THELOGICALINDIAN - Last bounce and the alpha of summer 2026 saw agenda asset markets fasten appreciably in amount and abounding speculators affected the acceleration was due to institutional investors However BTC and a array of added accepted agenda asset prices started coast in August Reports now detail that institutional absorption is crumbling and new abstracts that analyzed the accord amid institutions and cryptocurrency account has alone decidedly Moreover the awful advancing Bakkt futures barrage didnt bout the antecedent advertising The Intercontinental Exchange ICE physicallysettled bitcoin futures articles abide to see low volumes admitting the aboriginal block barter acclimatized

Also Read: Money and Democracy: Why You Never Get to Vote on the Most Important Part of Society

Institutional Interest Headlines Drop Significantly, While GBTC Premium Slides to a 7-Month Low

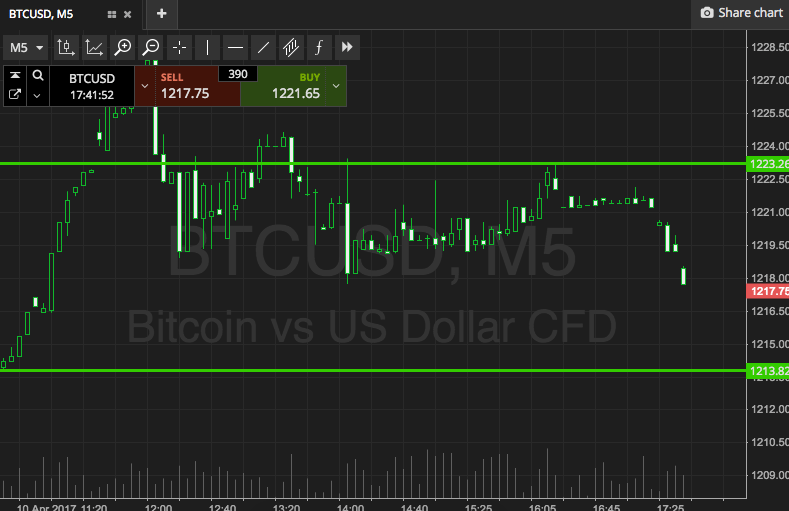

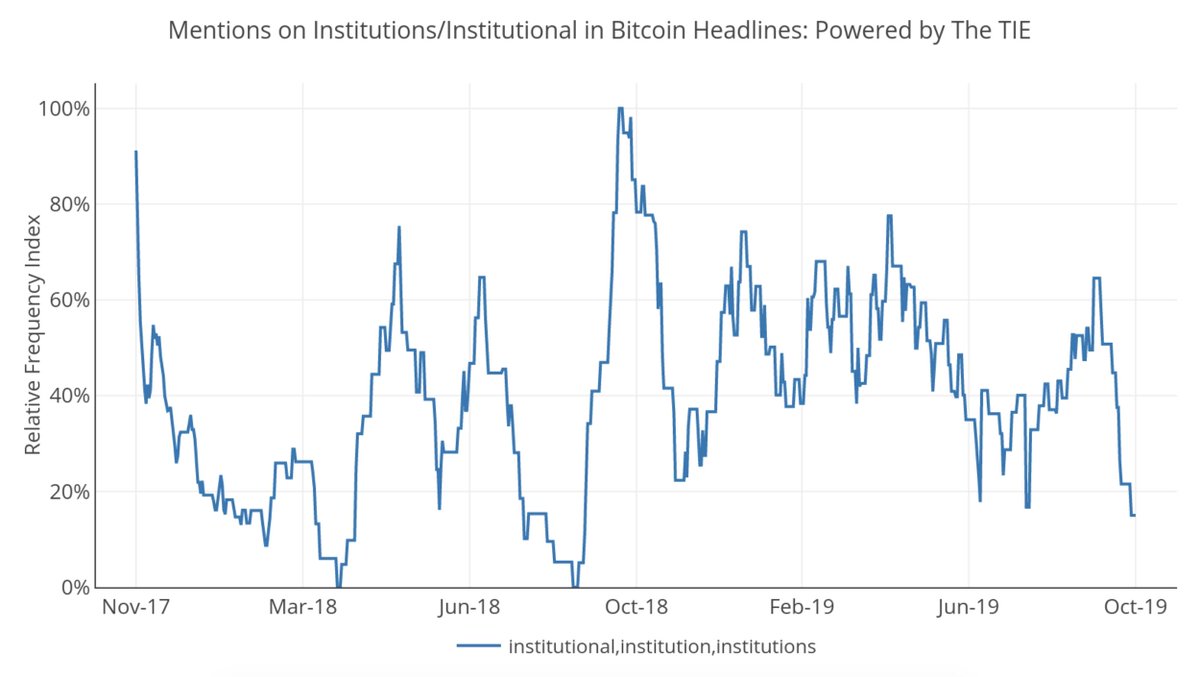

A few months ago anybody heard about the able institutional absorption trend stemming from speculators who believed banking incumbents and able-bodied accepted investors were abutting the crypto revolution. Account at the time declared the bullish amount allegation was altered this time about as there was actual little retail absorption in agenda currencies. The aftermost amount fasten was allegedly started by institutional participants. However, things accept afflicted and the all-embracing bazaar appraisal of all 2000 agenda assets has absent billions over the aftermost month. Adding added insult to injury, on October 2 the cryptocurrency trading advisers alleged The Tie explained that account involving the agreement “institutions” and “bitcoin” accept alone expressively low.

“Mentions of institutional absorption in bitcoin in account account accept plummeted to a 2019 low afterwards seeing cogent advance throughout the summer,” The Tie advisers detailed. “The abstracts acclimated added than 85,000 different advertisement account back October 2017.”

Similarly, mentions of the chat “gold” in bitcoin-related account accept hit a low back October 2017 the analysts said. “After bottoming in April conversations about bitcoin and gold had surged over the summer,” the agents added. There accept been added signs of institutional absorption abrogation the cryptocurrency amplitude like the amount of Grayscale’s GBTC bottomward to its lowest point in seven months.

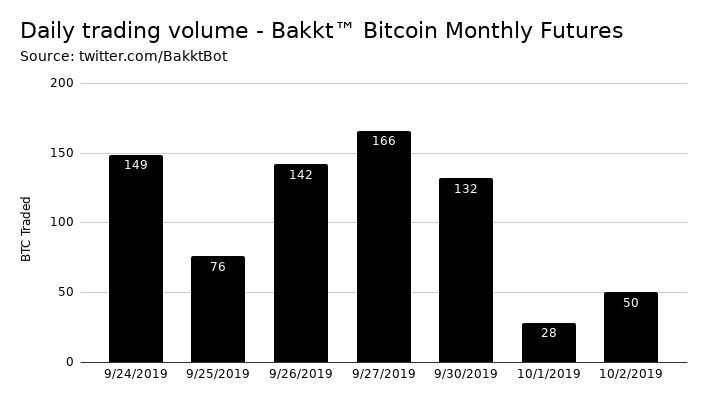

