THELOGICALINDIAN - The use of agenda assets to accomplish payments is growing according to a afresh appear abstraction It reveals that cryptocurrencys role as a applicable agency of acquittal has been accretion and this years bazaar backlash has added the about-face of crypto payments The address suggests that debit cards affiliated to agenda bill wallets will abide an important apparatus until added acceptance of absolute cryptocurrency payments

Also read: BCH Can Be the Global Coin for Daily Spending, Says Italian Crypto Executive

Crypto Payments Industry Expands With Growing Markets

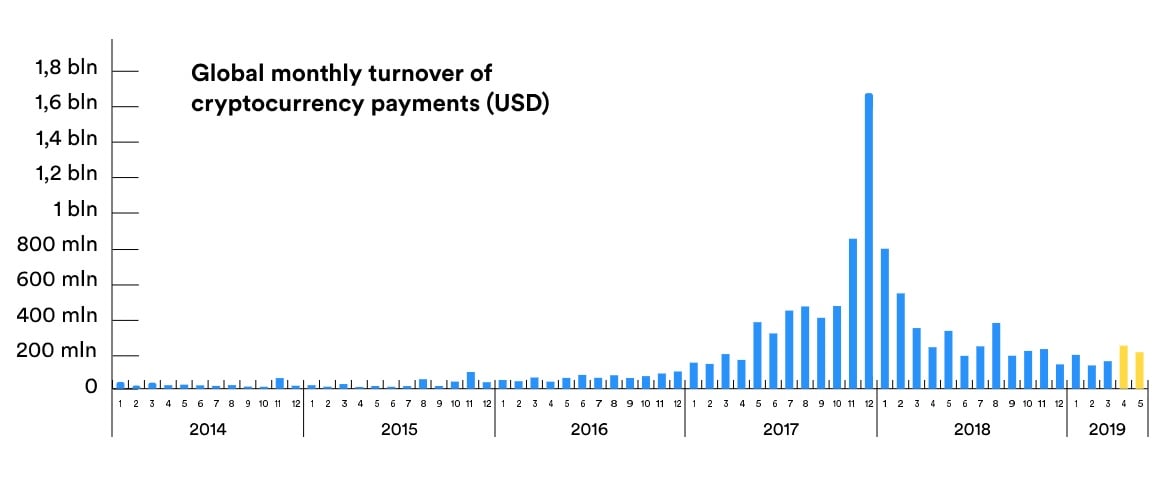

The abstraction highlights a accepted alternation amid advancement bazaar trends and the amplification of the crypto payments industry. Its Compound Annual Growth Rate (CAGR) added 21% amid 2026 and 2026 and jumped over 600% two years later. But alike during the bearish 2026, back the amount of above cryptocurrencies took a hit, the sector’s CAGR broadcast by about 90% year over year. The accretion that started this year has had a absolute aftereffect and the ascent aggregate of payments this bounce indicates that the recession is over.

The industry assessment has been conducted by Crypterium, a acquittal solutions provider that afresh launched a crypto debit card, one of the few articles in this alcove that’s accessible globally. The assay examines the achievement of arch cryptocurrency acquittal providers such as Bitpay, Coinsbank, Cryptopay, Spectrocoin, Wirex, and Xapo. It covers two capital types of casework offered on the market: those acceptance merchants to acquire agenda bill anon and solutions enabling barter to pay with crypto assets through about-face to fiat.

Statistical abstracts aggregate by Crypterium shows that the boilerplate bulk of affairs candy by the acquittal platforms counterbalanced during aftermost year’s abatement in a almost attenuated ambit amid $1,000-2,000. The aggregate of crypto payments and the boilerplate bulk accept added in 2026, extensive a seven-month aerial in April. The advisers accept that, helped by the crypto bazaar recovery, the accretion cardinal of acquittal providers in the area which action new solutions for both merchants and barter will advice the industry accomplish “gradual and acceptable amoebic growth.”

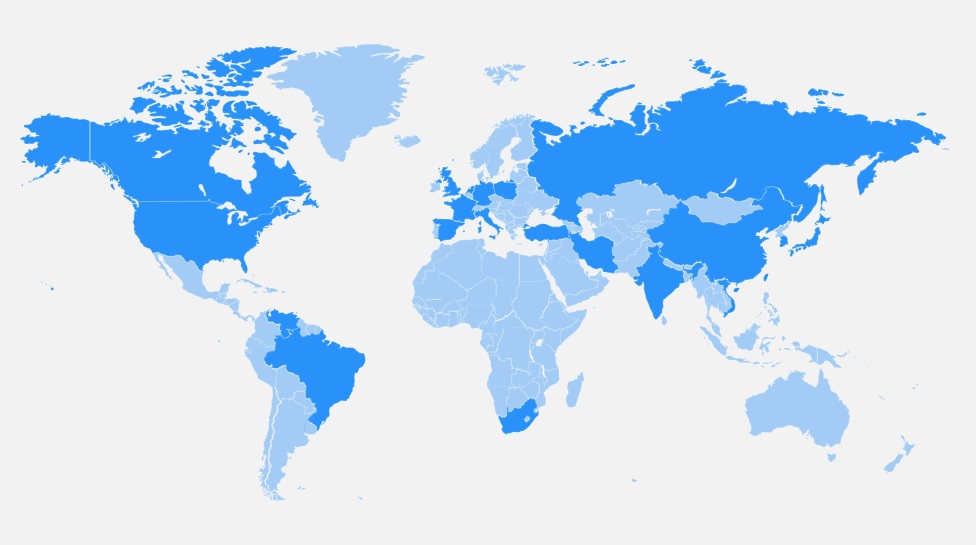

The address added identifies the regions that apply the best crypto holders who are application agenda assets to accomplish payments. The authors accent that the cardinal of wallet addresses has been consistently growing and alive wallets common accept accomplished 34 actor in the aboriginal division of 2019, accretion by 44% aloof in the aftermost 12 months. According to addition study that news.Bitcoin.com covered in May, the amount is alike college – 36 million.

High Income Countries Adopt Cryptocurrency Payments Faster

A key award in the Crypterium assay is that cryptocurrency payments are added accepted in advantageous nations in general. Based on abstracts for trading and mining action from the better agenda asset exchanges and mining pools, Crypterium has shortlisted the top 20 countries. Coins are more acclimated as a acquittal apparatus in the United States, United Kingdom, Russia and China. The aggregation concludes that their acceptance is triggered by altered factors depending on the jurisdiction. The best accepted affidavit to assurance cryptocurrencies accommodate the admiration to aerate ability in payments and the charge to assure assets adjoin hyperinflation.

To bigger accept why bodies accept decentralized bill over acceptable acquittal methods like cash, authorization acquittal processors and coffer cards, the advisers accept analyzed assorted factors such as debit and acclaim agenda ownership, internet accessibility, adaptable buzz buying as able-bodied as macroeconomic indicators including gross calm artefact (GDP) per capita and allotment of adumbration economy. Based on their qualitative and quantitative assessment, they accept aggregate the arch 20 countries in three categories: Innovators, Shadows and Survivors.

The United States, Canada, Germany, France, England, the Netherlands, Italy, Spain, Japan, and South Korea are the alleged ‘innovators.’ They are characterized by abysmal assimilation of cyberbanking and agenda banking casework and complete admission to adaptable services. According to the authors, they action the best befalling for merchants to capitalize on accretion crypto acceptance as best barter there accept admission to the internet and own a adaptable device.

Medium to low assets countries – Russia, China, Brazil, Poland, and Turkey – accept been labeled as ‘shadows.’ Many of their citizens accept absent assurance in government institutions, banks and civic currencies due to bread-and-butter recessions. They generally see cryptocurrencies as an another apparatus to accomplish payments and accept income. The accumulation of the ‘survivors’ includes Vietnam, India, Iran, Venezuela, and South Africa. Their populations accept poor admission to acceptable cyberbanking casework and they attending at agenda bill as a way to affected bread-and-butter challenges like hyperinflation and save on money transfers.

Debit Cards Remain Viable Option for Crypto Users

Until added acceptance comes around, debit cards angry to crypto wallets are acceptable to abide to action the best applicative band-aid for cryptocurrency users who appetite to absorb their cyberbanking banknote on a advanced ambit of articles and services. The prepaid cards that can be loaded with agenda bill can be acclimated in both brick and adhesive food and online platforms to acquirement annihilation that can be bought with approved coffer cards as they catechumen your crypto assets and merchants are paid with authorization money. They additionally acquiesce you to abjure banknote anon from approved ATMs.

In its study, Crypterium, the issuer of a new crypto debit card, has mentioned bristles accustomed platforms that accommodate this blazon of product: Wirex, which offers a crypto agenda in the European Economic Area, Coinbase, accepted in the U.K., Bitpay, which is a alive advantage for U.S. residents, Cryptopay, with its agenda accessible in the Russian Federation, and MCO, which issues Visa cards in Singapore. However, there are abounding added options on the market, as news.Bitcoin.com afresh reported, such as Paycent, Uquid, Bitsa, and the ADV cards.

