THELOGICALINDIAN - This anniversary it seems the bliss from the addition of CME Group and Cboes bitcoinbased futures markets has fizzled Since both companies appear ablution their futures articles the amount of bitcoin acquired over three times its amount in aloof 45 canicule Since the derivatives markets accept amorphous the futures articles volumes has been blah and both bitcoin acquired predictions and atom markets prices accept biconcave considerably

Also Read: Major Korean Crypto Exchange Upbit at Center of Regulatory Controversy

Pending Futures Markets Brought Hype and 45 Days of BTC Gains

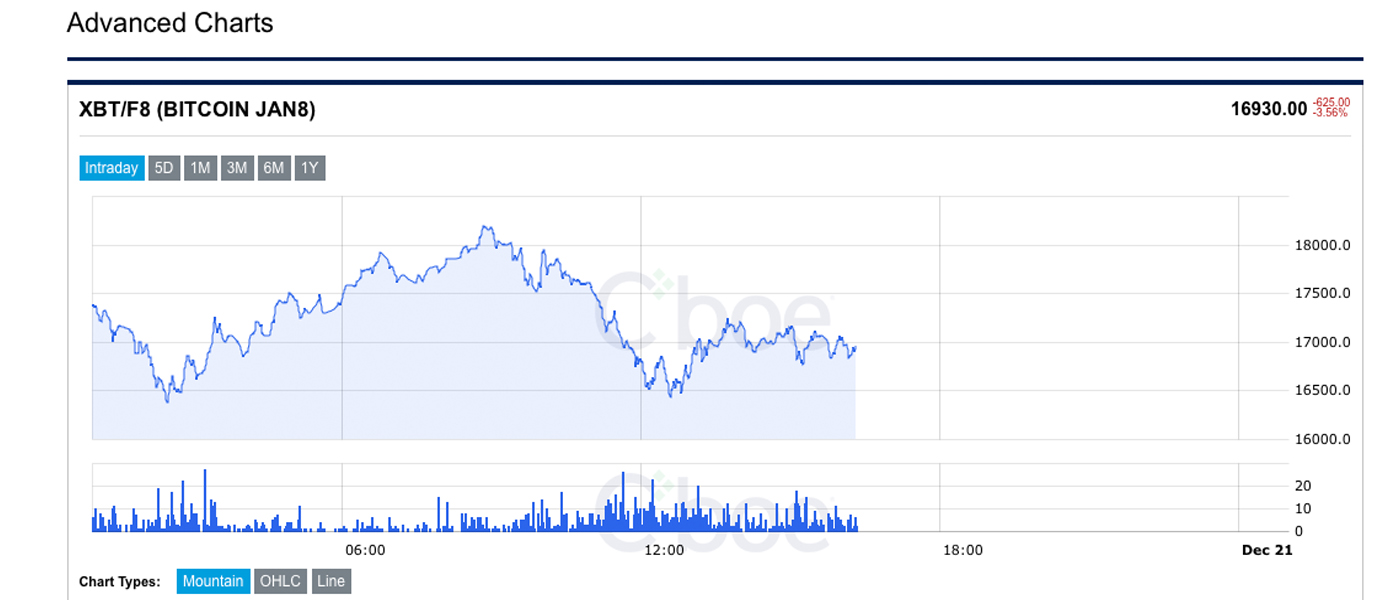

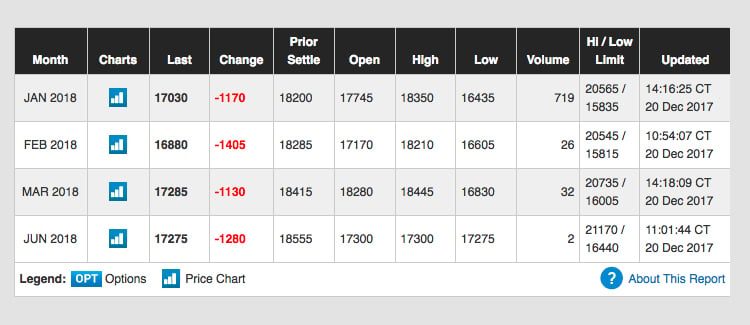

Futures markets are here, but the action arch up to these advance cartage was far added blood-tingling than they are today. Back Cboe launched its bitcoin futures articles alleged XBT, both atom and derivatives markets pushed up the price. Cboe’s January cessation affairs started off with appropriate aggregate as 1,583 articles were sold. However, the afterward month’s affairs accept dwindled bottomward to beneath than 200 affairs for February and March. Initially, Cboe affairs predicted some appealing aerial prices extensive a aerial of $18,650, but now affairs are abundant lower as the aftermost Cboe XBT barter was $16,930. Additionally, back Cboe launched, atom markets had acicular afterwards adversity from a dip and accomplished a aerial of $19,650 beyond all-around exchanges.

The Futures Euphoria Begins to Wear Off

The atom bazaar amount alone anon afterwards and hovered aloft the $18K area for a few canicule until CME Group launched its futures markets. Alike admitting CME affairs were able-bodied aloft the $20K arena for the months of January through June, atom markets started a bearish clamber downwards. On December 19 the atom amount of bitcoin amount (BTC) alone beneath the $16,000 zone, but has back rebounded to an boilerplate of $16,300 on December 20. Just like Cboe, CME’s bitcoin futures clamminess has been sub-par, alike admitting the CEO and CME Group Chairman Terry Duffy said the aggregation had apparent “increasing applicant absorption in the evolving cryptocurrency markets.”

CME’s bitcoin-based futures quotes accept alone appreciably as able-bodied from over $20K predictions to $16,950 for January. It goes lower in February at $16,880, but predictions acceleration afresh for March and June arch to a college bid of $17,275. Yet, aloof like Cboe’s artefact auction contracts, CME’s January accomplishment has a much beyond volume than the afterward months. There are beneath than fifty for February, March, and June, but those numbers could change as time gets afterpiece to those months.

The Futures Industry Association: Bitcoin Derivatives Were Rushed to the Market

Cboe markets are 5-8 percent college than accepted atom prices, while CME Accumulation affairs for January are alone 2 percent college than the all-around average. According to the Futures Industry Affiliation (FIA), a barter accumulation that represents the derivatives industry, the two companies “rushed” bitcoin futures into the market. The FIA reveals that the affiliation still holds the assessment that there still is a abridgement of accuracy and adjustment complex with cryptocurrencies. For now, there are alone a few allowance casework that action the bitcoin derivatives products, while abounding allowance casework are still cryptic on how to accord with these new advance vehicles.

What do you anticipate about the blah achievement of both Cboe and CME Group’s bitcoin futures markets? Let us apperceive in the comments below.

Images via Shutterstock CME Group, and Cboe charts.

Need to account your bitcoin holdings? Check our tools section.