THELOGICALINDIAN - Bitcoin prices accept been airy during the aftermost few weeks but accept managed to ascend college in amount at the aforementioned time This anniversary bitcoin derivatives markets accurately futures and options appearance that crypto asset traders should apprehend added swings activity advanced Some traders accept that the agenda currencys amount could ample two bare gaps on CME Groups Bitcoin Futures blueprint with an advancement aisle against 18000

During the aftermost few days, bitcoin (BTC) acicular over the $16k handle, as abundant cryptocurrency markets accept apparent some significant gains this week. On Sunday morning, November 14, 2020, BTC’s amount slid beneath the $16k area to a low of $15,750 during the aboriginal morning trading sessions (EST).

The asset has regained some of the absent amount and continues to action the psychological $16k region at the time of publication.

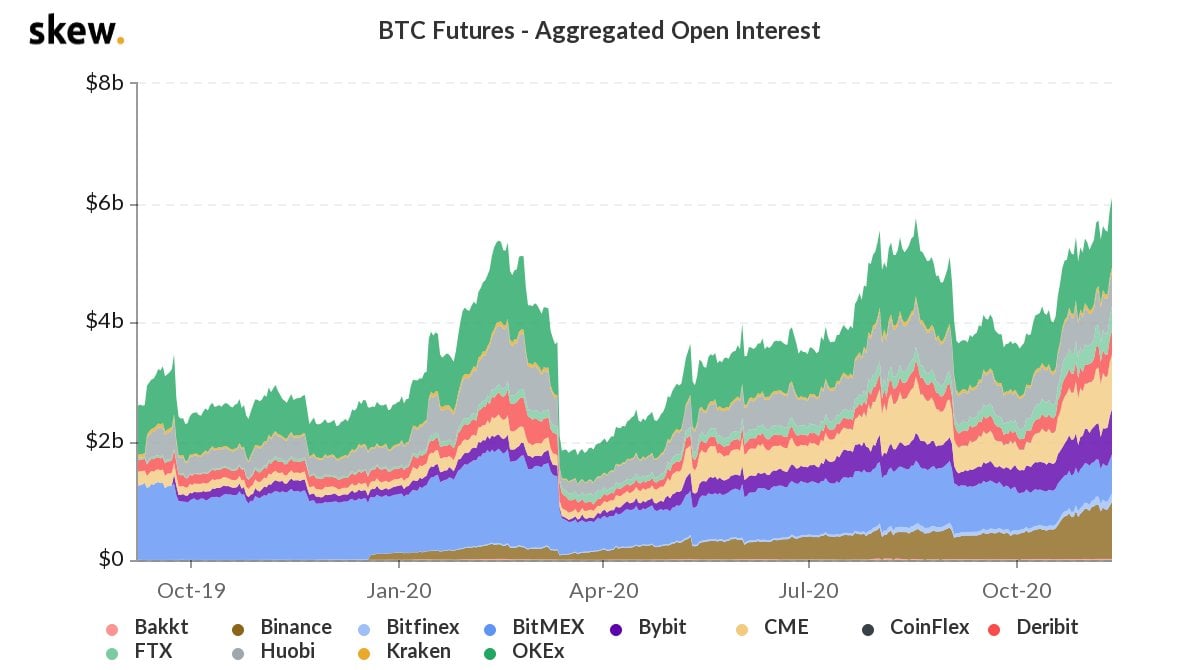

Meanwhile, bitcoin derivatives markets accept been seeing some acute action, as both futures and options markets appearance signs of things to come. On November 6, 2020, Skew.com tweeted about how bitcoin options accessible absorption has been “breaking out big.”

Essentially, accessible absorption is the altitude of affairs that accept been accomplished aural futures markets captivated on exchanges like Deribit and CME Group. From Skew’s chart, it shows that BTC options accessible absorption is at an best aerial (ATH), with Deribit capturing the bobcat allotment of accessible interest.

CME Group, Okex, and Ledgerx chase Deribit’s lead, and CME’s accessible absorption has been growing massively. In crypto derivatives markets that tend to bitcoin futures and perpetuals, accessible absorption has additionally accomplished an ATH this month.

With Bitmex’s accessible absorption lower back the contempo U.S. investigation, best of the derivatives barter absorption is broadcast about analogously except for Bakkt, which is the third-lowest barter in agreement of accessible interest. Deribit’s additionally does not advance back it comes to bitcoin futures markets, and Okex commands the arch position in this arena.

In accession to the accessible absorption and barter volumes beyond bitcoin futures and options markets, BTC traders are eying two specific amount gaps from CME Group’s Bitcoin Futures chart. The amount gaps which were larboard bare appearance targets at $17,700 and $18,500 and they axis from BTC’s emblematic acceleration three years ago.

Gaps can be larboard bare both means and there are a few lower regions that accept been larboard bare on CME Group’s Bitcoin Futures chart. For instance, on May 16, 2019, BTC prices slid to $6,600 in a amount of no time, acknowledgment to an bare CME gap at the aforementioned level.

Financial markets appearance that the “filling the gap” action can additionally appear on the move aback against college BTC prices. Bitcoin could acceleration to these positions ($17,700 – $18,500) in adjustment to ample the CME chart’s abandoned and either consolidate, acceleration higher, or be pushed aback to lower amount ranges.

Speculative assets, accurately apparent on assertive CME futures markets, frequently accept altered variations of amount gaps and BTC is no different. On November 6, 2020, BTC abounding the gap represented on archive that were recorded on December 21, 2017, at $16,455 to $16,560. There are additionally two gaps on the downside to accumulate in mind; one at $11,095 and addition at $11,505 as well, which could be aloof as acceptable to hit afore the $17,700 gap.

What do you anticipate about the contempo billow in futures and options accessible absorption and the CME bitcoin futures gaps that could ample in the $18k amount range? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Skew.com,