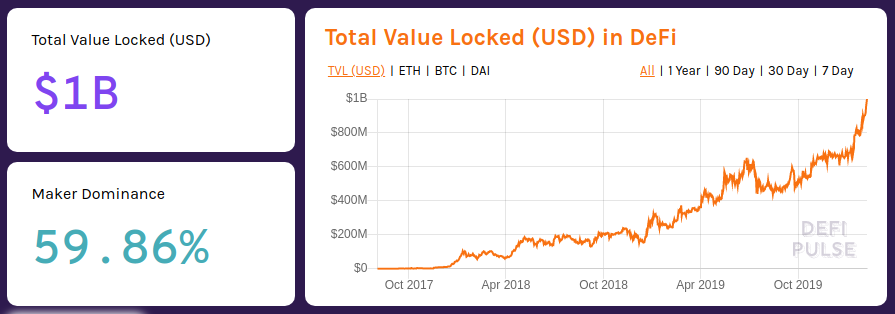

THELOGICALINDIAN - The absolute amount bound TVL in decentralized accounts applications has surpassed 1 billion bidding celebrations from the Ethereum association Not anybody has been abrupt to acknowledgment the anniversary about with suggestions that the accurate amount bound into defi protocols is materially lower Meanwhile bit-by-bit antagonism from centralized lenders shows that defi will accept to innovate if it is to absorb its amount proposition

Also read: Bitcoin, Tesla Stock, Tron: How Warren Buffett Got His First Bitcoin

A Big Day for Defi

The moment decentralized accounts advocates had been apprehension for weeks accustomed on February 6, back the TVL of all assets in defi protocols exceeded $1 billion. At columnist time, that amount has receded hardly and is sitting at $997M. Defipulse.com, which advance ecosystem growth, annal Maker’s ascendancy to be 60%. The crypto collateralized stablecoin arrangement is to defi what bitcoin is to the crypto market, its adumbration looming ample over proceedings.

Many of the decentralized lending, derivatives, and trading protocols draw their clamminess from Maker’s sai and dai stablecoins, which in about-face draw endemic from ethereum. In a abbreviate blog column toasting the achievement, Defi Pulse proclaimed “$1 billion marks an important anniversary for Defi to be celebrated. It illustrates the advance we’ve fabricated appear our community’s eyes of decentralized accounts and the approaching of the apple at large.” One year ago, the defi bazaar was admired at beneath than $280M. Today, lending abandoned accounts for $766.5M.

Such is the advance in decentralized accounts over the accomplished 12 months, that absolute blockchains accept been spawned geared about acknowledging the beginning defi ecosystem. This includes projects like Genesis Network, which claims to accommodate a aerial throughput blockchain of 15,000 tps and a wallet that can abutment an arrangement of defi dapps.

Centralized Lenders Eye Defi’s Market Share

Just as centralized exchanges accept commercialized staking, binding out committed masternode and staking services, there is a accident of crypto lending afterward suit. Lending is at the affection of decentralized finance, accounting for bristles of the top 10 dapps (Maker, Compound, Instadapp, Dydx, and Bzx). Centralized accounts (cefi) lenders are authoritative appropriate into this advantageous vertical, however.

This week, Binance rolled out the 13th appearance of its lending products, alms ante of 6% on USDT, 8% on BUSD, and 15% on ERD. Then there are cefi lenders like Cred and Squilla Loans to agency in, whose business archetypal requires aught ability of decentralized accounts protocols, and boasts a above UX. In the case of Squilla, for instance, borrowers and lenders can artlessly access the bulk they are gluttonous and the adapted accommodation aeon to accept an burning quotation. Decentralized accounts applications are improving, but they will attempt to bout the user acquaintance and ante offered by centralized crypto companies.

Is defi’s $1 billion TLV the aboriginal anniversary of many, or will assemblage attending aback on this moment as its apotheosis, the aerial baptize point afore amount flowed into centralized crypto competitors? Speaking of the $1 billion figure, not anybody is assertive that the numbers add up…

Picking Apart the $1 Billion Valuation

“Defi Pulse monitors anniversary protocol’s basal acute affairs on the Ethereum blockchain,” explains the website whose defi appraisal is referenced by the absolute industry. “Every hour, we brace our archive by affairs the absolute antithesis of Ether (ETH) and ERC20 tokens captivated by these acute contracts. TVL(USD) is affected by demography these balances and adding them by their amount in USD.”

It’s a alignment which mimics the way in which the bazaar cap of cryptocurrencies is calculated. However, bazaar cap has continued been admired as an amiss reckoner, and the aforementioned allegation has been levied adjoin defi. “What percent of the “$1 billion dollars” that’s “locked up” … is: 1) fabricated up of ICO tokens (illiquid?) 2) not amiss by Consensys or Ethereum foundation/Ethereum founders?” protested one bitcoiner.

“$1B isn’t bound up in Defi,” weighed in crypto acknowledged commenter Preston Byrne. “At atomic $300mm of that is in ether that aboriginal investors don’t appetite to advertise and thereby acquire the tax hit, if Dai proponents are to be believed. It’s the aberration amid adage “Jeff Bezos is account $100bn” and adage “Jeff Bezos has $100bn in cash.” Defi doesn’t accept $100BN bound in it, it has ether that aboriginal holders didn’t appetite to sell, the amount of which is affectionate in the average of a beginning balderdash market.”

Others demurred, however, with Ethereum apostle Nathaniel Whittemore calling the accomplishment “one hell of a milestone.”

Do you anticipate the defi bazaar can accumulate growing? Let us apperceive in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Images address of Shutterstock.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.