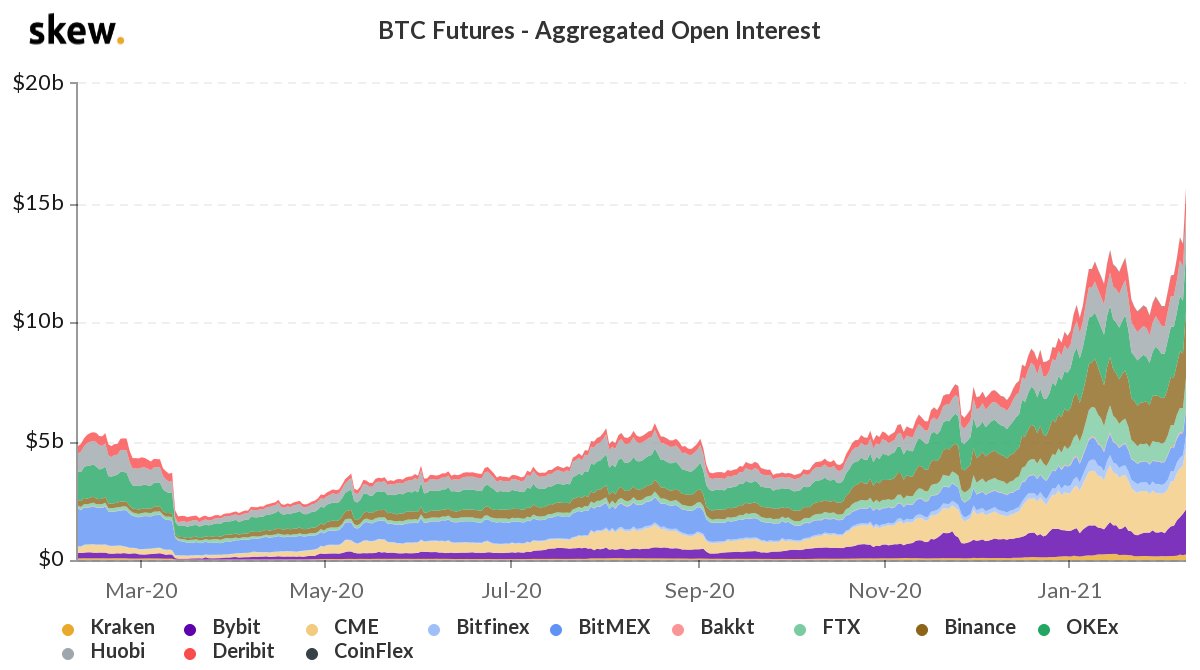

THELOGICALINDIAN - Following the adumbration that Tesla now owns 15 billion in bitcoin crypto atom markets beyond the lath skyrocketed Data shows that crypto derivatives markets additionally saw cogent appeal as bitcoin futures accessible absorption broke 15 billion on Monday Moreover this anniversary was the alpha of ethereum futures on CME Groups barter and etherbased futures registered 33 actor account on the aboriginal day of barrage

Bitcoin Futures Open Interest Jumps to $15 Billion

Bitcoin (BTC) derivatives markets are in aerial appeal these canicule and added cryptocurrencies like ethereum (ETH) and bitcoin banknote (BCH) acquired articles are as well. Just recently, news.Bitcoin.com reported on Bit.com’s addition of BCH options which saw volumes bifold every day back the launch.

Then on February 8, 2021, it was apparent that Tesla had purchased $1.5 billion account of BTC, and the crypto asset saw its largest circadian candle to date. Moreover, the activity additionally acquired massive appeal for BTC futures and the crypto derivatives analysts over at skew.com tweeted about the accountable on Tuesday.

Skew tweeted:

The accessible absorption is an accumulated from all the derivatives exchanges that action bitcoin futures including Kraken, Bybit, CME, Bitfinex, Bitmex, and abounding others. On Monday Skew additionally noted that “short positions are actuality unwound by leveraged funds on CME bitcoin futures.”

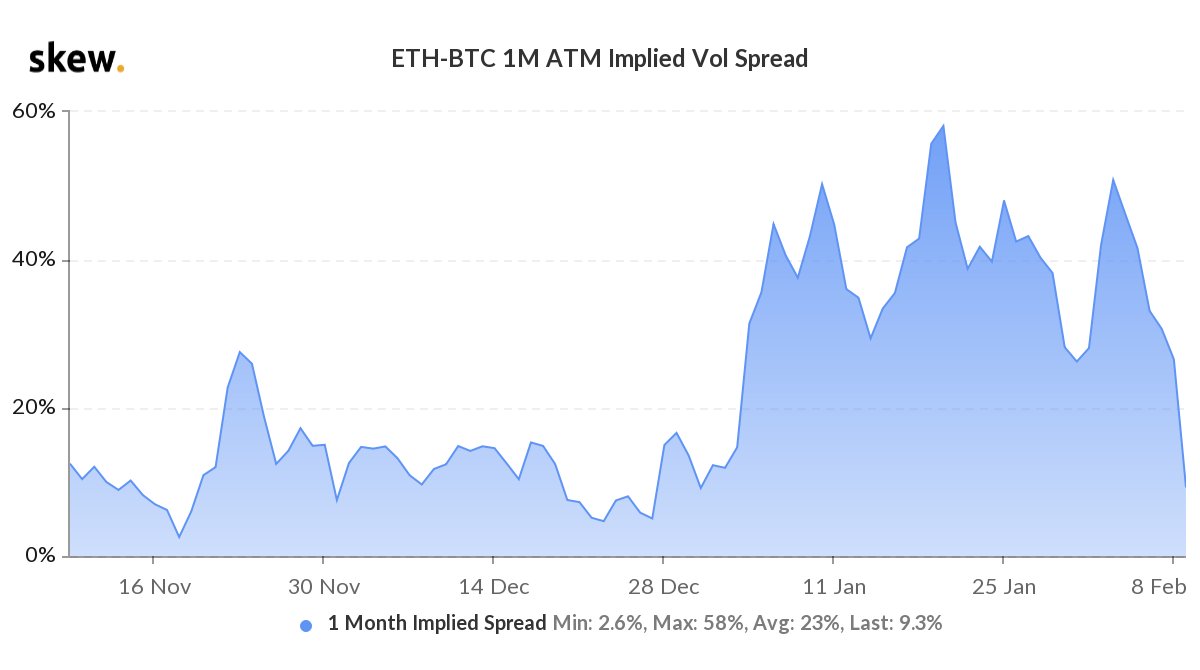

Skew has additionally has been discussing the afresh launched ETH-based futures on CME as well. ETH/BTC awash off tweeted the afterward day on Tuesday. “ETH/BTC adumbrated vol advance collapsed,” Skew added.

CME Group’s Ether-Based Futures Sees $33 Million Contracts on Day One

CME Group Inc (NASDAQ: CME) Exchange additionally launched its ETH-based futures artefact on Monday and affairs are dubbed ETH1. Affairs started to be accomplished appropriate abroad as anon as the bazaar opened and by the closing bell, 388 affairs account over 19,400 ETH were registered.

Following the ether futures addition on CME, ETH atom markets accomplished a 2021 aerial at over $1,800 per token. Ethereum’s amount has aloof from that ambit and hovers aloof aloft the $1,700 handle.

Michael Moro, CEO of Genesis Global Trading discussed the CME barrage on Monday and said CME Group has helped bolster agenda currencies into a new asset class. “CME Group has been an basic actor in the connected institutionalization of this asset class, and the barrage of Ether futures is yet addition milestone,” Moro said.

“Genesis is aflame to abide to assignment carefully with CME in this effort,” the controlling added.

What do you anticipate about the added appeal for crypto derivatives articles and markets? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, CME Group ETH1 stats, Skew.com, Twitter,