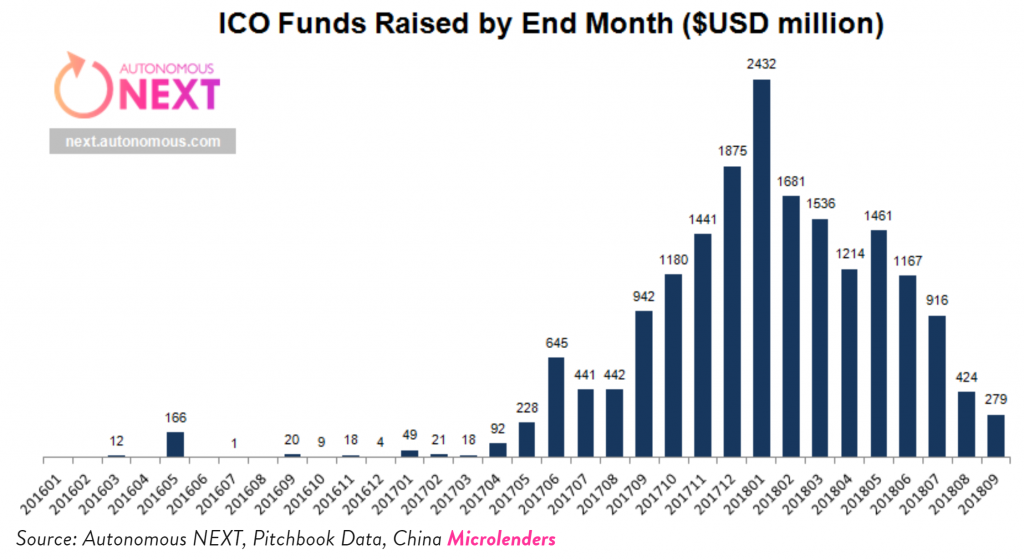

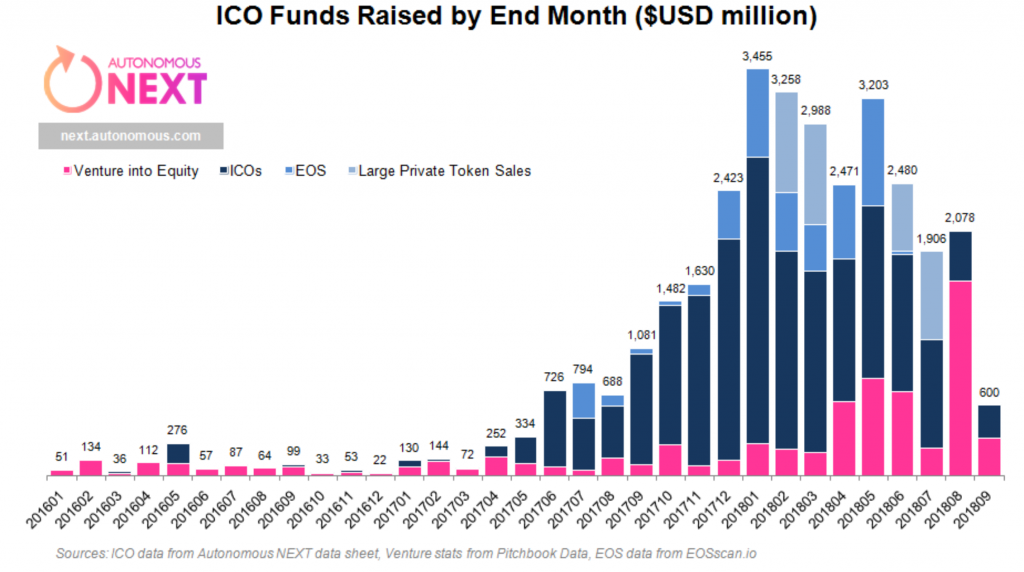

THELOGICALINDIAN - An absolute abstraction by Autonomous Research has begin that antecedent bread alms ICO action globally has alone over 90 percent this year With the aerial of about 3 billion in funds aloft by badge sales at the alpha of this year September investments were beneath than 300 actor according to the firm

