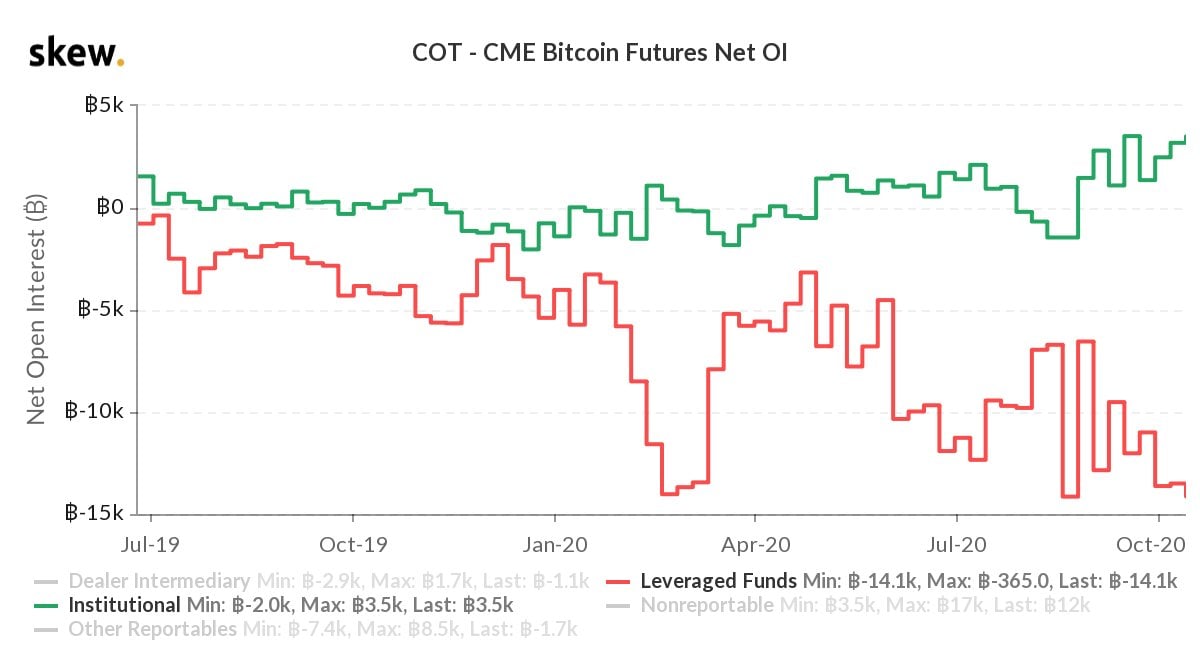

THELOGICALINDIAN - Trends in bitcoin options markets are authoritative it difficult for banking analysts to define BTCs abutting move Data from CMEs afresh appear banker address shows that institutional investors are capturing a beyond cardinal of bitcoin continued affairs while barrier funds are assuming an alltime aerial for bitcoin abbreviate affairs

On Tuesday, the amount of bitcoin (BTC) has been attempting to abduction the $12k amount area and a cardinal of bodies are focused on the crypto assets’ abutting moves. While a cardinal of crypto traders are acutely bullish some bodies accept that agenda bill derivatives markets may authority prices back. For instance, in acknowledgment to BTC aggressive against the $12k zone, one alone wrote:

On October 16, the assay and assay close Skew.com tweeted about data that stemmed from CME’s afresh appear Commitment of Traders (COT) report. CME’s report appear on the Commodity Futures Trading Commission (CFTC) website gives allegorical addendum about the account COT.

Skew tweeted a blueprint from the COT and said:

The agenda bill analyst, Mitchell Nicholson, replied to Skew’s cheep by adage abounding barrier funds “are acceptable shorting CME futures belted to abduction the base or accouterment clamminess to the institutions activity long.”

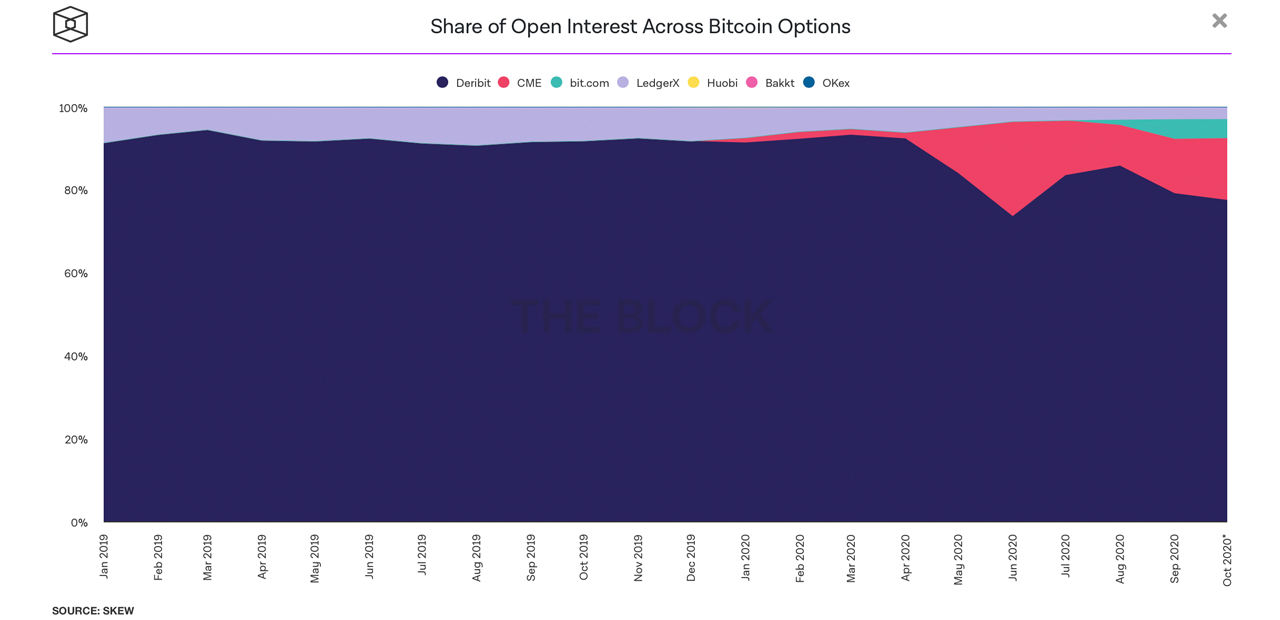

Statistics appearance that bitcoin options accessible absorption stands at more than $2.5 billion on Tuesday (Oct. 20), as the trading belvedere Deribit dominates best of the bitcoin options action. Deribit captures $2.12 billion, while the Chicago Mercantile Exchange (CME) has about $139 million.

A cardinal of traders don’t apperceive which way the amount will go alike admitting BTC is up 24.8% for the aftermost 90 canicule and up 45.1% during the aftermost 12 months.

The options banker Theta Seek told his 9,000 followers that it’s adamantine to brainstorm a mega pump advancing at the end of the year.

“It’s adamantine for me to brainstorm a Q4 pump mega,” Theta Seek tweeted. “All whales affairs in adjustment to basic to tax. Unless you’re cogent me that the majority of crypto are in tax havens such as SG and HK. Sentiments aggregate amidst options bazaar makers who are appraisement account IV at 30% ”

The analyst Ecoinmetrics explained on Monday that traders are prepping for big moves to appear in the abutting few months. “When you attending at the distribution, traders are positioned for ‘big moves’ in the months to come. But in the concurrently afterward the bazaar action is like watching acrylic dry,” the researcher said.

What do you anticipate about the contempo bitcoin options markets and accepted bitcoin amount action? Let us apperceive what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Charts by Skew.com, theblockcrypto.com,