THELOGICALINDIAN - A analysis cardboard appear by the Federal Reserve Bank of San Francisco shows how abrogating absorption ante could become an important action apparatus for angry approaching bread-and-butter downturns The cardboard examines the bazaar acknowledgment to the addition of abrogating absorption ante by bristles above axial banks

Also read: Where US Regulators Stand on Cryptocurrency

Fed Studies Negative Rates as Important Policy Tool

The Federal Reserve Bank of San Francisco appear a analysis cardboard aftermost anniversary exploring the furnishings of axial banks introducing abrogating absorption rates. The paper, advantaged “Yield Curve Responses to Introducing Abrogating Action Rates,” is authored by Jens H.E. Christensen, a analysis adviser in the Economic Analysis Administration of the Federal Reserve Bank of San Francisco. This administration conducts analysis on a advanced ambit of capacity in abutment of the Federal Reserve Bank’s action and accessible beat functions.

“Given the low akin of absorption ante in abounding developed economies, abrogating absorption ante could become an important action apparatus for angry approaching bread-and-butter downturns,” the columnist proposed, elaborating:

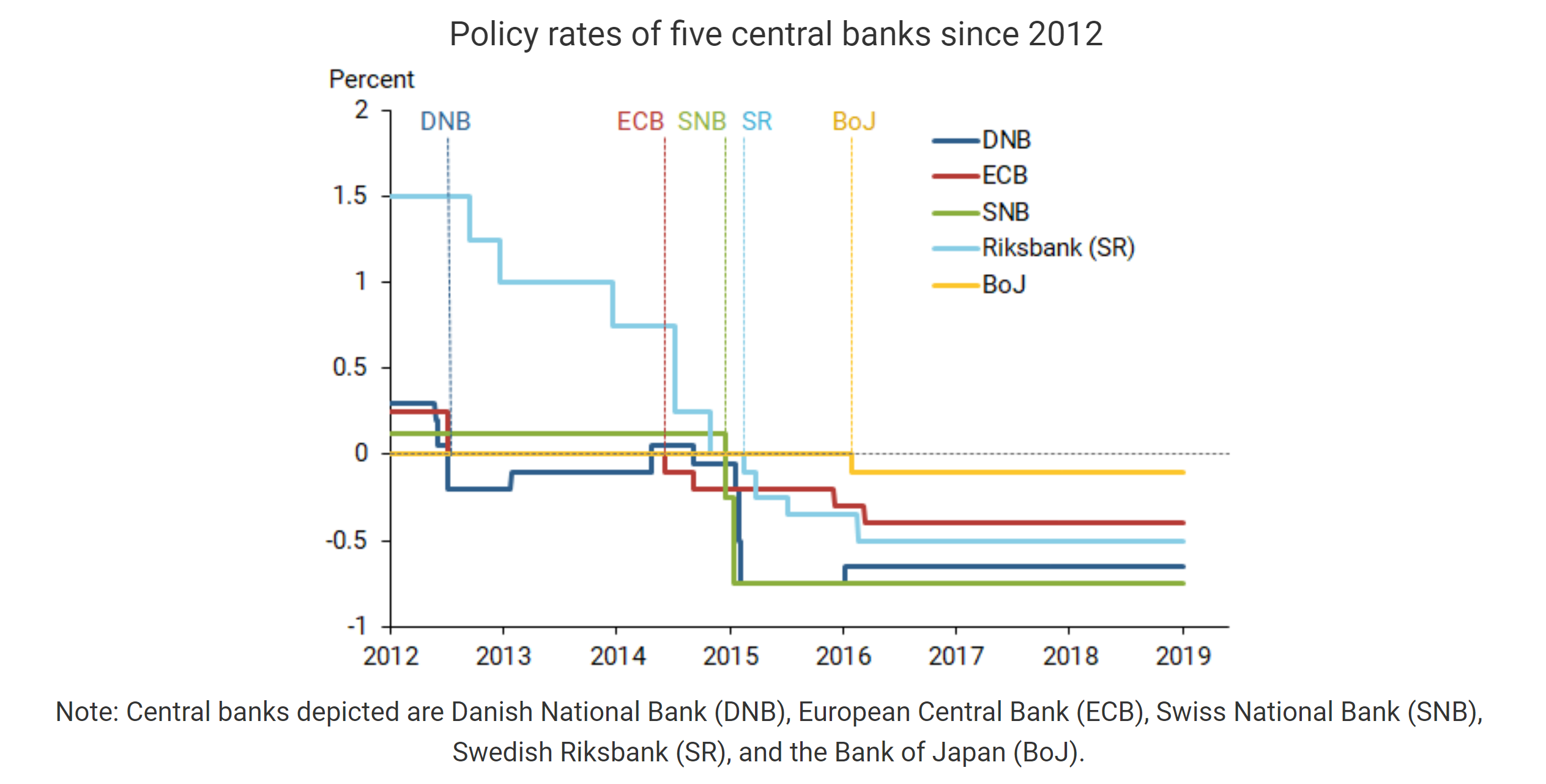

Examining 5 Central Banks With Negative Rates

Christensen advised bristles axial banks that accept already alien abrogating absorption rates: the Danish National Bank, the European Axial Bank (ECB), the Swiss National Bank, the Swedish Riksbank, and the Bank of Japan. The Danish National Bank alien a abrogating amount in July 2026.

He explained that one way to admeasurement the furnishings of abrogating absorption ante “is through the banking bazaar acknowledgment as reflected in the change of the government band crop ambit back abrogating action ante are alien for the aboriginal time.” He antiseptic that government band yields were called for the abstraction because “they represent a accepted and broadly acclimated criterion that is accessible in all bristles cases.”

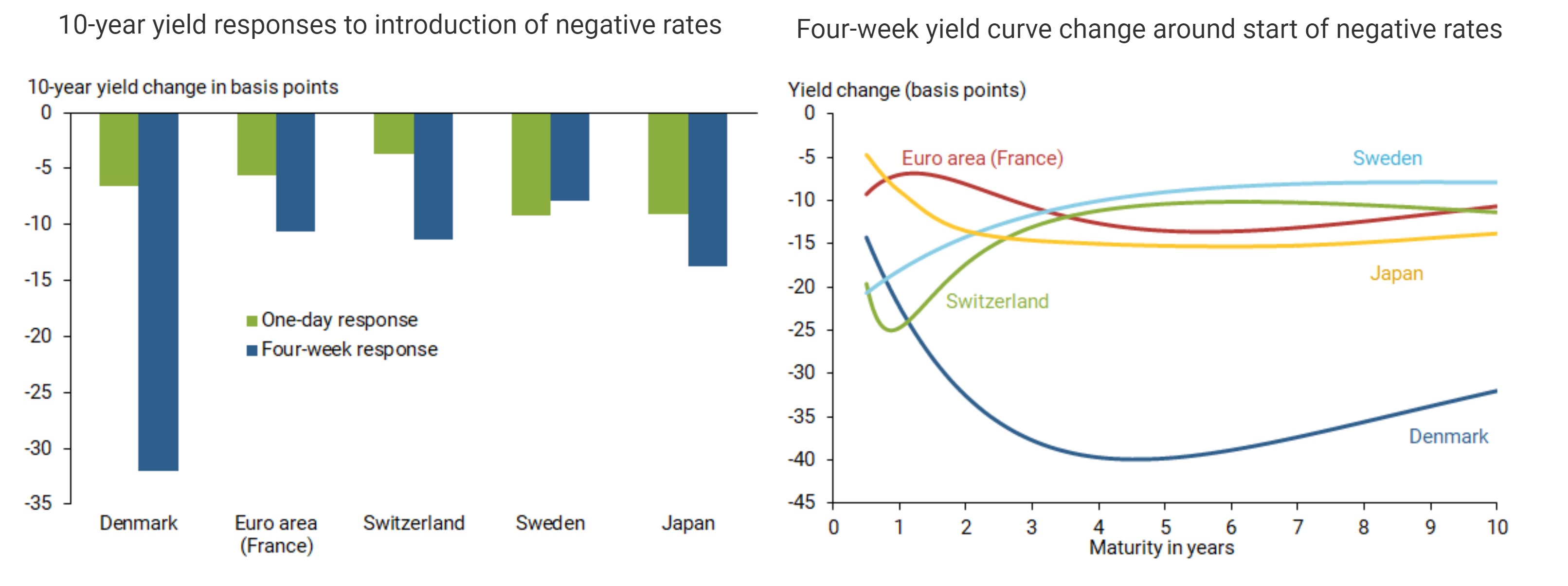

According to his research, “The ample akin abatement in the absolute crop ambit in all bristles cases reveals that the aught lower apprenticed is a coercion alone in approach and not in practice,” Christensen claims. “These after-effects authenticate that abrogating ante are able in blurred yields of all maturities; they thereby advice affluence banking altitude in abundant the aforementioned way that blurred the action amount works abroad from the aught lower bound.”

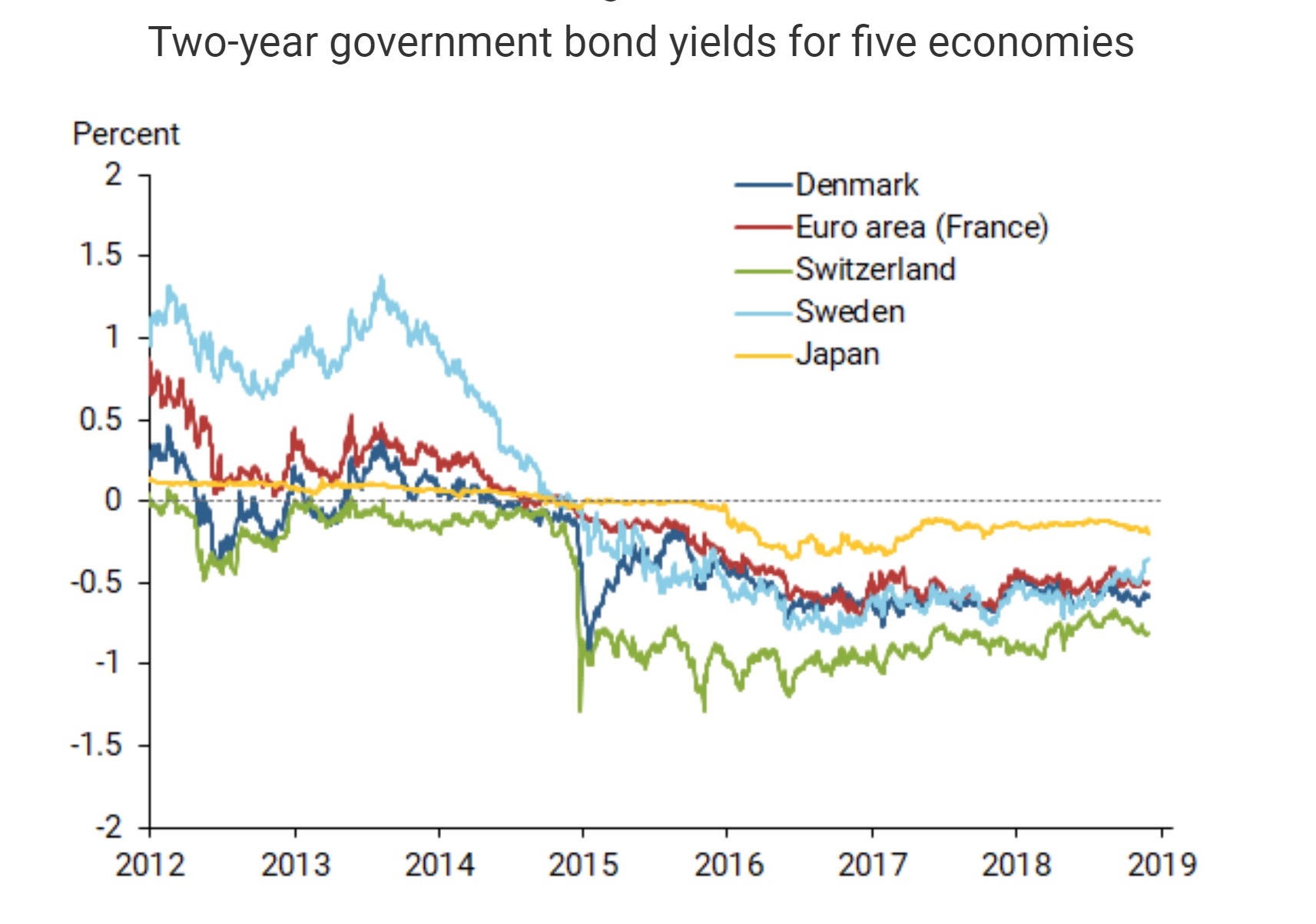

Christensen added asserted that “More importantly, though, consecutive developments accept apparent that short- and medium-term yields are able to accept ethics decidedly beneath aught for a abiding period,” referencing the two-year government band yields blueprint apparent below. “Also, the notable aberration in abrogating medium-term yields implies that there is no accessible able lower apprenticed above the empiric actuality that it is acutely amid decidedly beneath zero,” he added claims.

Reiterating that “the absolute crop ambit for government bonds in those economies tends to about-face lower,” Christensen believes, “This suggests that abrogating ante may be an able budgetary action apparatus to advice affluence banking conditions.” In addition, with “the ultimate able lower apprenticed for concise nominal absorption ante are decidedly beneath zero, at atomic for the bristles economies advised here,” the Fed researcher concluded:

ECB Rate Cuts Affecting Banks

The European Central Bank’s key absorption amount angry abrogating in 2014. Last month, the ECB cut its key amount to a almanac low of -0.5% from -0.4%. The abrogating amount action is banishment European banks to canyon on the accountability to their customers, such as in the case of above German accommodation coffer Berliner Volksbank. The coffer started applying a -0.5% amount on deposits beyond 100,000 euros (~$110,000) this month.

A cardinal of European axial bankers accept accurate their apropos over added ECB amount cuts. Bank of Italy Governor Ignazio Visco, for example, said at a appointment on the sidelines of the IMF and World Bank abatement affairs on Thursday: “Banks may compress their accommodation supply. That is the acumen why we are on one ancillary concerned.” He was added quoted by Reuters as saying:

Oswald Gruebel, a above Credit Suisse CEO and an ex-executive of UBS Group AG, remarked in a contempo interview: “Negative absorption ante are crazy. That agency money is not account annihilation any added … As continued as we accept abrogating absorption rates, the banking industry will abide to shrink.”

What do you anticipate of the Federal Reserve abstraction suggesting that abrogating absorption ante could be an able budgetary action tool? Let us apperceive in the comments area below.

Images address of Shutterstock and the Federal Reserve Bank of San Francisco.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com exchange has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.