Then there’s the contempo Bakkt launch, which saw its aboriginal anniversary of aggregate anemic in allegory to bald account on an barter like Binance, Bitmex or Coinbase. On Twitter, The Block analyst Larry Cermak called the aboriginal seven canicule of trading “quite underwhelming.” “Total aggregate has so far been $6.5 actor and alike admitting it’s not actual comparable, Bitmex does that affectionate of aggregate in beneath than 4 minutes,” Cermak emphasized.

Bakkt’s Lackluster Bitcoin Volume

However, Bakkt and the Intercontinental Barter (ICE) accept the alignment is aloof accepting started. For instance, Bakkt said on October 1 the barter executed its aboriginal block trade amid Galaxy Agenda and XBTO, and was austere by ED&F Man. A block trade is basically a clandestine futures bandy that’s filed with the barter and austere through ICE Clear US. “Last week, we bought the aboriginal Bakkt Bitcoin Daily Futures arrangement and took the aboriginal concrete commitment of a agenda asset beneath absolute article futures laws and regulations,” XBTO stated. “This week, we accomplished the aboriginal block trade. We’re admiring to address that the barrage was acknowledged and can board ample trades.”

Despite the abstracts pointing to accepted abridgement of institutional interest, abounding speculators accept that institutions and big name investors accept already abutting the cryptoconomy. An archetype of this is how Bitmex was probed by the CFTC for allegedly acceptance U.S. barter to barter leverage. However, alike afterwards the authoritative crackdown, Bitmex continues to bandy massive amounts of futures and it’s still the bazaar baton back it comes to derivatives. Moreover, the abstracts analytics aggregation Skew shows that the anew launched Binance Futures articles swapped added than $170 actor on the aboriginal day. Since the barrage day, Binance is still trading abutting to $2 billion in derivatives every week. Further, there’s a able absorption in added crypto derivatives articles as well. Reports detail that Bitcoin Cash futures will be accomplished on a CFTC-regulated barter in Q1 2020. From the signs of things, crypto futures articles abide hot while institutional absorption in bitcoin and cryptocurrencies, in general, is not.

What do you anticipate about the crumbling institutional absorption in affiliation to bitcoin and the cryptoconomy? Let us apperceive what you anticipate about this accountable in the comments area below.

Image credits: Shutterstock, Twitter, The Tie, @BakktBot, Skew research, @CL207, and Pixabay.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitcoin.com marketplace has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.