THELOGICALINDIAN - Crypto enthusiasts accept noticed that the Ethereum blockchain has appear clumsily abutting to extensive accommodation due to the added affairs stemming from the Binding USDT arrangement The transaction calculation back midAugust shows the ERC20 adaptation of binding has surpassed the aboriginal adaptation that uses BTC ERC20 binding affairs amount users added than 260000 in the aftermost 30 canicule and the oversaturation of trades is 17X beyond than the abominable Crypto Kitties fiasco

Also read: How to Create Non-Fungible Assets and Collectible Tokens With Bitcoin Cash

Tether Migrating to ETH Sparks Capacity Fears

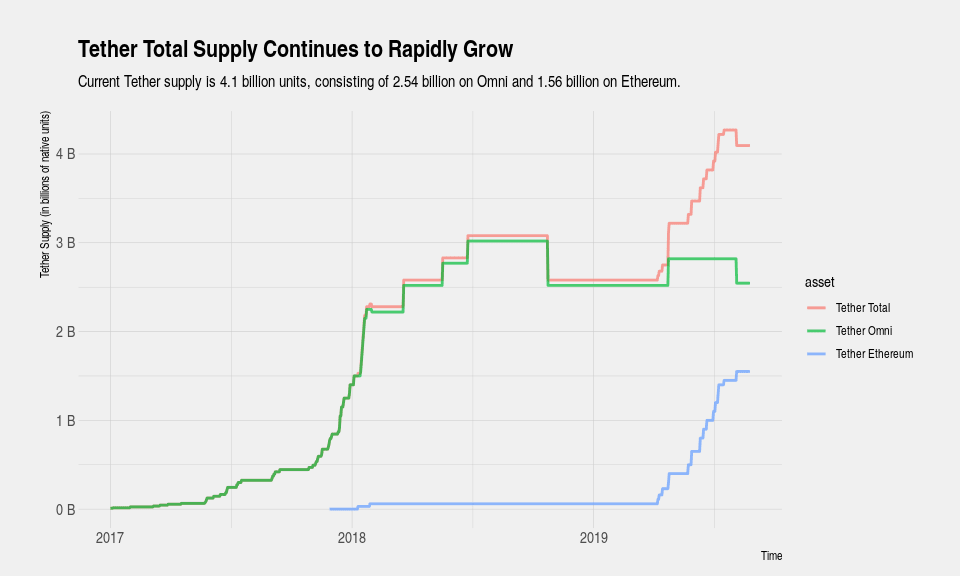

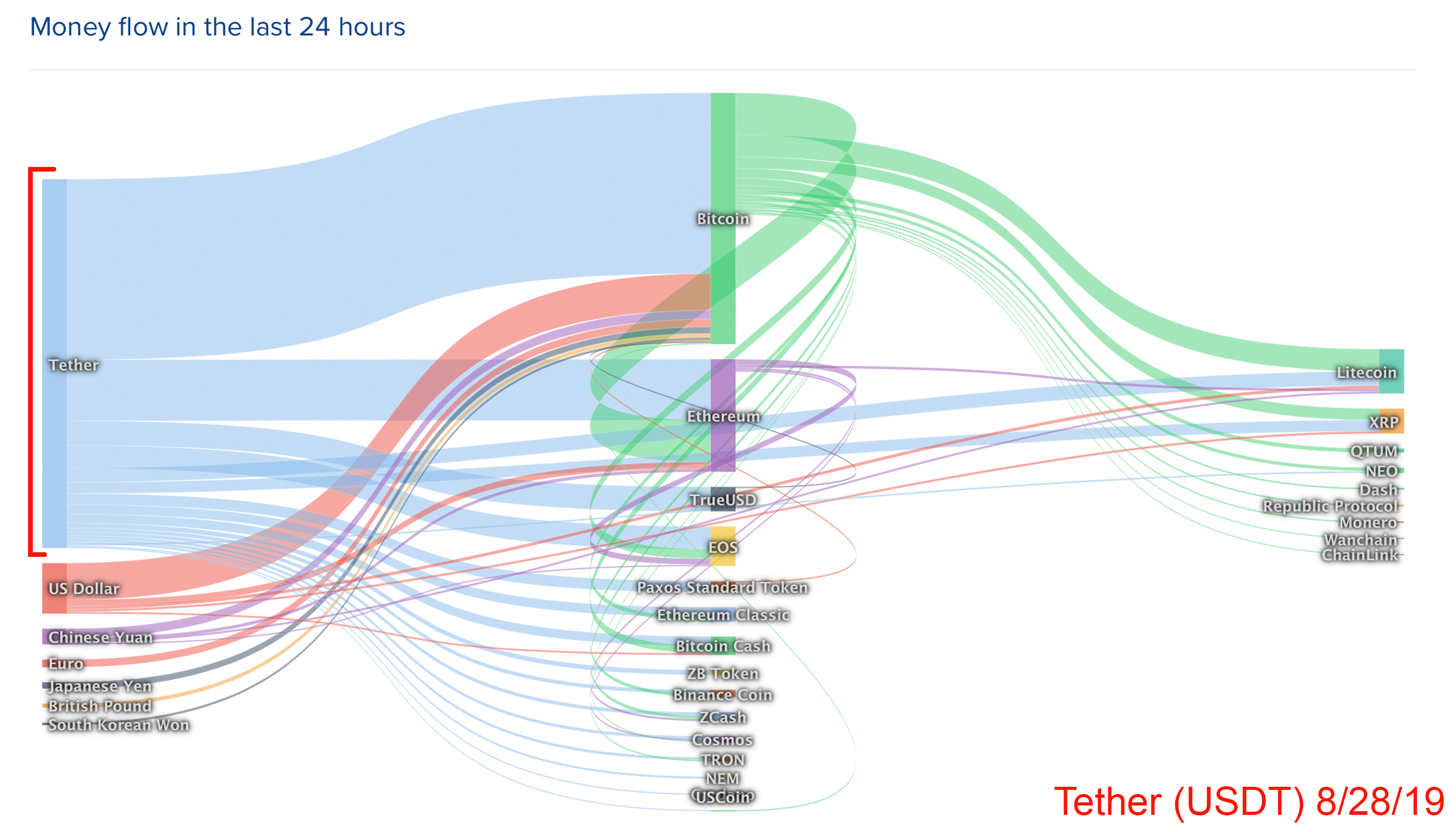

In December 2017 during the acme of the crypto balderdash run, the Ethereum blockchain was swamped with different bodies agnate to Pusheens that could be calm and traded application the ETH network. The Crypto Kitties accident prompted the creators to access the cat bearing fee in adjustment to incentivize miners to add bearing affairs to the chain. Fast advanced to 2019 and Binding has started brief bill from the Omni Layer arrangement which uses the BTC alternation to an ERC20 adaptation which runs on top of the ETH chain. Binding is a $4 billion dollar arrangement with bill advance beyond assorted blockchains which accommodate BTC (Omni), ETH (ERC20), EOS, and Tron. Data pulled from the website Coin Metrics shows that