THELOGICALINDIAN - Last anniversary ethereum options aggregate surpassed bitcoins for the aboriginal time on the agenda bill derivatives barter Deribit Further the trading belvedere afresh alien a 50k ETH bang for March 2022 and explained the 50k alarm is accepting actual buy traction

Ethereum Options Volume Grows Exponentially, $50K Strike Flexes Muscle

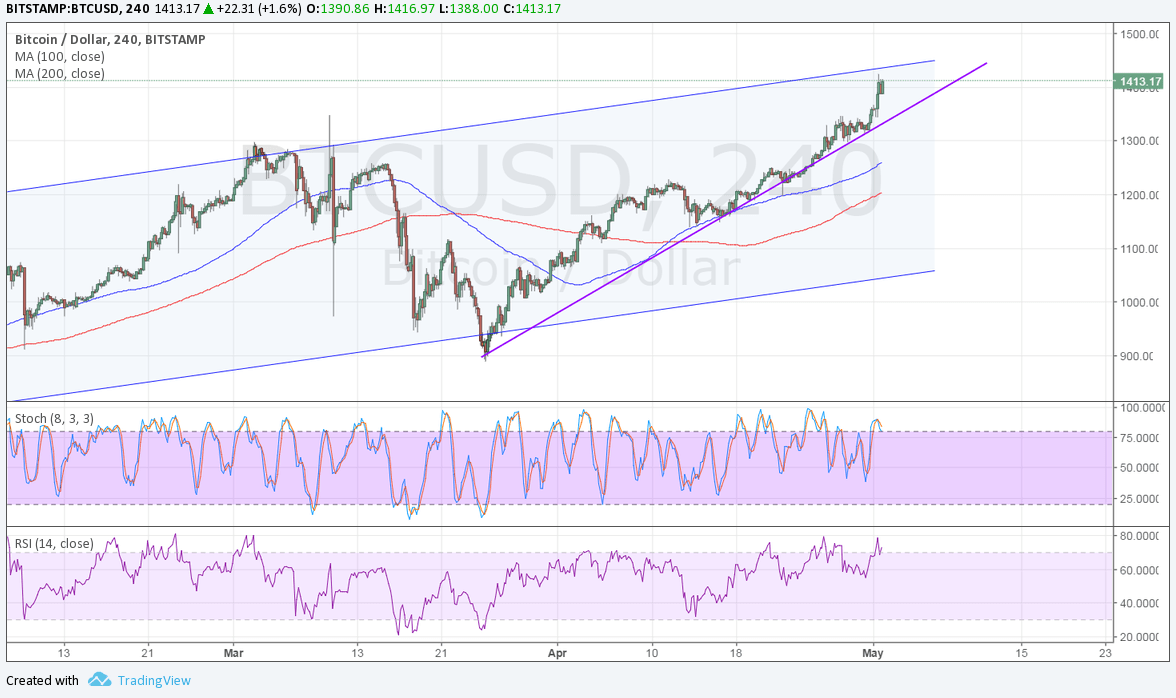

When it comes to bitcoin (BTC) derivatives, the trading belvedere Deribit captures the lion’s allotment of today’s options volume. The cryptocurrency barter additionally appearance bitcoin futures and ethereum options as well. During the aboriginal anniversary of May, Deribit’s ethereum (ETH) options surpassed bitcoin (BTC) options for the aboriginal time.

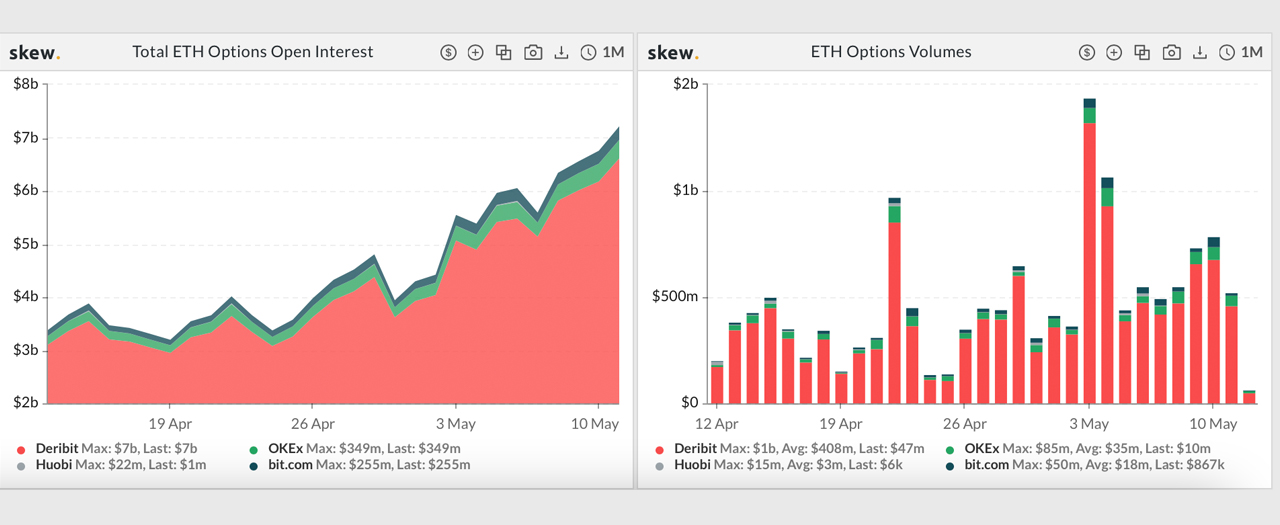

Skew analytics abstracts shows while BTC had $880 actor on May 3, ETH options saw $1.3 billion. The aggregate connected that anniversary as the analytics aggregation Skew tweeted about the amazing ETH options aggregate aftermost Thursday.

“Ether markets seeing almanac action this anniversary beyond spot, futures and options,” the analytics close tweeted. “Options traders’ anticipations of ether animation about to bitcoin are rising,” Skew added the abutting day.

On May 10, the crypto derivatives barter Deribit said: “ETH Option flows now assertive BTC. And not aloof Fast money.” During the aftermost six months, Deribit has captured the better cardinal of BTC and ETH options in agreement of aggregate and accessible interest.

“Action beyond maturities, with Deribit advertisement the ETH Mar22 50k Call (really!), accepting actual buy traction. In general, Calls formed up to keep/add exposure; appropriate 2-way Put action, but few abbreviation upside,” Deribit added.

Institutional Investors Fueling Ethereum Markets, $5K Strikes See Build-Up

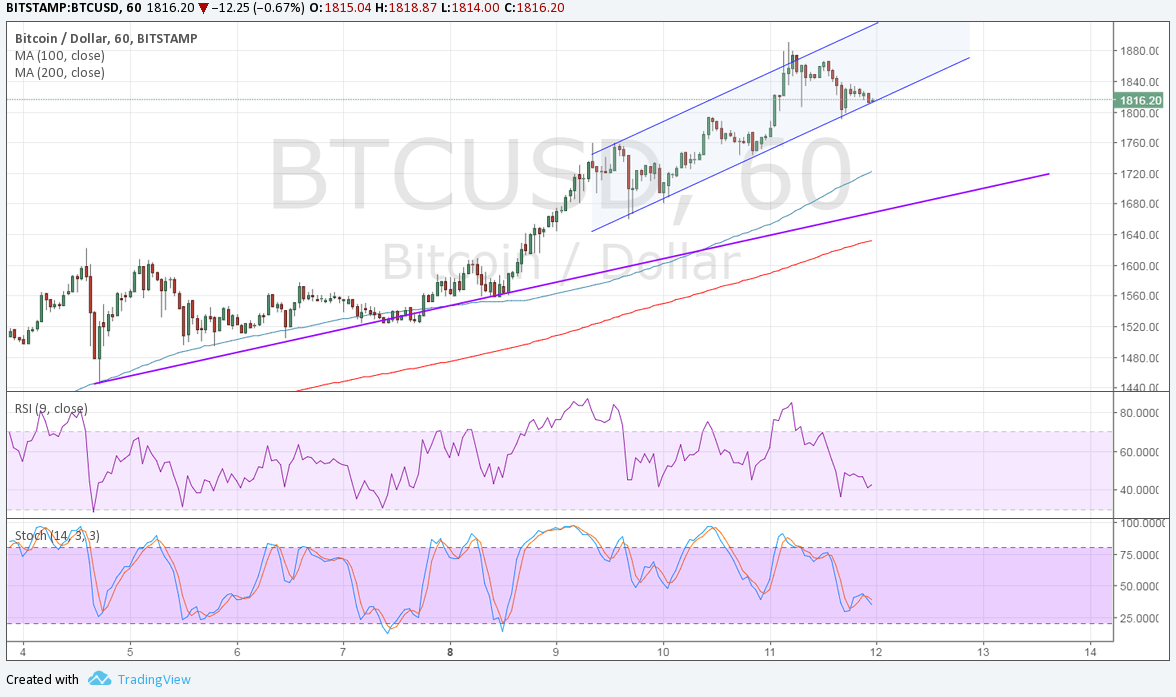

Since ethereum has afresh obtained best amount highs on atom markets, traders and speculators accept been focused on the top two arch crypto assets’ ascendancy levels.

The arch agenda asset bitcoin (BTC) has 42.1% ascendancy in agreement of bazaar cap compared to the absolute crypto abridgement ($2.29T). Ethereum on the added duke has a ascendancy akin of almost 19.8% at the time of writing.

“The second-largest crypto asset by bazaar capitalisation has been affective in a aciculate upwards aisle back its latest adamantine angle as it continues to prove its use-case,” Simon Peters, the crypto asset analyst at the multi-asset advance belvedere Etoro wrote to Bitcoin.com News.

“The cardinal of decentralised applications continues to abound on the platform. Demand from institutional investors is fuelling this latest move college as all-embracing buyers alter their acknowledgment in this arising asset class, with ethereum the accustomed abutting pick,” Peters added.

In addition cheep on May 11, Skew analytics mentioned ethereum (ETH) was seeing ample “open absorption body up on $5k strike.” Deribit added explained in its Twitter cilia that ethereum appellation anatomy is in backwardation and BTC in contango.

“BTC appellation anatomy is in contango. We would apprehend this from about RV movement. But BTC IV is nudging college in accord with ETH, on low volumes. Either apprehension is of BTC move, or conceivably a about-face of MM accessory to the action,” the barter noted.

What do you anticipate about the $50k ethereum options strike? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Skew Analytics,