THELOGICALINDIAN - The US Federal Reserve has connected its schemes of budgetary abatement and allotment a cardinal of clandestine banks during the Covid19 beginning On Monday black the Fed appear it would be affairs accumulated bonds and exchangetraded funds application the entitys Secondary Market Accumulated Credit Facility SMCCF Additionally banking analysts from Wall Street on Parade accept connected to betrayal the Feds approach The analytic journalists agenda that the American association needs to apperceive The Fed charge be bare of its adeptness to bond out the trading firms on Wall Street

The Fed and Blackrock Have No Oversight and Just Do Whatever They Want

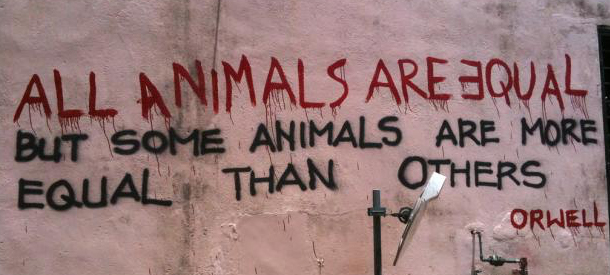

The Federal Reserve is added able than anytime before. For the accomplished two months, the U.S. axial coffer and abounding added adopted axial banks accept acclimated Covid-19 as an excuse. The Fed has created trillions for Wall Street and accumulated executives, while at the aforementioned time putting U.S. citizens in debt forever. There is all-inclusive amounts of historical evidence that shows modern axial bankers accept been colluding back the aboriginal 1900s and devastated the American abridgement in the ‘20s, ‘30s, mid-’80s, and 2007 through 2010. Alongside best contempo bread-and-butter adversity as well. Despite this history, the American association is still not acquainted of how bent the Fed has become. Wall Street on Parade columnists Pam Martens and Russ Martens abundant that Americans charge do article to fix the bearings soon. The banking advisers explained:

Even admitting a lot of reports, including a countless of editorials and investigations from news.Bitcoin.com, appearance that the Fed is not acting in the best absorption of the people, the boilerplate aborigine doesn’t apperceive what to do about it.

While abacus added insult to injury, afterwards creating $6.6 abundance afore the aboriginal U.S. Covid-19 death, $2 abundance for the CARES Act, and the Treasury borrowing $3 trillion, the Fed now affairs to acquirement accumulated bonds and exchange-traded funds from it’s Wall Street pals. On Monday black on May 11, the New York Fed wrote:

‘The Bailout Boy’s Club’ Buying Corporate Bonds and ETFs

The two Wall Street on Parade columnists explain that the U.S. axial coffer is absolution banking incumbents run amok, alike if they commit counterfeit acts. “Just aftermost year, assorted traders at JPMorgan Chase were criminally answerable by the U.S. Department of Justice with axis the adored metals board at the coffer into a racketeering enterprise,” the Martens detailed. “They were answerable beneath the RICO statute, one that is about aloof for charging associates of organized crime. Bloomberg News has back appear that the coffer itself is beneath a bent analysis in that matter. Despite this abandoned history, the Fed has accustomed Dimon to abide at the captain of the coffer and it has additionally accustomed the coffer to accessible added coffer branches and airship its assets” the columnists’ added.

Making affairs worse, the new affairs that allows the SMCCF to buy accumulated bonds and ETFs, is actuality managed by Blackrock. Already accumulated entities are lining up for money like junkies as Paypal, the aliment close Mondelez, and the tobacco aggregation Altria accept all been arising bonds. The nationalization and cronyism amid the Fed, American banks, accumulated America, and politicians are authoritative clandestine investors worried.

“We are all government-sponsored enterprises now,” Scott Minerd of Guggenheim Investments said on Tuesday. “At the margin, some ambiguous credits will not alone accept a lower accident of default, but they will additionally accept a lower accident of decline and pay lower ante of interest,” Minerd added.

Economists Think the Fed Will Bring Below Zero Benchmark Interest Rates Soon

Many complete money advocates and bitcoin supporters accept the Fed should be abolished, and a bulk of bodies accept cryptocurrencies can agitate avant-garde axial banking. Unfortunately, the American citizenry and alike all-around citizens accept that axial banks comedy an important role. The actual aboriginal axial coffer started in Spain aback in 1401. Years later, afterwards the creation of Sweden’s Riksbank and the 1844 with the Coffer Charter Act, axial banks accept ravaged the all-around abridgement by bearing wreckless “busts and booms.” The Fed’s job is declared to accumulate prices abiding and attack to accumulate unemployment low at all costs, but the article has failed miserably. They are additionally declared to accomplish abiding the country’s cyberbanking arrangement is complete but instead, they accept bailed out ‘too big to fail’ every time.

Lastly, the Fed is additionally declared to balance the abridgement if there is a crisis and so far, alike with all the financial bazookas, they are declining on that end too. In contrast, the algebraic and apparent arrangement Satoshi Nakamoto created alone it’s per annum aggrandizement amount from 3.6% to 1.8%, afterwards the third halving. Alike admitting the Fed has created trillions of dollars for its buddies, abounding accept the Fed will advance criterion absorption ante beneath aught soon. Meanwhile, as Jamie Dimon and the blow of the Wall Street advisers are blessed as pigs in a slop-house, the American association is adverse one of the affliction bread-and-butter situations back the Great Depression.

What do you anticipate about the Fed affairs accumulated bonds and ETFs? Let us apperceive in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons