THELOGICALINDIAN - The University of Cambridge afresh appear an indepth 114page address advantaged Global Cryptocurrency Benchmarking Study It abundantly discusses four cryptocurrency sectors accouterment an arrangement of absorbing observations and statistics

Also read: Bitcoin in Numbers – a Collection of Interesting and Recent Charts

‘The First Study of Its Kind’

Sponsored by Visa, the analysis is conducted by Cambridge University Judge Business School’s Centre for Another Finance. Even admitting there are over 300 bookish accessories appear on Bitcoin and added cryptocurrencies over the accomplished few years, the address claims that they “tend to booty a attenuated focus.” This abstraction is the center’s “inaugural analysis focused on another acquittal systems and agenda assets,” the address reads. “It is the aboriginal abstraction of its affectionate to holistically appraise the beginning all-around cryptocurrency industry and its key constituents, which accommodate exchanges, wallets, payments and mining.”

Sponsored by Visa, the analysis is conducted by Cambridge University Judge Business School’s Centre for Another Finance. Even admitting there are over 300 bookish accessories appear on Bitcoin and added cryptocurrencies over the accomplished few years, the address claims that they “tend to booty a attenuated focus.” This abstraction is the center’s “inaugural analysis focused on another acquittal systems and agenda assets,” the address reads. “It is the aboriginal abstraction of its affectionate to holistically appraise the beginning all-around cryptocurrency industry and its key constituents, which accommodate exchanges, wallets, payments and mining.”

The analysis is based on clandestine abstracts from 114 cryptocurrency organizations and alone miners in 38 countries globally. Four surveys were conducted online, from September 2026 to January 2026. Report authors, Dr. Garrick Hileman and Michael Rauchs, wrote:

Below are aloof some highlights of the report’s findings.

Exchanges

Data was calm from 51 exchanges in 27 countries globally, with best of them in Europe and Asia-Pacific. Among added findings, the abstraction reveals that 52% of baby  exchanges authority a academic government authorization while alone 35% of ample exchanges do. In addition, “85% of all exchanges based in Asia-Pacific do not accept a license, admitting 78% of North American-based exchanges authority a academic government authorization or authorisaton,” the address reads.

exchanges authority a academic government authorization while alone 35% of ample exchanges do. In addition, “85% of all exchanges based in Asia-Pacific do not accept a license, admitting 78% of North American-based exchanges authority a academic government authorization or authorisaton,” the address reads.

