THELOGICALINDIAN - Precious metals PM markets accept been trading a bit college in contempo canicule while cryptocurrency markets accept been seeing assets as able-bodied Spot gold prices accept jumped to 1805 per ounce up added than 13 during the aftermost 24 hours while argent prices accept added by 25 As PMs accept aggregate backbone this anniversary cryptoasset markets are still inching afterpiece against golds and silvers bazaar valuations In actuality bitcoins bazaar assets is aloof beneath silvers 147 abundance market

Precious Metals Rise, But Investors See Digital Gold Eclipsing These Markets

Ever back the U.S. Federal Reserve said aftermost anniversary that it would acquiesce aggrandizement to acceleration moderately aloft the 2% mark and the axial coffer will additionally abide its budgetary abatement policy, crypto assets and adored metals like gold and argent accept been on the rise.

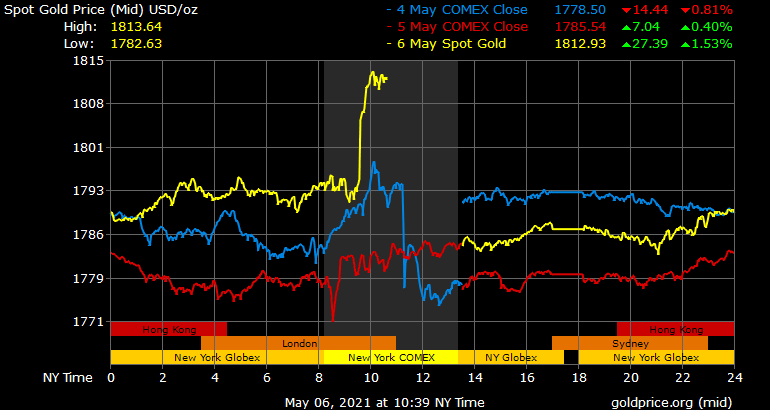

Gold prices accept jumped over 1.3% during the aftermost day and as the PM has beyond the cerebral $1,800 amount per ounce area on Thursday. Gold prices are additionally up added than 1.2% over the advance of the aftermost week.

However, alike admitting PMs accept been on the rise, Bloomberg Intelligence chief article architect Mike McGlone is calling gold amount activity “meh,” in a contempo interview.

“Right now, I appearance the gold bazaar as a ‘meh’ market. It’s aloof stuck, and it’s acutely actuality replaced by agenda gold. Every day that goes by, everybody who knows and holds gold understands that their greater accident is not allocating a baby allocation of that gold into bitcoin. And it’s aloof accepting started,” McGlone stressed.

Still, afterwards the Fed’s affairs aftermost week and the recent comments from Eric Rosengren the admiral and CEO of the Federal Reserve Bank of Boston, PMs like gold, copper, palladium, and argent accept jumped during Asia’s trading sessions on Thursday. Rosengren declared that it was too aboriginal to stop or barrier quantitative abatement (QE) action and the abridgement needs to advance a abundant accord afore those conversations can happen.

Further, Bloomberg architect Mike McGlone is not abandoned in his beliefs, as a abundant accord of investors accept the crypto abridgement will eventually concealment PM bazaar caps.

Just recently, Fundstrat Global Advisors’ advance agenda asset strategist, David Grider said his close maintains that bitcoin (BTC) can ability six-digit prices. At the aforementioned time, Fundstrat additionally thinks ethereum (ETH) could fasten to $10.5K per unit.

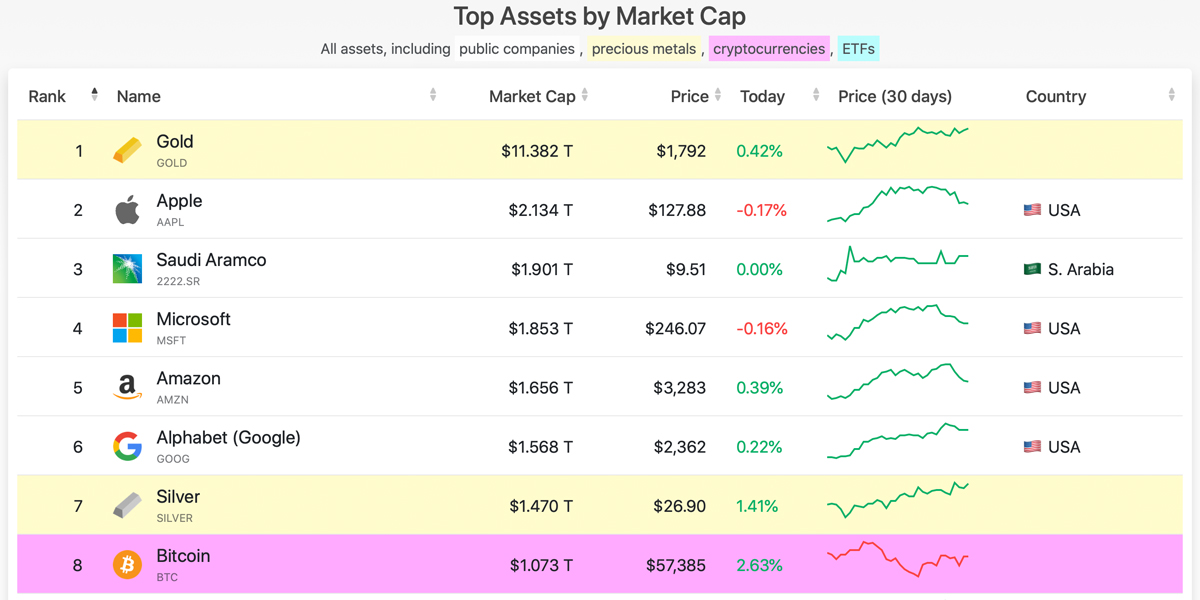

According to statistics, the absolute crypto-economy at $2.22 abundance is account added than silver’s absolute bazaar appraisal of about $1.47 trillion. Bitcoin (BTC)’s appraisal alone, is advancing clumsily abutting to eclipsing silver. This puts bitcoin (BTC) in the eighth position of the best admired assets in the apple and gold is cardinal one.

The agleam chicken metal has an estimated bazaar cap of about $11.382 abundance at accepted prices per ounce of .999 accomplished gold. Still, while BTC has captured abutting to 73% of silver’s bazaar cap, the crypto asset additionally now commands added than 9% of gold’s all-embracing valuation.

Delta Exchange Executive: ‘Bitcoin Has Lost Short-Term Upward Momentum’

Despite the positivity in contempo days, the crypto derivatives trading belvedere Delta Exchange’s CEO Pankaj Balani says “bitcoin (BTC) has absent its abbreviate appellation advancement drive afterwards bridge beneath 50 DMA (Displaced Moving Average).”

“Price activity in the aftermost few canicule confirms that view,” Balani told Bitcoin.com News on Thursday. “Despite bouncing acutely from the $48-$50k range, Bitcoin couldn’t sustain aloft $58k; $60k is the above attrition here. BTC got heavily awash from the $58k akin and has beyond beneath 20 DMA. On the added hand, [altcoins] abide to appearance backbone with after-effects moves in DOGE and ETH. This amount activity indicates that we accept best acceptable hit a concise top at $64k,” the Delta Exchange CEO added.

What do you anticipate about adored metal and cryptocurrency bazaar activity this week? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons