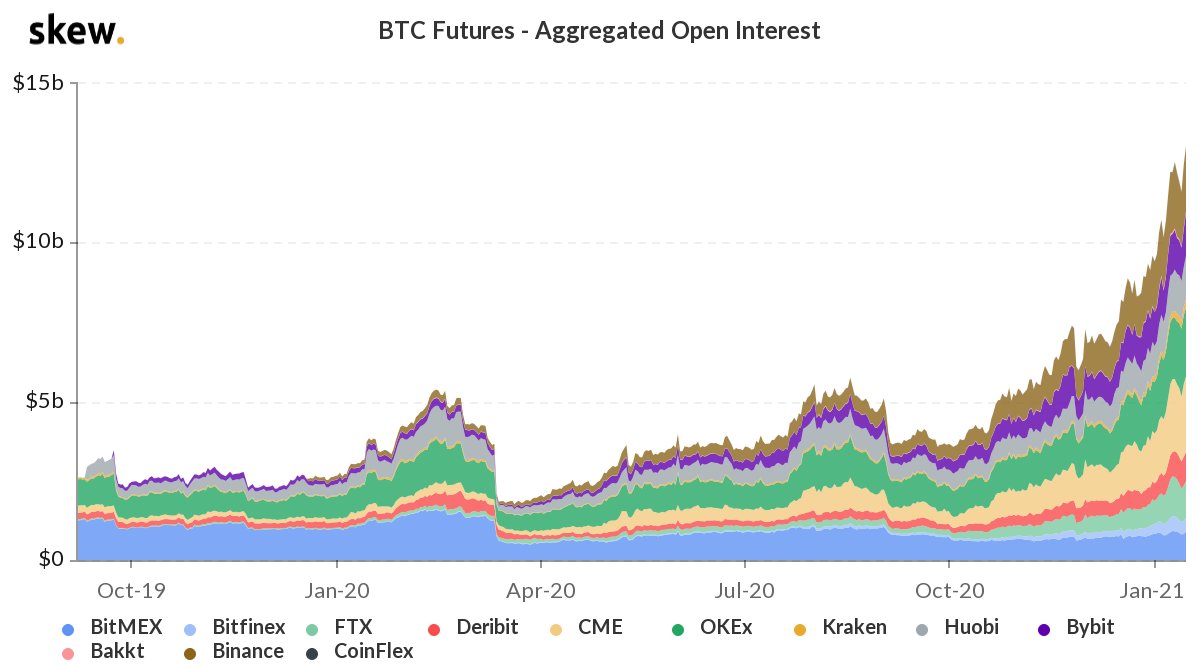

THELOGICALINDIAN - Bitcoin options accessible absorption has accomplished 96 billion according to derivatives bazaar abstracts as the metric is advancing the aerial captured on January 7 2026 Moreover the accumulated accessible absorption in bitcoin futures is steadily advancing alltime highs

While cryptocurrency atom markets accept consolidated, bitcoin-based derivatives markets accept apparent connected action. At the time of publication, both bitcoin futures and options accessible absorption has been ascent significantly.

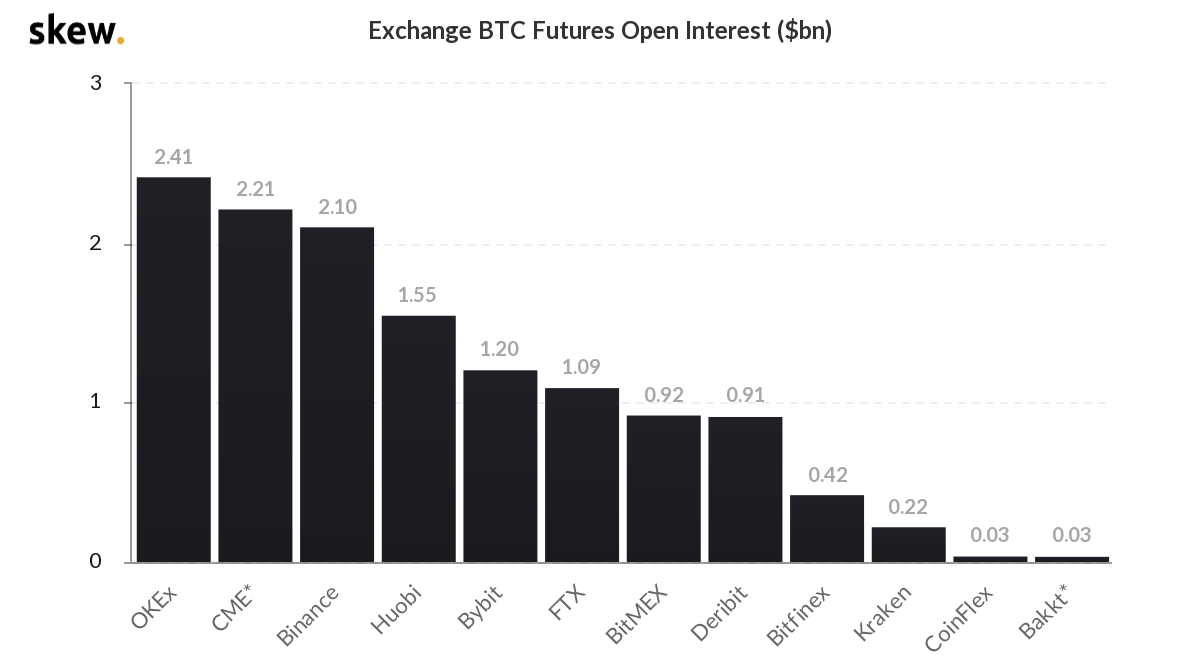

For instance, advisers at skew.com afresh tweeted that “bitcoin futures accessible absorption [is] bound bouncing aback to a new best high.” Skew additionally added that CME Group was now the better accessible absorption “by some margin.” Data from exchanges ambidextrous with bitcoin futures shows that accessible absorption continues to climb.

Okex holds the reins as far as bitcoin futures accessible absorption today, followed by the platforms CME and Binance. These three arch bitcoin derivatives markets are followed by Huobi, Bybit, FTX, Bitmex, Deribit, Bitfinex, Kraken, and Coinflex respectively.

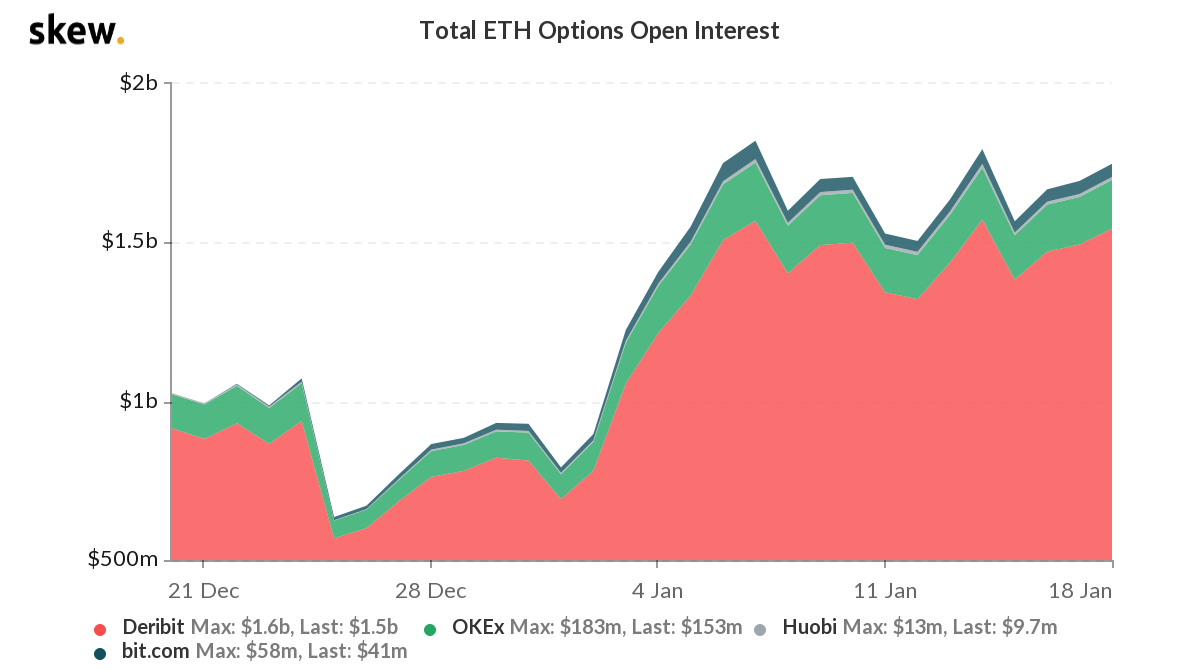

In accession to bitcoin futures advancing best highs in agreement of accessible interest, ethereum futures and options accept apparent increased demand as able-bodied as the crypto asset’s atom markets near best amount highs as well. Skew analytics indicates absolute ETH options absorption is about $1.7 billion with Deribit advantageous $1.5 billion. Deribit’s ETH options accessible absorption is followed by Okex ($153M), Bitc.com ($41M), and Huobi ($9.7M).

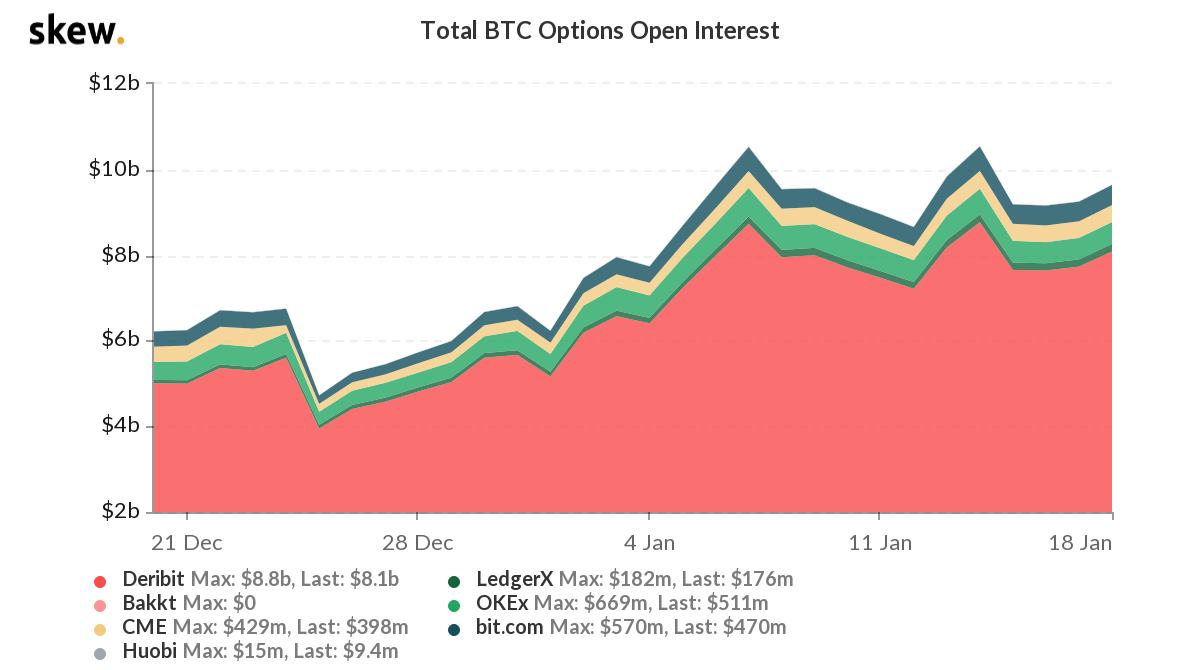

Alongside the admiration for crypto futures, bitcoin options accept added essentially during the aboriginal ages of 2026. The estimated abstract amount of all accessible bitcoin options positions is $9.6 billion with an accomplishment set for January 29, 2026.

The crypto barter Deribit commands the lion’s allotment of BTC options with 84.37% ($8.1B) of accessible interest. Deribit is followed by derivatives platforms such as Okex ($511M), Bit.com ($470M), CME ($398M), Ledgerx ($176M), and Huobi ($9.4M).

The accumulated of accessible absorption on bitcoin options has swelled progressively over the aftermost six months. Data from Bybit’s 24-hour long/short ratio shows shorts are up 50.64% while longs are 49.36%.

BTC longs and shorts stemming from Bitfinex according to Tradingview abstracts shows longs are increasing while BTC/USD shorts accept remained low.

The added appeal for bitcoin-based derivatives, follows BTC’s lifetime best amount aerial of $42,000 recorded alone 12 canicule ago. At the time of publication, BTC/USD atom bazaar prices are still bottomward 11.8% back affecting the $42k handle.

Meanwhile, with the 258,818 BTC in options accessible interest, 99,753 BTC or $3.7 billion is set to expire in ten days.

What do you anticipate about the contempo access in accessible absorption for bitcoin derivatives like futures and options? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Skew.com, Twitter,