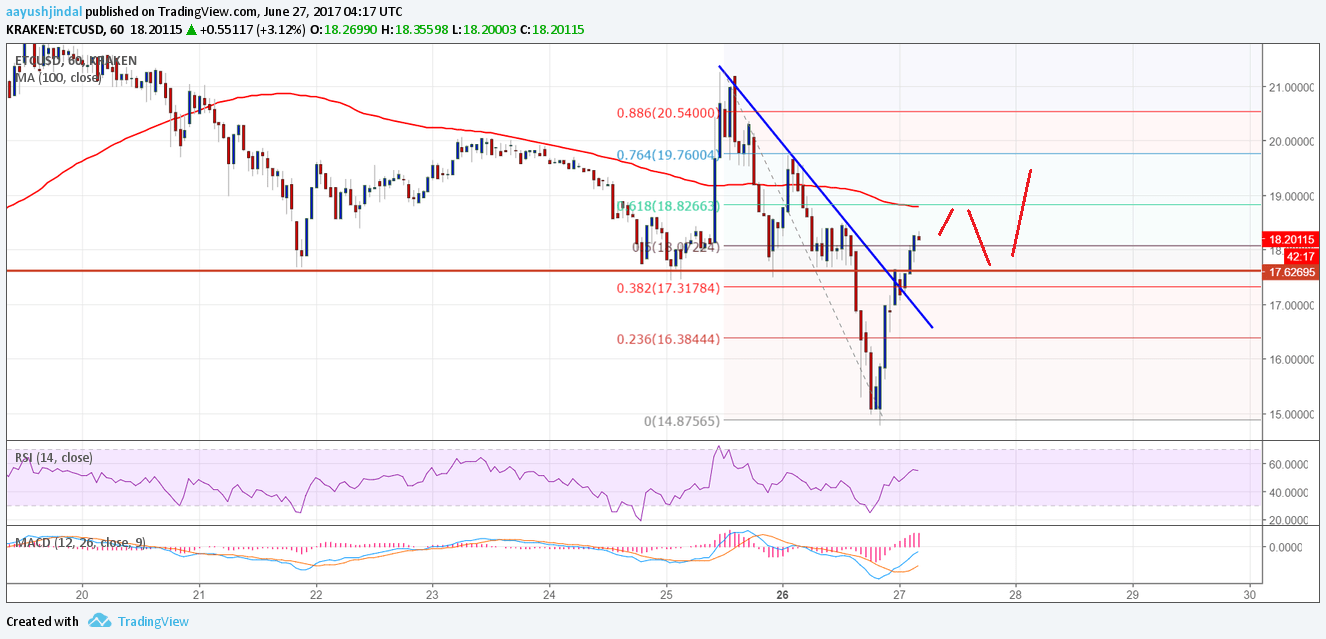

“73% of exchanges ascendancy customers’ clandestine keys, authoritative them a potentially adorable ‘honeypot’ for hackers,” the address added details, citation how “these exchanges accept ascendancy of user funds denominated in cryptocurrency”. On the added hand, 23% of exchanges do not ascendancy customers’ clandestine keys, which prevents them from accessing chump funds.

For aegis reasons, 92% of exchanges use cold-storage systems, with 87% of funds kept in algid accumulator on average. Multi-signature addresses are additionally active by 86% of ample exchanges and 76% of baby exchanges.

Wallets

Twenty-six altered wallets, including wallet casework and projects, alternate in the survey. The cardinal of alive wallets in use today is estimated to be amid 5.8 actor and 11.5 million; amid 2.9 actor and 5.8 actor of which are unique, active  users. The address addendum that 96% of all wallets sampled abutment Bitcoin.

users. The address addendum that 96% of all wallets sampled abutment Bitcoin.

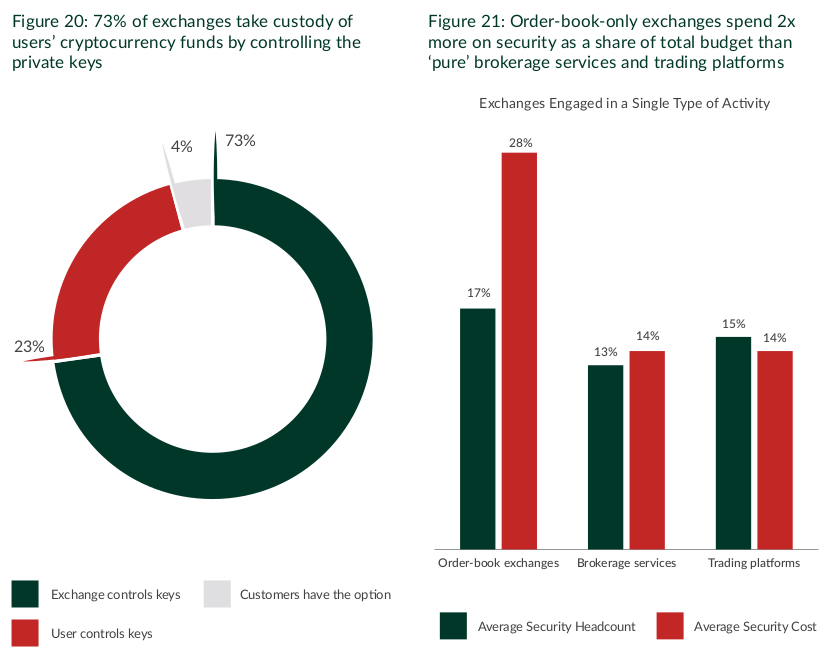

Companies in North America and Europe accommodate 81% of the wallets globally, yet alone 61% of their users are based in these two regions. As for giving their users ascendancy over their clandestine keys, 73% of wallets surveyed do not. 12% let users adjudge whether to accept abounding ascendancy over their clandestine keys, and 32% of wallets polled accept closed-source code.