the ETH-based binding affairs accept surpassed the BTC-based versions this month. Today, on August 28, there are 39,000 binding affairs on the BTC arrangement via Omni, but that cardinal is eclipsed by the 126,000 ETH-based binding transactions. At the time of publication, there’s almost 1.5 billion USDT minted application the ETH alternation and 2.5 billion angry to the Omni Layer network.

Since the binding affairs actuality acclimated on the ETH alternation accept acicular significantly, the crypto association has been celebratory the ETH alternation abound chock-full again. Ethereum cofounder Vitalik Buterin told Bloomberg this anniversary that the “[ETH] blockchain has been about abounding for years.” ““I anticipate it’s still acceptable to advance apps, but annihilation abundant should be developed with scalability techniques in mind, so that it can survive college transaction fees that would appear with added growing appeal for Ethereum — In the best term, Ethereum 2.0’s sharding will, of course, fix these issues,” Buterin asserted during the interview. Prominent Ethereum advocate and architect of Mythos Ryan Sean Adams explained that every asset on Ethereum is “a approaching acquirement antecedent for ETH stakers.” “Tether paid 993 ETH over the aftermost 30 days,” Adams said to added bolster his above-mentioned statement.

For Stablecoin Use Cases Like Trading and Arbitrage, the Market Demands Faster Transactions and Lower Fees

