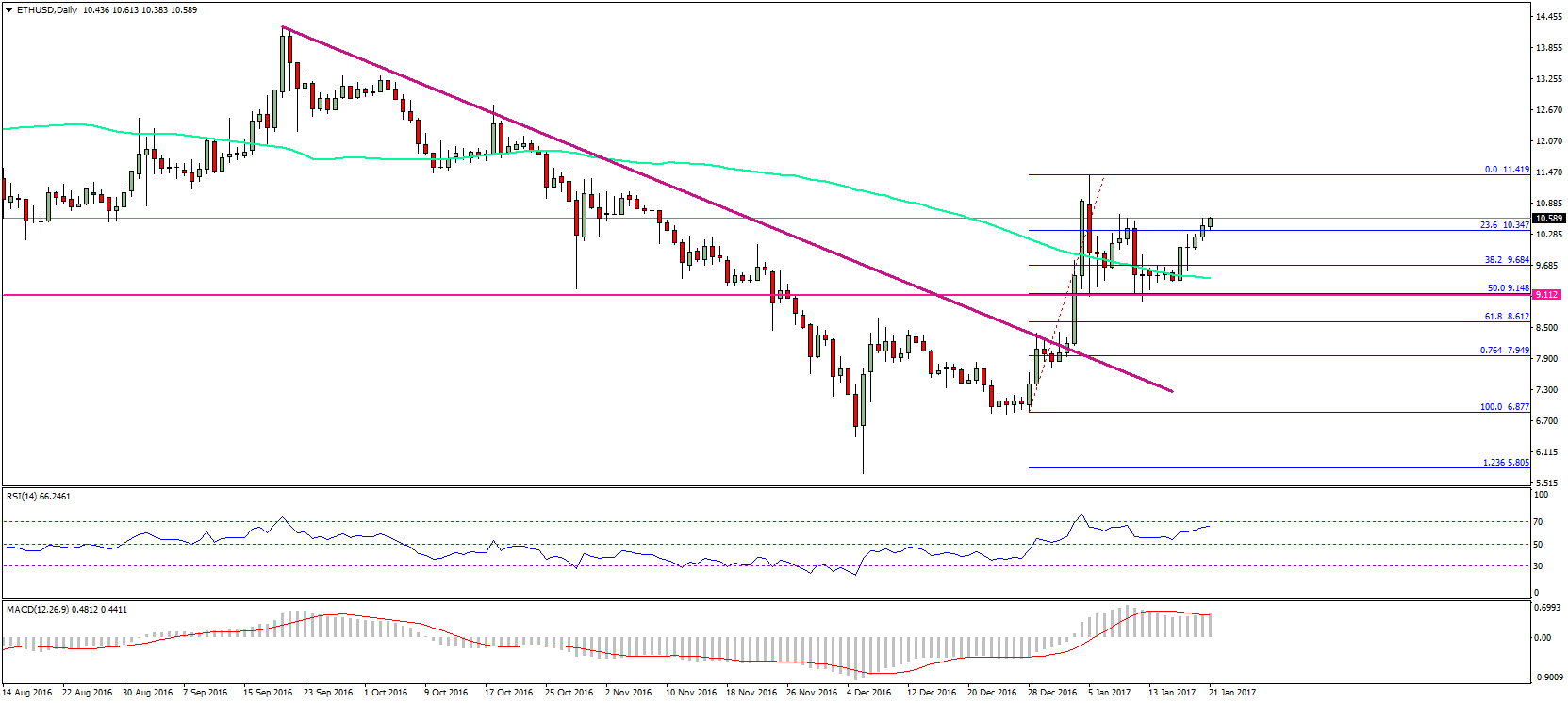

Meanwhile, bitcoin (BTC) atom prices accept been acutely airy on Sunday skyrocketing to $27,800 during the aboriginal afternoon trading sessions (EST) and dipping bottomward to the $26,521 ambit during the day as well.

Moreover, skew.com tweeted that there are some futures attractive at the $30,000 area already. “Some June futures [are] already trading > $30k,” the advisers tweeted.

What do you anticipate about the bitcoin derivatives markets activity lately? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons