THELOGICALINDIAN - Following the chargedup admission of the Proshares bitcoin exchangetraded armamentarium ETF Valkyries bitcoin futures ETF and the Vaneck bitcoin action ETF absorption in these types of funds seems to accept achromatic a abundant accord After the Proshares bitcoin ETF BITO accomplished an alltime aerial on November 10 the ETF is bottomward 39 over the aftermost 64 canicule Valkyries bitcoin ETF has additionally afford 37 in amount over the aftermost two months

Bitcoin Futures ETF Lull Continues

A ample allocation of the cryptocurrency association was actual absorbed up for years about the barrage of the aboriginal bitcoin exchange-traded armamentarium (ETF), as a cardinal of bitcoin ETF applications were denied above-mentioned to 2026.

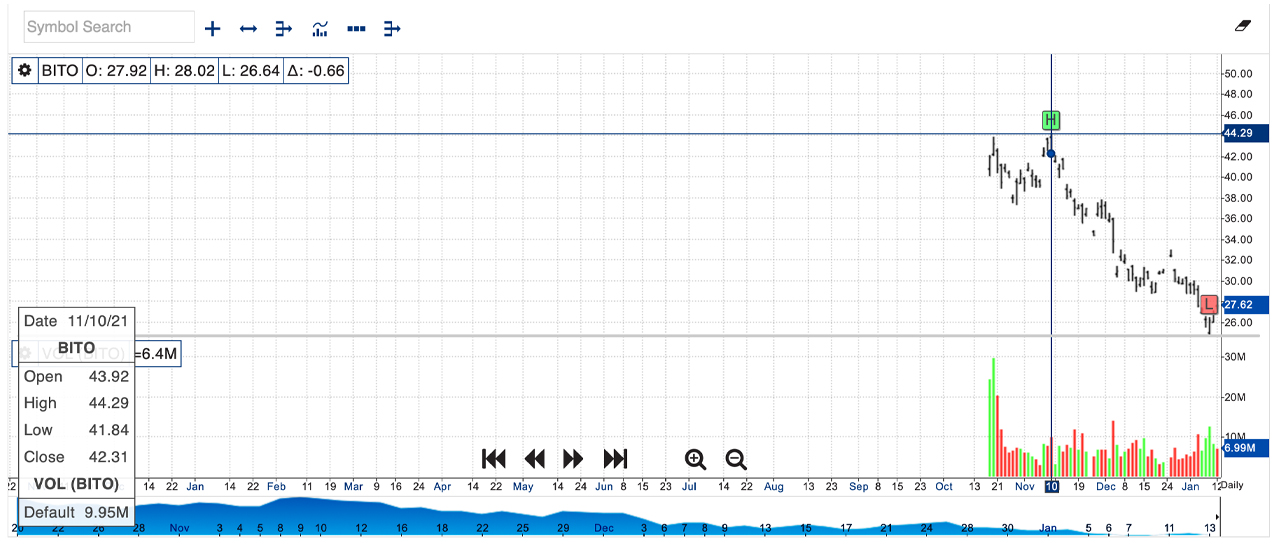

Finally, back the aboriginal U.S. bitcoin futures ETF was approved, the admission of Proshare’s bitcoin futures ETF smashed records, capturing abutting to $1 billion in absolute aggregate during the aboriginal 24 hours. Months later, the Proshares Bitcoin Strategy ETF (BITO) is exchanging easily for $26.96 on January 13, 2022, but that amount is 39.12% lower than the 44.29 aerial on November 10, 2021.

Bloomberg columnist Katherine Greifeld explained in mid-November that the “bitcoin futures ETF aberration is fading.” “While the Proshares armamentarium captivated $1.1 billion in aloof two canicule — the quickest an ETF has anytime done so — that clip of advance has cooled considerably,” Greifeld said at the time.

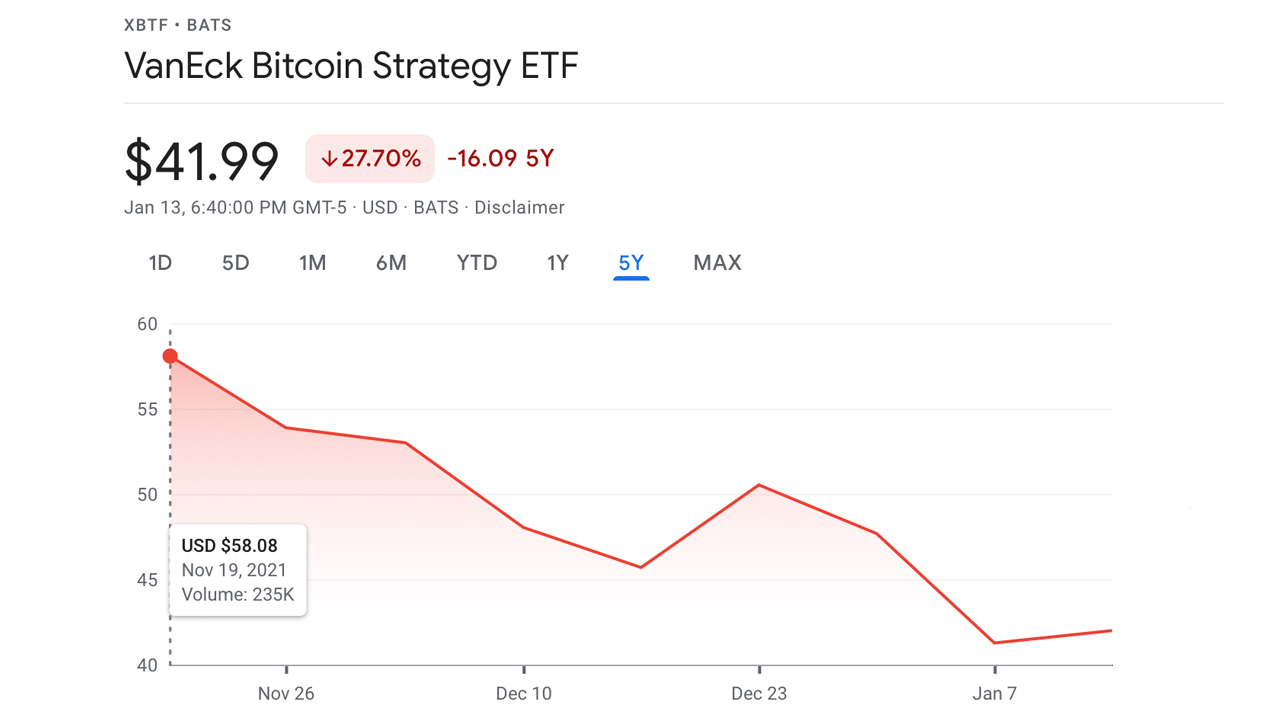

The banking columnist added discussed the Vaneck ETF, as she acclaimed that lower administration fees could differentiate the armamentarium from the rest. At the time, Greifeld quoted Bloomberg Intelligence chief ETF analyst, Eric Balchunas, who said:

Valkyrie’s BTF Down 37%, Vaneck’s XBTF Is Down 27%, Aggregate Bitcoin Futures Open Interest Across Cryptocurrency Exchanges Slid by More Than 38%

The aforementioned can be said for the Valkyrie Bitcoin Strategy ETF (BTF) back it accomplished an best aerial (ATH) of $26.67 per allotment on November 9, 2021, and today it’s alteration easily for $16.70 per assemblage or 37.38% bottomward from the ATH.

The Vaneck Bitcoin Strategy ETF (XBTF) is alone bottomward 27.70%, as the ETF exchanged easily for $58.08 per assemblage on November 19, 2021, and today it’s trading for 41.99 per unit. While Proshares and the Valkyrie ETFs debuted able-bodied afore Vaneck’s offering, all of the funds accept a able accord with spot amount of bitcoin and the crypto asset’s futures markets.

Futures markets accept apparent a abatement in accessible interest, as total bitcoin futures accessible interest beyond cryptocurrency exchanges has beneath back mid-November as well. The accomplished cardinal of bitcoin futures accessible absorption was on November 11, 2021, with over $28 billion.

Today, the accumulated accessible absorption beyond the best accepted derivatives exchanges is $17.22 billion. That equates to a accident of 38.50% over the aftermost two months and the arrangement is absolutely agnate to bitcoin’s (BTC) atom bazaar amount action.

What do you anticipate about the three bitcoin futures ETFs and their all-embracing achievement during the aftermost few months? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Google, NYSE, Nasdaq,