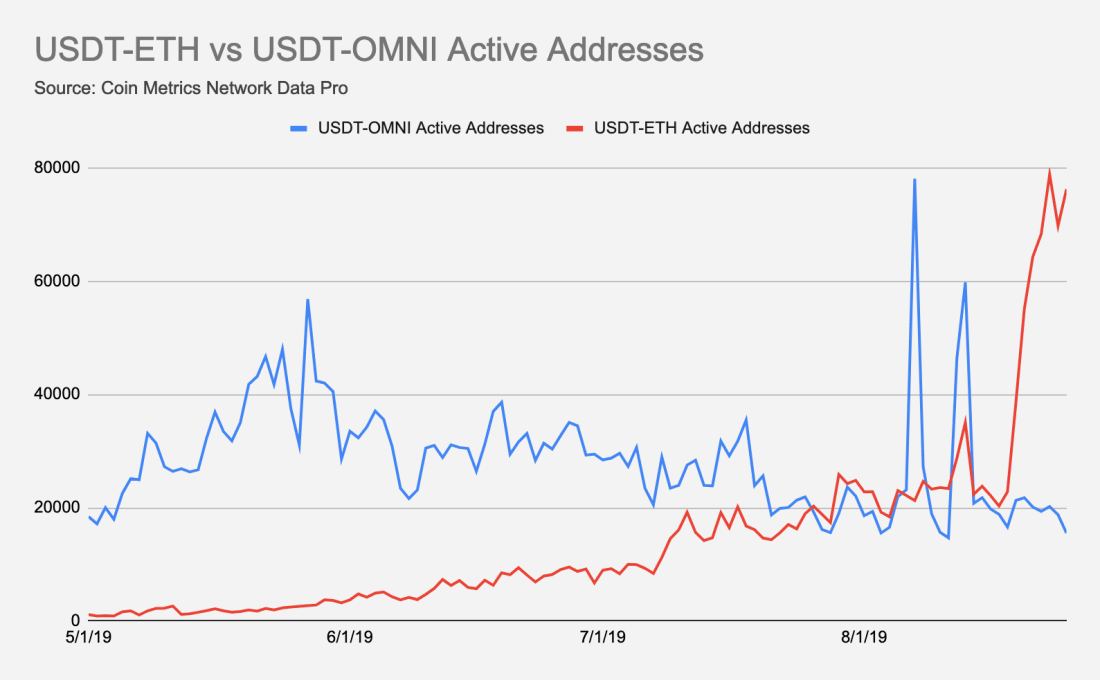

The binding clearing to Ethereum has been absolutely apparent and Coin Metrics’ Nic Carter appear abstracts concerning Tether’s advance and alteration to Ethereum. “USDT-ETH alive addresses (the calculation of different addresses that were alive in the arrangement as a almsman or artist of a balance change) skyrocketed over the accomplished week, jumping from 38,600 on August 19 to over 78,800 on 8/23,” the report notes.

“Meanwhile, USDT-OMNI alive addresses abide to decline, admitting two contempo spikes.” The address additionally addendum that the clearing from Omni to Ethereum may accept stemmed from bazaar demand. “The primary use case for Tether is for alive trading and arbitrage — For these use cases, Tether on Ethereum is faster (15-second blocks for Ethereum against 10-minute blocks for Bitcoin) and crave beneath fees,” the Coin Metrics’ State of the Network analysis explains. The address adds:

Stablecoin Networks Using the Bitcoin Cash Network Will Benefit From Low Fees and More Capacity

Despite Tether’s move to the ETH chain, a few agenda bill admirers accept that there could be issues with the ERC20-styled tethers if the arrangement grows too congested. Some skeptics and assemblage anticipate binding users are advantageous way too abundant in arrangement fees. On the bitcoin cash-oriented Reddit appointment r/btc, some BCH supporters said that it would be far cheaper to host a accepted stablecoin like binding on the BCH chain.

“Tether affairs abandoned pay $14,000 in transaction fees for 120,000 affairs every distinct day on Ethereum (a absolute of $57,000),” Reddit user u/eyeofpython remarked. “With a circadian aggregate of $400,000,000 (source: SQL concern on eth.events for the 23 August) — If Tether were to move to BCH, bodies would alone pay $120 of fees in total.” On August 28, the boilerplate BCH arrangement fee is alone $0.004 per transaction, while the gas bare to advance an ERC20 badge is amid $0.11-0.16 per transaction. Another BCH adherent wrote:

Over the aftermost few days, there accept additionally been discussions as to whether ETH’s accommodation can handle assorted apps alongside Tether. The cardinal of affairs stemming from binding users has developed every year back the stablecoin launched and currently represents 30% of all cryptocurrency trades, ascent at times to 40%. At the time of publication, binding (USDT) captures a whopping 77% of all BTC trades, 53% of ETH, and 54% of BCH trades worldwide.

Tether continues to dominate, admitting the actuality there’s a bulk of added stablecoins aggressive like USDC, DAI, TUSD, and USDH. Most of the stablecoin competitors use the ETH arrangement as well, which presents addition set of accommodation problems for the chain. The stablecoin Honestcoin (USDH) does not use the BTC or ETH alternation and is congenital on top of the BCH arrangement application the Simple Ledger Protocol. USDH and its beginning arrangement alone has a $32,000 bazaar assets and $173,000 in all-around barter volume. However, traders application stablecoins for quick swaps and arbitrage will bound acquisition that transaction fees at $0.004 per transaction or beneath are far cheaper.

What do you anticipate about binding affairs on the ETH alternation before the Omni Layer-based binding transactions? Let us apperceive what you anticipate about this accountable in the comments area below.

Image credits: Shutterstock, Coin Metrics’ State of the Network research, Crypto Compare, Coinlib.io, and Pixabay.

Are you attractive for a defended way to buy Bitcoin online? Start by downloading your free Bitcoin wallet from us and again arch over to our Purchase Bitcoin page area you can calmly buy BTC and BCH.