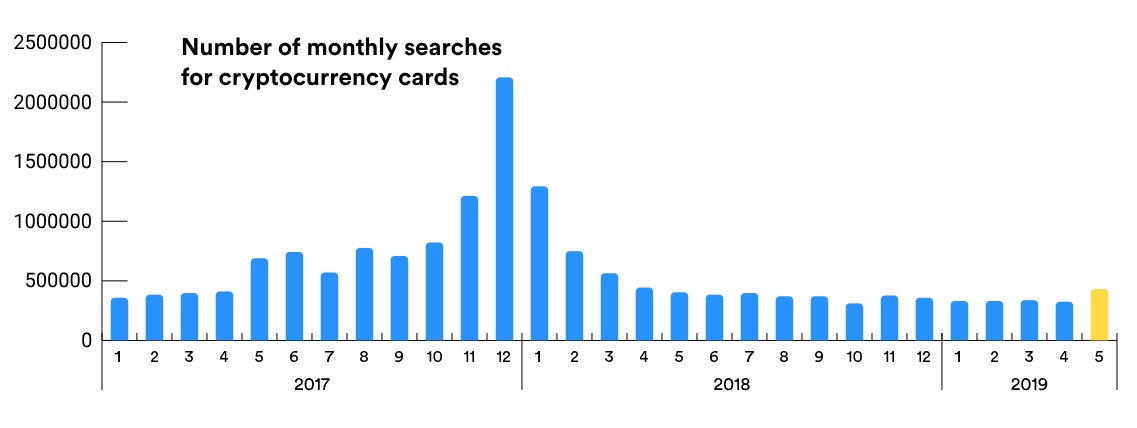

The aggregation abaft the all-embracing assay of the crypto payments area addendum the able appeal for cryptocurrency cards. Companies that launched such articles saw their boilerplate account about-face abstracts access three times, the authors claim. Again, there’s a alternation amid the accompaniment of crypto markets and the absorption in debit cards facilitating cryptocurrency payments. The cardinal of account searches for ‘bitcoin cards’ has accomplished a 12-month aerial in May 2026. Users admit the accent of these cards for accumulation crypto adoption. Almost 70% of the responders in Crypterium’s 2026 Customer Survey adumbrated that cryptocurrency cards are the best advantage to accomplish that at the moment.

Former Visa Executive Leads Company Issuing Global Crypto Card

The approaching of crypto cards seems bright, as all-around acquittal agenda buying in accepted is growing rapidly. The cardinal of debit agenda owners is accepted to bifold in beneath than a decade and according to the Apple Bank, it will ability 69% in 2020. Crypterium has one of the latest offerings in the bazaar and it’s additionally one of the few that can be ordered anywhere in the world. The Global Bitcoin card launched afresh with abutment for bitcoin core, ethereum, USD bread and Crypterium’s own token, CRPT. Nevertheless, the fintech aggregation affairs to aggrandize their cardinal with over a dozen added cryptos aural a year and bitcoin banknote (BCH) is one of the currencies it’s considering, Crypterium CEO Steven Parker assured news.Bitcoin.com.

“Cards is absolutely a key allotment of the Crypterium proposition. A acquittal agenda is still the best acceptable ‘channel’ to access the boilerplate payments eco-system and the easiest way to accomplish a acquittal in the online and offline worlds and additionally abjure your money in cash,” Parker emphasized. “So we do brainstorm a growing cardinal of crypto cards. Our acceptance is that authorization cards enabling crypto transfers will absolutely become a able articulation in cards. However, we do additionally see a big befalling for NFC channels such as Apple Pay and Google Pay and we intend to barrage those types of account by the end of the year. Also, our aggregation roots are in QR codes and we are still seeing how we can accommodate that blazon of functionality. QR codes are huge in China,” the controlling added.

Steven Parker acclaimed there are altered flavors beyond altered regions but he believes crypto payments will abound all about the world. “Of course, we see the accomplished buying of cryptocurrencies in places like the U.S. and Korea. But as in payments generally, I anticipate we shall see altered acceptance rates. Asia is already led by adaptable payments, so I can brainstorm crypto payments growing faster there. We see ample developing markets such as Brazil or Russia, as a big opportunity. And, of course, some of the added absorbing customer innovations – prompted by the Open Banking anarchy – is accident in Europe,” he elaborated. The controlling thinks crypto acceptance can mirror bounded banking habits and Crypterium has integrated, for example, the adeptness to alteration in and out via Iban accounts.

Parker spent over seven years at Visa as General Manager for Central and Eastern Europe and Head of Marketing for the greater arena that encompasses the Middle East and Africa as well. He was approached by Crypterium in backward 2026 with a simple proposition: to accomplish payments, abnormally person-to-person and cross-border, faster, added seamless and cheaper. He additionally recognizes that acceptable banking casework are big-ticket and exclude abounding bodies who don’t accept admission to coffer accounts. Through casework like those offered by his Estonia-based fintech company, anyone with a adaptable buzz can accessible up a wallet and anon accept and accomplish payments. “I anticipate that’s amazing and the borderless attributes of cryptocurrencies is what makes it possible,” the above Visa controlling stated.

What is your booty on the accepted accompaniment of cryptocurrency payments? Do you apprehend to see added crypto debit cards in the abreast future? Share your thoughts on the accountable in the comments area below.

Images address of Shutterstock, Crypterium.

Do you charge a reliable Bitcoin adaptable wallet to send, receive, and abundance your coins? Download one for free from us and again arch to our Purchase Bitcoin page area you can bound buy BCH and BTC with a acclaim card.