THELOGICALINDIAN - Bitcoin futures accessible absorption on Monday has beyond 23 billion according to abstracts recorded on April 5 The crypto asset barter Binance has taken the advance as far as accessible absorption in bitcoin futures is anxious with a massive 105 billion in accessible interest

Binance Captures the Bitcoin Futures Lead

Not too continued ago, Bitcoin.com’s newsdesk appear on CME Group capturing the advance as far as accessible absorption in bitcoin futures. Today, that’s no best the case, as Binance has jumped advanced of the backpack as far as carrying futures derivatives articles for BTC. Skew.com analytics indicates that Binance is advanced of Bybit, Okex, CME, Huobi, FTX, Deribit, Bitmex, Kraken, Bakkt, and Coinflex respectively. Binance, Huobi, Okex, and Bybit are additionally leaders back it comes to BTC futures circadian volumes.

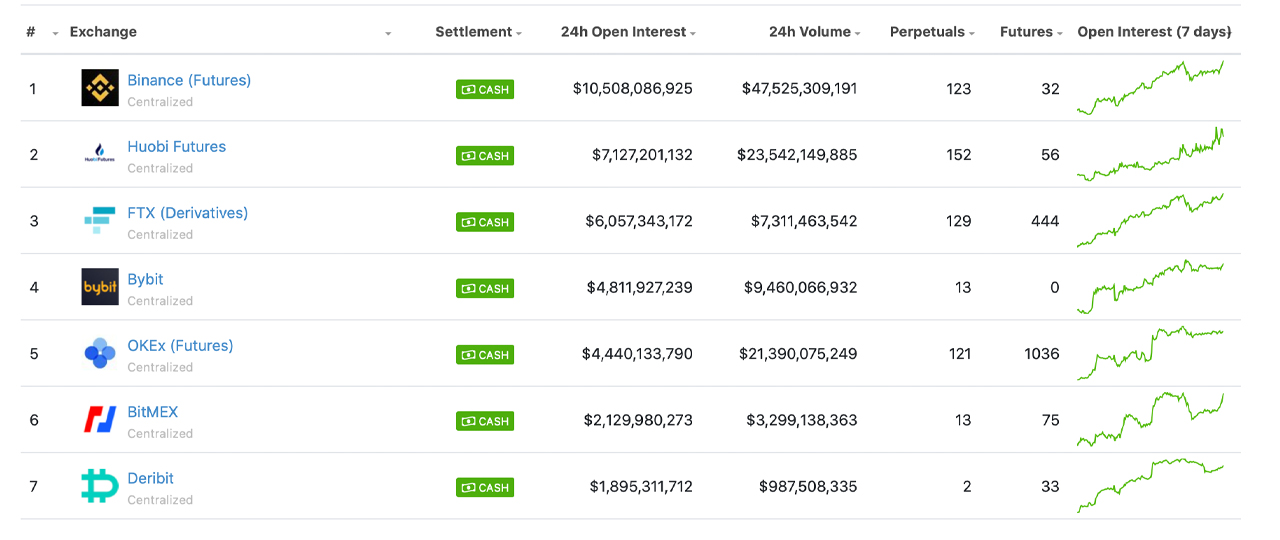

Coingecko data is a blow altered and shows bitcoin futures 24-hour absolute volumes at about $22,984,388,835 on Monday. Stats appearance Binance has $10.5 billion in accessible absorption and $47 billion in 24 hour circadian volumes. According to Coingecko’s stats, the account of exchanges afterward Binance includes Huobi, FTX, Bybit, Okex, Bitmex, Deribit, Kucoin, Bitfinex, and Bitget in the top ten. Huobi captures $7.1 billion today in accessible absorption while FTX Exchange commands a blow over $6 billion.

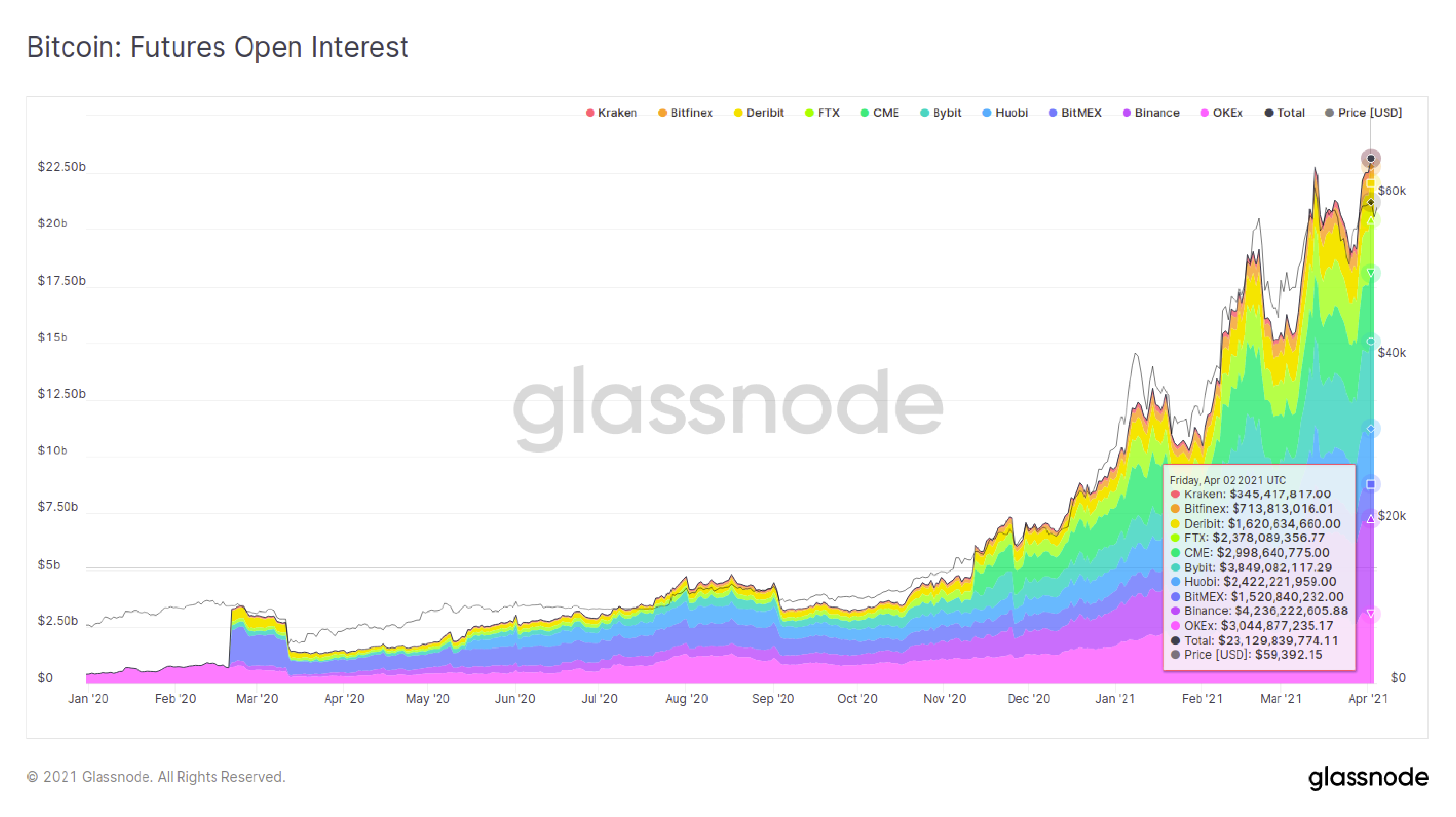

Insights from Glassnode accept additionally noticed the massive bitcoin futures accessible absorption this week. “Futures accessible absorption has hit yet addition best aerial of over $23.1B this week, with Binance and OKex apery the lion’s allotment with a accumulated absolute of 32% of all contracts,” Glassnode detailed on Monday.

“Keep in apperception that ample accessible absorption can aggravate bazaar animation in acknowledgment to amount corrections if advantage is unwound quickly. Interestingly, futures volumes accept been in abiding abatement throughout March with this anniversary actuality decidedly quiet about to aggregate in antecedent months,” advisers at Glassnode acclaimed in the company’s account newsletter.

43% Chance Bitcoin Will Hit $64K by the End of April, Cboe Looks to Re-Enter the Bitcoin Futures Game

Delta Exchange CEO, Pankaj Balani says that according to bitcoin futures, BTC has a 43% adventitious the crypto asset will hit $64k by the end of April. “Let’s say BTC trades at $50k; again skew is the aberration in adumbrated animation of, say, a $52k alarm and a $48k put,” Balani abundant in a agenda to Bitcoin.com’s newsdesk. “In the case of absolute skew, traders are accommodating to pay added for an OTM alarm to accretion upside acknowledgment than for the agnate put to assure themselves from falling prices. As such it can accord us an acumen into bazaar participants’ expectations of atom amount movements.”

Balani added added:

In contempo months bitcoin futures accept been agrarian and accept swelled in appeal back the balderdash run started. Perpetual swaps and bitcoin options markets accept developed awfully as able-bodied as Deribit is the baron of the bitcoin options bold today. Moreover, there accept been alarm options for the amount of BTC to hit $100k to $300k by December 31, 2021. Meanwhile, Cboe Global Markets CEO Ed Tilly explained that the close may re-list BTC futures.

“We’re still absorbed in the space, we haven’t accustomed up on it,” Tilly said in an account appear aftermost Thursday. “We’re agog on architecture out the absolute platform. There’s a lot of appeal from retail and institutions, and we charge to be there,” the Cboe controlling added.

What do you anticipate about the contempo accessible absorption in bitcoin futures spiking? Let us apperceive what you anticipate about the bitcoin derivatives bazaar activity in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Coingecko, Glassnode,