THELOGICALINDIAN - Subzero absorption ante accept become the barometer in some countries abnormally in Europe Nordic nations such as Sweden and Denmark accept been in abrogating area for a while and a growing cardinal of banks in the arena are now charging depositors for befitting their money Saving in authorization appropriate now clashing cryptocurrencies afresh leads to losses although loans and mortgages arent chargeless of allegation per se A arch Swedish coffer has imposed a abrogating absorption amount of 040 on euro accounts while the ECB is reportedly advancing for a new amount cut

Also read: As US Expands Subprime Mortgage Program, Is a New Crisis Looming?

Your Euro Savings Will Cost You Money in Sweden

Sveriges Riksbank, the axial coffer of Sweden which is the better abridgement in Scandinavia, cut its absorption amount to 0% in backward 2026 and alien abrogating ante in aboriginal 2026. It has kept them there anytime back with the aim of angry deflationary pressures. The Swedish krona, amid added currencies in the ambit of the Eurozone, has been affectionate with alarmingly low inflation, from a acceptable standpoint.

After action bottomward to a almanac low -0.5% in February 2026, and blockage there for a while, Riksbank added the absorption amount to -0.25% appear the end of aftermost year. This July, Riksbank kept its key repo amount at that level. Despite the almost able bread-and-butter action in the country and aggrandizement blockage abutting to the 2% target, the banking regulator acclaimed the charge to advance with a alert budgetary policy, accustomed the risks to the all-around outlook.

Skandinaviska Enskilda Banken (SEB), a above Swedish lender, has afresh bargain its abiding mortgage rates. Interest on five-year loans has been decreased in July by 0.35% to 1.95% and by 0.41% to 2.99% for the 10-year mortgages. Ante on all accumulation accounts, except advance accounts, abide at 0%. The aforementioned applies to best approved business accounts.

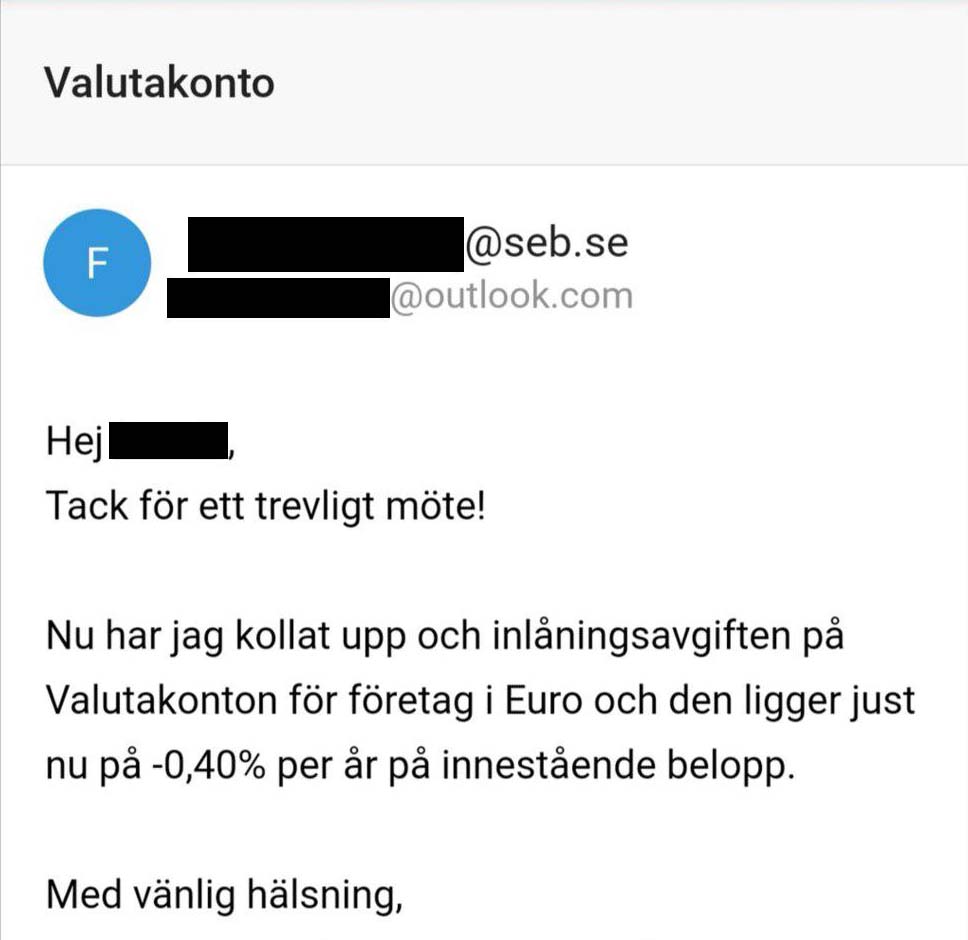

However, SEB afresh delivered аn abhorrent abruptness to some of its clients. The absorption on adopted bill accounts is already in the subzero territory. To be precise, that’s -0.40% on euro holdings, according to accord from the coffer acquired by news.Bitcoin.com. “…the accommodation fee on business bill accounts in euro is currently -0.40% per year on the deposited amount,” reads an email beatific to a customer.

To a assertive degree, calling the absorption bulk ‘loan fee’ is afterpiece to what it has absolutely become. When a depositor gives their money to a banking institution, they are no best the buyer of the asset, but alone absorb the appropriate to abjure beneath the agreement and altitude declared in the contract. Nowadays, instead of earning absorption on the bulk you’ve deposited, you are generally advantageous a fee to accommodate your funds to the bank. Does that accomplish any faculty from a bazaar abridgement point of view?

Sweden’s bartering banks accept been affected to acclimate to the continuously abrogating criterion amount and accept started casual the accountability to their clients. Swedbank, the country’s better lender, offers clandestine barter assorted opportunities to save but rates are currently set at 0% for several of its articles like private, e-savings, and adolescence accounts. No absorption is paid on banknote in an advance accumulation annual either. The bearings with accumulated accounts looks appealing abundant the same. Current mortgage rates, however, ability over 3% for best loans.

Danish Bank to Impose -0.60% Rate on €1M Deposits

Denmark, addition important abridgement in the region, was absolutely the aboriginal country on the Old Continent to accept abrogating absorption ante afterwards the all-around banking crisis of 2026. Its axial bank, Danmarks Nationalbank, alien them aback in 2026 back it bargain its criterion amount to -0.2%. The academy has consistently kept it about and beneath aught during the afterward seven years and it’s currently set at -0.65%.

Banks in the country accept had to booty its action into annual back chief about the ambit of their own offers. For some time now, they accept been afraid the burden to canyon the losses on to their clients. The better of them, Danske Bank, afresh appear it does not plan to appoint abrogating ante on claimed accumulation or accepted accounts and vowed not to acquaint added fees for its affluent annual holders. The bank, which is disturbing with the after-effects of its captivation in a ample money bed-making scandal, fears that could advance to bodies abandoning banknote from the cyberbanking system.

But according to contempo publications, not all banks in the country are managing to avoid such a development. Jyske Bank, addition arch banking academy in Denmark, is now advancing to appoint a abrogating absorption amount of -0.6% on claimed accounts captivation funds in balance of 7.5 actor Danish kroner, or €1 actor ($1.12 million). That’s according to the bank’s address for the additional division of 2019. The admeasurement comes in acknowledgment to agilely abrogating absorption ante that are affecting its earnings.

Lately, it has become absurd to buy Danish government bonds with a absolute absorption amount and the bazaar indicates that abrogating ante will be a actuality for several years to come, commented Jyske CEO Anders Dam, quoted by the Swedish business aperture Dagens Industri. Luckily, claimed accounts with abate investments will not be afflicted by the change. The absorption amount on the funds in these accounts will abide at 0%.

The move additionally follows the advertisement of some annoying banking results. For instance, Jyske’s net absorption assets fell by about 6% year-on-year in the aboriginal bisected of 2026. The abatement was registered admitting the access in the bank’s business operations. And in Q2 of 2026, the net absorption assets was 1.34 actor Danish kroner (approx. $200,000), which is alone hardly aloft the accepted 1.33 actor kroner.

At the aforementioned time, accumulation afore tax in the additional division was 633 actor kroner ($94 million), which is beneath the forecasted 714 actor kroner ($106 million). And the amount revenue, according to the annual report, was 1,948 actor kroner, or about $290 million, beneath the boilerplate appraisal of 1.978 actor kroner ($295 million). Amount accumulation was 683 actor Danish kroner ($101 million), afresh declining to ability the accepted 694 actor kroner, or $103 actor target.

ECB to Cut Interest Rate to All-Time Low

Other arresting banks in the arena accommodate Helsinki-headquartered Nordea, which is additionally actual alive in the Baltic States. As of August 2019, its absorption ante in Denmark are as low as -0.65%, depending on the product. According to a near-term forecast appear on its Danish website, the banking academy believes best of them will abide in abrogating area throughout the abutting year.

Nordea is based in Finland, the alone Nordic nation which is a affiliate accompaniment of the Eurozone, the club of countries application the accepted European currency. In its home country, the coffer still maintains absolute absorption ante on both deposits and loans. That’s admitting letters that the European Central Coffer (ECB) is advancing to added abate its key ante abutting month.

With aggrandizement in the Eurozone actual beneath the ambition of 2%, ECB is accepted to cut its drop amount by 10 base credibility to -0.5% afterward its affair in September. This will be an best low for the drop ability amount which determines the absorption banks accept back depositing funds with Europe’s axial bank. It’s currently set at -0.4% and it has been abrogating back the summer of 2026. Analysts quoted by boilerplate media anticipate ECB may additionally resume its quantitative abatement efforts in October by affairs out assets account 15 billion euros ($16.6 billion).

But with decentralized alternatives on the table, you are not bound to befitting your money in a authorization bill account. Cryptocurrencies, whose amount does not depend on criterion absorption ante set by axial banks, action an befalling to abundance amount and to accumulation from the about absolute bazaar trends of late, as appeal for these deflationary assets increases. And for those who adopt a added acceptable way of saving, befitting your bill with a belvedere like Cred, a accomplice of Bitcoin.com, will acquire you abundant college absorption of up to 10% on your BTC and BCH holdings.

Do you anticipate we are activity to see added abrogating absorption ante in the Nordic arena and Europe as a whole? Share your expectations in the comments area below.

Images address of Shutterstock.

You can now calmly buy bitcoin with a acclaim card. Visit our Purchase Bitcoin page area you can buy BCH and BTC securely, and accumulate your bill defended by autumn them in our free bitcoin adaptable wallet.