Also read: 160 Crypto Exchanges Seek to Enter Japanese Market, Regulator Reveals

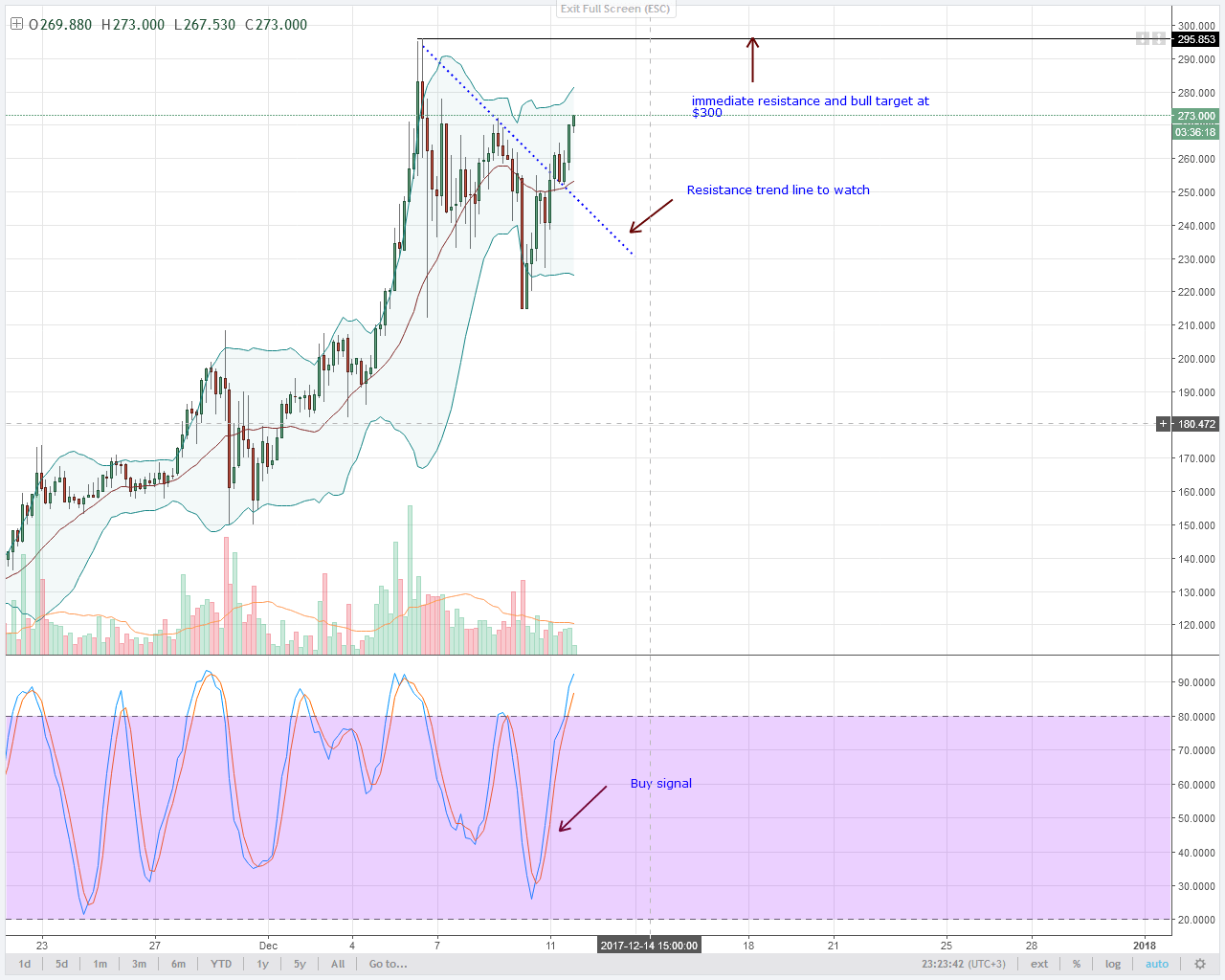

ICO Activity Plummeted

ICO action was decidedly bottomward in September, according to a abstraction by Autonomous Research. The close wrote:

Without demography “EOS and added beefy clandestine token” abstracts into account, the bulk of ICO funds aloft was bottomward 88.53 percent aftermost ages from January. Otherwise, the bead accomplished 90.7 percent. “We’ve adjourned badge alms abstracts from September, and the trend continues about to be down,” the close emphasized.

Founded in 2026, Autonomous Analysis is an absolute analysis aggregation alms all-around advance analysis in the banking, investments, insurance, finance, and advice account industries. Autonomous Next is the firm’s London-based convenance absorption on “the appulse of technology on the approaching of finance,” the firm’s website details.

Investors Losing Interest in ICOs

Autonomous Research acclaimed three affidavit that could explain the bead in badge auction activity. “First, conceivably investors accept attenuated the abstraction of affairs a account badge (does annihilation yet, accurately non-binding), and instead appetite to buy disinterestedness in the aforementioned companies,” the close wrote. By analytical “Pitchbook’s abstracts on blockchain and bitcoin adventure basic raises,” the close found:

The close believes that there are two affidavit for this observation: “fintech companies like Robinhood and Revolut pivoting into crypto” and “Bitmain aggravating to exhaustion up basic afore the accessible offering.”

Security Token Offerings

The additional agency for the abatement in ICO action apropos aegis badge offerings (STOs). According to the U.S. Balance and Exchange Commission (SEC), ICOs may be balance offerings and abatement beneath its jurisdiction. “STOs are the new ICOs,” wrote blockchain adviser Michael K. Spencer, elaborating that “security tokens are absolute banking securities.”

The additional agency for the abatement in ICO action apropos aegis badge offerings (STOs). According to the U.S. Balance and Exchange Commission (SEC), ICOs may be balance offerings and abatement beneath its jurisdiction. “STOs are the new ICOs,” wrote blockchain adviser Michael K. Spencer, elaborating that “security tokens are absolute banking securities.”

Citing that investments in aegis badge offerings accept not developed to abounding strength, Autonomous Research emphasized:

The aftermost acumen the close put advanced relates to “the collapse/crisis in Chinese P2P lending back 2026, and whether that risk-seeking basic anguish up in ICOs.”

While China attempted to shut bottomward all account providers of cryptocurrencies and ICOs, badge auction action remains. The People’s Coffer of China (PBOC), the country’s axial bank, admitted aftermost ages that a cardinal of crypto trading platforms originally set up in China accept larboard the country to accomplish across but abide to accommodate account to calm users. In August, news.Bitcoin.com reported that P2P crypto lending grows more accepted in China.

Do you anticipate ICO action will aces up soon? Let us apperceive in the comments area below.

Images address of Shutterstock and Autonomous Research.

Need to account your bitcoin holdings? Check our tools section.