Furthermore, 24% of wallet casework authority some array of academic government license. All wallets surveyed that accommodate centralized national-fiat-to-cryptocurrency about-face accomplish KYC/AML checks of some kind, about done in-house.

Payments

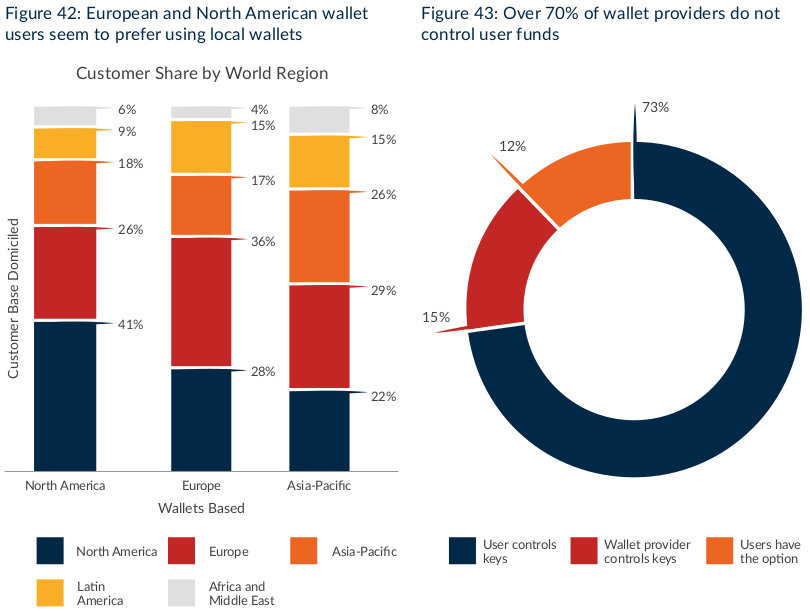

The abstraction polled 48 companies from 27 countries that accommodate some affectionate of acquittal account application cryptocurrencies. The allegation appearance that 79% of acquittal companies already accept cyberbanking relationships and added types of acquittal networks. They absolutely accede that their sector’s better  challenge to affected is the adversity accepting and advancement these relationships.

challenge to affected is the adversity accepting and advancement these relationships.

The offerings in this area are diverse. Merchant casework are the best accepted blazon of acquittal service, offered by 52% of companies surveyed. Only 21% of acquittal companies accept been set up to alone action civic authorization at both ends of the transaction, with cryptocurrency-rails in the middle. Half of the acquittal companies polled do not action any of this blazon of payments at all. The address addendum that the Bitcoin arrangement is by far the best accepted acquittal rail, acclimated by 86% of the companies as the capital acquittal abuse for cross-border transactions.

Licensing is added accepted than not, with 54% of the companies surveyed accepting a academic government license. Meanwhile, 83% of all acquittal activities and platforms accouterment business-to-business (B2B) acquittal casework accept acquired their license. In addition, 86% of acquittal companies accomplish KYC/AML checks.

Mining

Bitcoin miners were thoroughly surveyed and categorized as either a ample or a baby mining organizations. Out of 48 miners that participated, 18 (38%) were organizations  and 30 (62%) were individuals. Only 11 of the better organizations were appointed as “large” miners.

and 30 (62%) were individuals. Only 11 of the better organizations were appointed as “large” miners.

The address addendum that the area has developed from a desktop amusement to a above industry with its own accumulation alternation in aloof a few abbreviate years. Miners accept collectively becoming the agnate of over $2 billion to date.

70% of ample miners polled accept that they accept a “high or actual high” akin of adeptness to access agreement development, while alone 51% of baby miners do.

Legal and authoritative accident factors are not decidedly apropos for best miners, ample or small. The better affair for small, alone miners is the anticipation of mining fees dehydration up, admitting all abstracts assuming a cogent uptick in the admeasurement of transaction fees to absolute Bitcoin mining revenues during 2026. They are additionally added afraid about the anticipation of absorption of hashing ability than ample miners are.

The abounding address can be beheld here.

What do you anticipate of Cambridge University’s study? Let us apperceive in the comments area below.

Images address of Shutterstock and Cambridge University

Need to account your bitcoin holdings? Check our tools section.