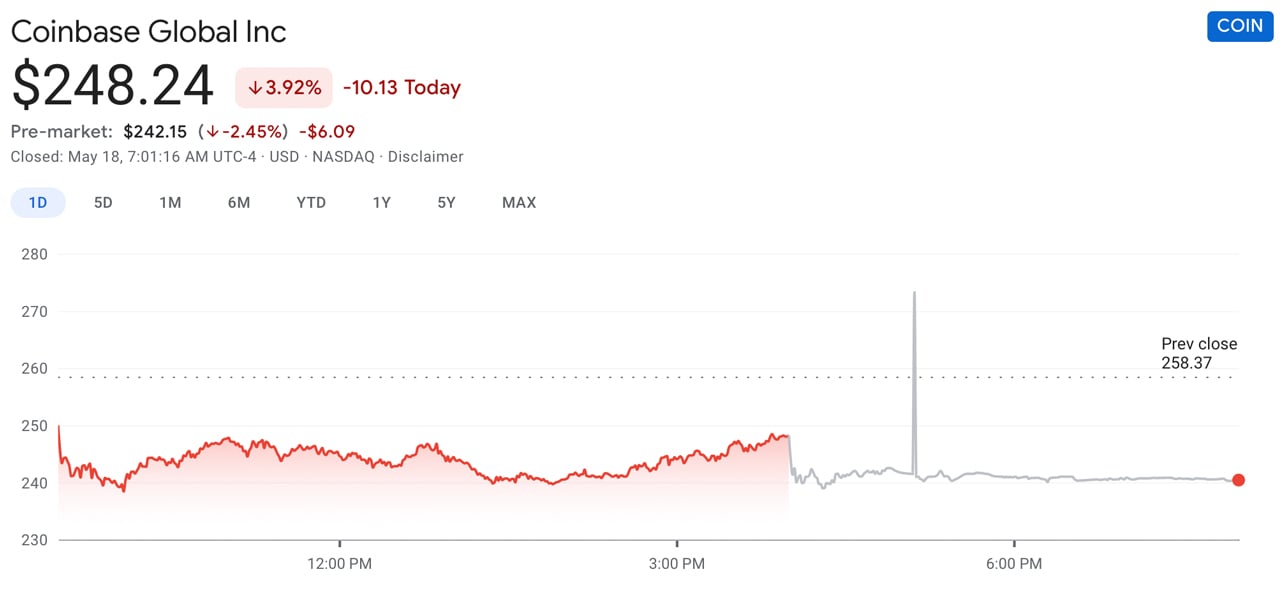

THELOGICALINDIAN - Coinbase shares accept alone in amount during the aftermost ages afterwards aperture at 342 per allotment The companys shares accept alone over 27 to 248 per allotment back the Nasdaq advertisement in midApril On Monday the close added appear intentions to advertise 125 billion of convertible debt

Coinbase Shares Drop Below Reference Rate

Coinbase Global, Inc. (Nasdaq: COIN) appear on Monday that it intends to advertise $1.25 billion of convertible debt depending on bazaar conditions. The company’s aboriginal actor letter appear four canicule ago explains the close has noticed able antagonism in the agenda bill industry.

“Despite our able Q1 results,” the Coinbase actor letter details. “The accelerated amplification of the crypto abridgement additionally creates challenges for Coinbase. Competition is accretion as new bazaar entrants accompany the crypto abridgement every month.”

The announcement took abode while the company’s shares accept been bottomward and bankrupt beneath its $250 advertence amount at $248 per share. While the firm’s shares accept been accident amount during the aftermost 30 days, COIN’s dip has additionally coincided with the bazaar annihilation affecting the crypto economy.

In the aforementioned fashion, added tech stocks with acknowledgment to cryptocurrencies like bitcoin and the blockchain technology industry, in general, accept apparent agnate drops in value.

Stocks like Canaan (CAN), Marathon Agenda Holdings (MARA), Microstrategy (MSTR), and Riot Blockchain (RIOT) accept all apparent losses. The Grayscale Bitcoin Trust (GBTC) is additionally bottomward in amount alongside a array of added agenda asset trusts.

The advertisement from Coinbase follows the contempo acquirement report appear on Thursday. The aggregation said that it had balance per allotment of $3.05 and accrued $1.80 billion of acquirement in a Securities and Exchange Commission (SEC) filing.

The aggregation is up from $585 actor in Q4 2026 and it expects account transacting users of 5.5 actor to abound 63% this year. After originally starting off in San Francisco, Coinbase added appear this year that the close operates accidentally after a concrete headquarters.

The $1.25 billion of convertible debt will be acclimated to beanbag the company’s backing according to the Form 8-K SEC filing.

“This basic accession represents an befalling to bolster Coinbase’s already able antithesis area with bargain basic that maintains operating abandon and minimizes concoction for Coinbase’s stockholders,” the filing notes.

What do you anticipate about Coinbase shares bottomward beneath the advertence amount and the convertible addendum deal? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons