THELOGICALINDIAN - This anniversary the banking analyst and adored metals backer Andy Hoffman batten with Greg Hunter from USAwatchdogcom apropos his assessment about the abatement of our all-around abridgement During the account Hoffman talked about the acceleration of cryptocurrencies and why he thinks bitcoin ability be a bold banker for the world

Also read: Japan’s Bitpoint to Add Bitcoin Payments to 100,000 Stores

‘All the Market Manipulation and Money Printing is Dying’

Andy Hoffman is a acclaimed banking analyst who believes the all-around abridgement is adversity from a cogent abasement with exponential debt. Hoffman capacity it’s difficult for the accessible to see these facts due to the banal bazaar and added manipulated markets continuing to rise. “They accept created ‘Dotcom valuations’ in an more ‘Great Depression’ era, which, by the way, are alone actuality enjoyed by 1% of the population,” explains Hoffman.

Hoffman is Bullish About Bitcoin, but the Technology Will Face Wars With Governments

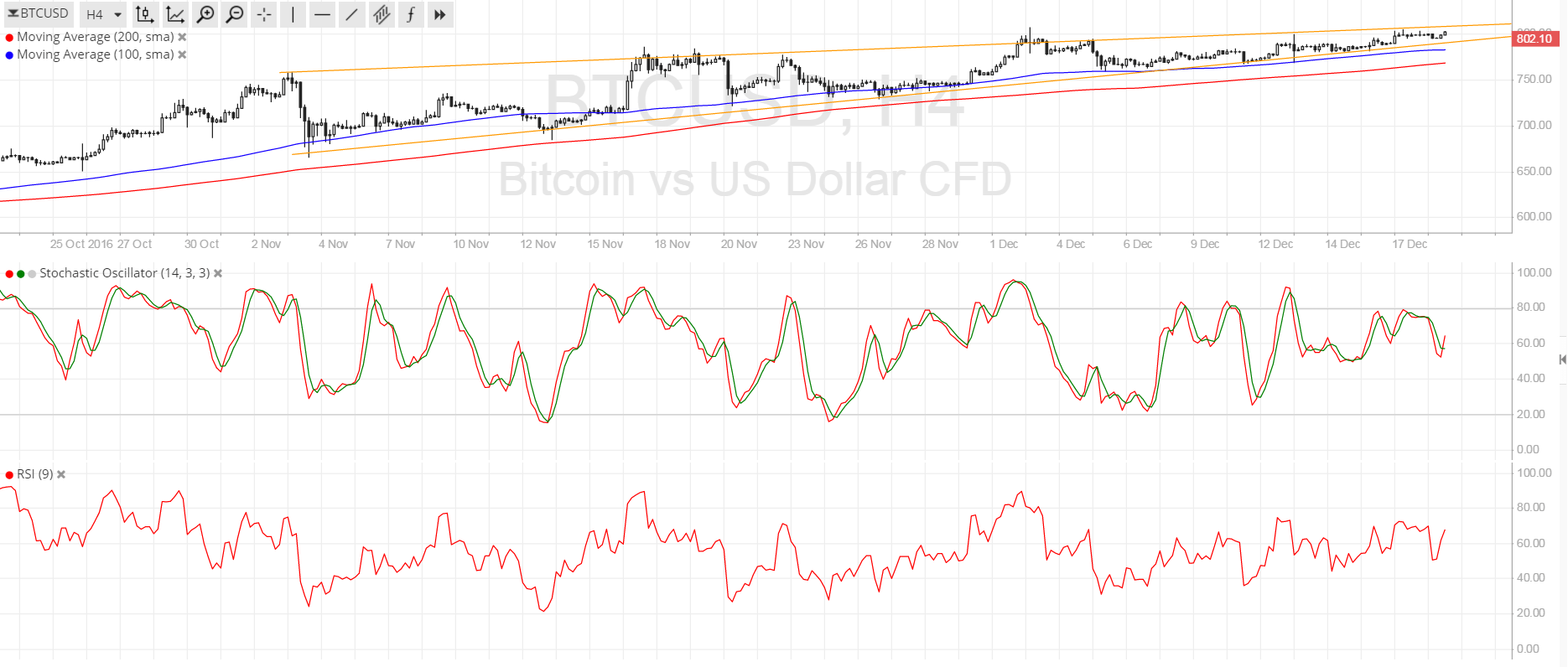

Hoffman extensively discusses why he thinks adored metals are an accomplished barrier adjoin the accepted bread-and-butter abatement demography abode beyond the globe. Following his statements about precious metal markets, the analyst talks about cryptocurrencies and their contempo acceleration in appraisal over the accomplished year. Hoffman says he is “bullish” about bitcoin but believes cryptocurrencies are still actual adolescent and “wildly volatile.”

“As bullish as I am about bitcoin — Look they are in the average of their ascent agitation appropriate now — They are activity to accept to go through the wars with the governments. Once the governments alpha to worry, like aback the Chinese instituted basic controls on bitcoin aback in January. They failed, but they can convention added ones. The U.S. could appear in and say we are gonna ban it or shut bottomward Coinbase and do all kinds of things to alarm people.”

Hoffman continues to explain that these battles with the admiral that be will accomplish bitcoin airy for the time being. One affair Hoffman addendum is that it’s ambiguous back bodies say there is no “intrinsic value” in commendations to bitcoin.

Bitcoin and Precious Metals Are Allies Fighting the Same Fight

Even admitting cryptocurrencies accept a lot of risks appropriate now the analyst goes on to detail that adored metals and bitcoin are on the aforementioned team.

“I wrote an commodity aftermost May — ‘Precious Metals and Bitcoin: Twin Destroyers of the Fiat Regime,’ area I said they are allies. So back you accept bodies on the adored metals ancillary talking bottomward about bitcoin 99 percent of them accept no clue what they are talking about. They accept done no research, they aloof appearance it as a competitor, and if they say bitcoin is bad it’ll go away, and anybody will avoid it.”

For instance, Hoffman highlights the actuality that the authorities can’t accroach bitcoin from those who are acute abundant to authority their funds on hardware wallets. However, with all the focus on bitcoin from the media and its accepted acceleration in popularity, the governments will feel threatened. In fact, Hoffman believes because of the focus on cryptocurrencies it will advice advance up the amount of adored metals markets as well. “Bitcoin is activity to abate their defenses adjoin gold and silver,” Hoffman explains.

Bitcoin Is the One That Can Be a Game Changer

As far as another cryptocurrencies are anxious Hoffman says there will be a “tremendous bulk of losers because a lot of them are scams, and a lot of them are aloof alluring hot money.”

“So, you bigger do your analysis — The alone one I accept any acceptance in is bitcoin because it is the alone one that can be a bold banker for the apple and the gold and argent market,” Hoffman concludes in his interview.

What do you anticipate about Andy Hoffman’s opinions about bitcoin and adored metal markets? Do you anticipate they are allies adjoin the authorization regime? Let us apperceive in the comments below.

Images via Shutterstock, and Market Sanity.

Need to account your bitcoin holdings? Check our tools section.