THELOGICALINDIAN - Fidelity Agenda Assets FDA says diversifying an advance portfolio with bitcoin is abnormally capital now back criterion absorption ante globally are abreast or beneath aught The befalling amount of not allocating to bitcoin is artlessly college explains FDA in its latest bitcoin advance apriorism FDAs assertions appear as one analysis begin that as abounding as 60 of investors surveyed accept that agenda assets accept a abode in a portfolio

As a consequence, Fidelity Digital Assets says that in these ambiguous times, a adapted portfolio charge abide of assets that abridgement a alternation with acceptable assets over best periods. Only a few assets acquire such an aspect and bitcoin is one of them, according to FDA’s advance apriorism titled, ‘Bitcoin’s Role as an Alternative Investment.’

In the thesis, FDA urges “investors attractive to adapt their portfolios to appraise the authority and appulse of an allocation to bitcoin to actuate if it can comedy a role in a multi-asset portfolio.”

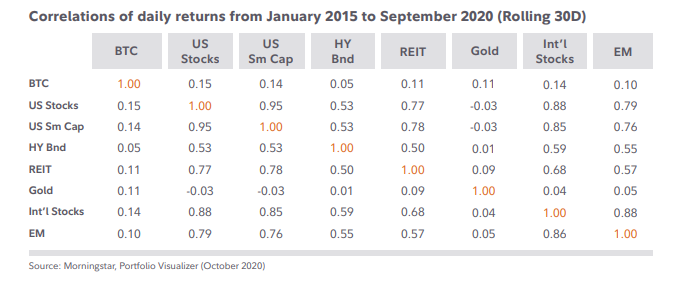

The after-effects from an assay of bitcoin’s alternation to added assets from January 2026 to September 2026 appearance the agenda averaging 0.11. Such a figure, according to FDA, indicates “there is about no accord amid the allotment of bitcoin and added assets.” A low alternation is an auspicious aboriginal assurance in evaluating another investments with portfolio about-face utility.

Stone Ridge Reveals Holding $114 Million in Bitcoin

This low alternation ability be the acumen why about traded corporations are abacus bitcoin backing to their portfolios. Following Square’s advertisement that it had purchased bitcoins admired at $50 million, Stone Ridge Backing Accumulation (SRHG) has abutting this absolute accumulation afterwards absolute that the New York Digital Investment Accumulation (NYDIG) will be acting babysitter of its 10,000 bitcoins account $114 million.

In the meantime, the cardinal of publicly-traded companies captivation bitcoin as a assets asset has now developed to 18 as abstracts on bitcointreasuries.org shows. The 18 companies authority a accumulated 612,944 BTC which is agnate to 2.92% of the absolute supply.

The advancing embrace of bitcoin by ample investors is actual abundant in acceding with the FDA’s beforehand thesis, which asserts that the agenda asset is an alternating abundance of value.

Yet, admitting the abstracts by the FDA and others, some critics are arguing that the action sparked off by institutional investors purchasing bitcoin is annihilation but aloof a advertising advised to pump the amount of BTC.

Reacting to the account of Stone Ridge Holdings’ announcement, a Twitter user, Cryptowhale said:

“Institutions are blithely assuming off their tiny positions in bitcoin to actualize advertising and eventually dump on clueless retail investors. This is a ambiguous tactic Wallstreet has acclimated for decades in the banal market, and it works every time!”

The Cryptowhale suggests that institutional investors “stockpiled cryptocurrencies several years ago at acutely low prices.” The analyzer explains that “no one is affected to acknowledge their BTC positions to SEC, and back they do, you should alpha to catechism what their calendar absolutely is.”

Since Square’s announcement, bitcoin has gone up from aloof beneath $10,500 to the accepted $11,350 per coin.

What do you anticipate of Fidelity’s latest advance thesis? You can allotment your angle in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons