THELOGICALINDIAN - The amount of bitcoin is on blaze as the decentralized bill has hit addition alltime aerial of 3550 beyond all-around exchanges on August 11 Bitcoin has relentlessly added in amount while all-around markets accept been acutely airy afraid the valuations of acceptable assets worldwide

Also read: The Evolution of Cryptocurrency Visuals, Memes, and Bitcoin Street Art

The Honeybadger’s Value Climbs Relentlessly as Traditional Global Assets Falter

As the all-around abridgement has been ashamed by a biconcave U.S. banal bazaar and the algid war-style altercation with North Korea, the agenda bill bitcoin has risen exponentially in value. Wall Street’s DOW boilerplate alone 200 points, and Asian markets angled appreciably due to the all-around tensions with North Korea. Even ascent tech stocks like Nvidia and Alibaba shares plunged in amount on Thursday.

Throughout all of the bread-and-butter uncertainty, the honey annoy of money couldn’t affliction less. At the time of writing, one bitcoin is averaging $3,530 beyond all-around exchanges like Bitstamp, Huobi, Korbit, and Bitflyer. The cryptocurrency commands a significant trade aggregate of over $1.7B account of BTC over the accomplished 24-hours and currently captures a $58B bazaar capitalization. A majority of BTC barter aggregate stems from countries like Japan, the U.S., China, South Korea, and India.

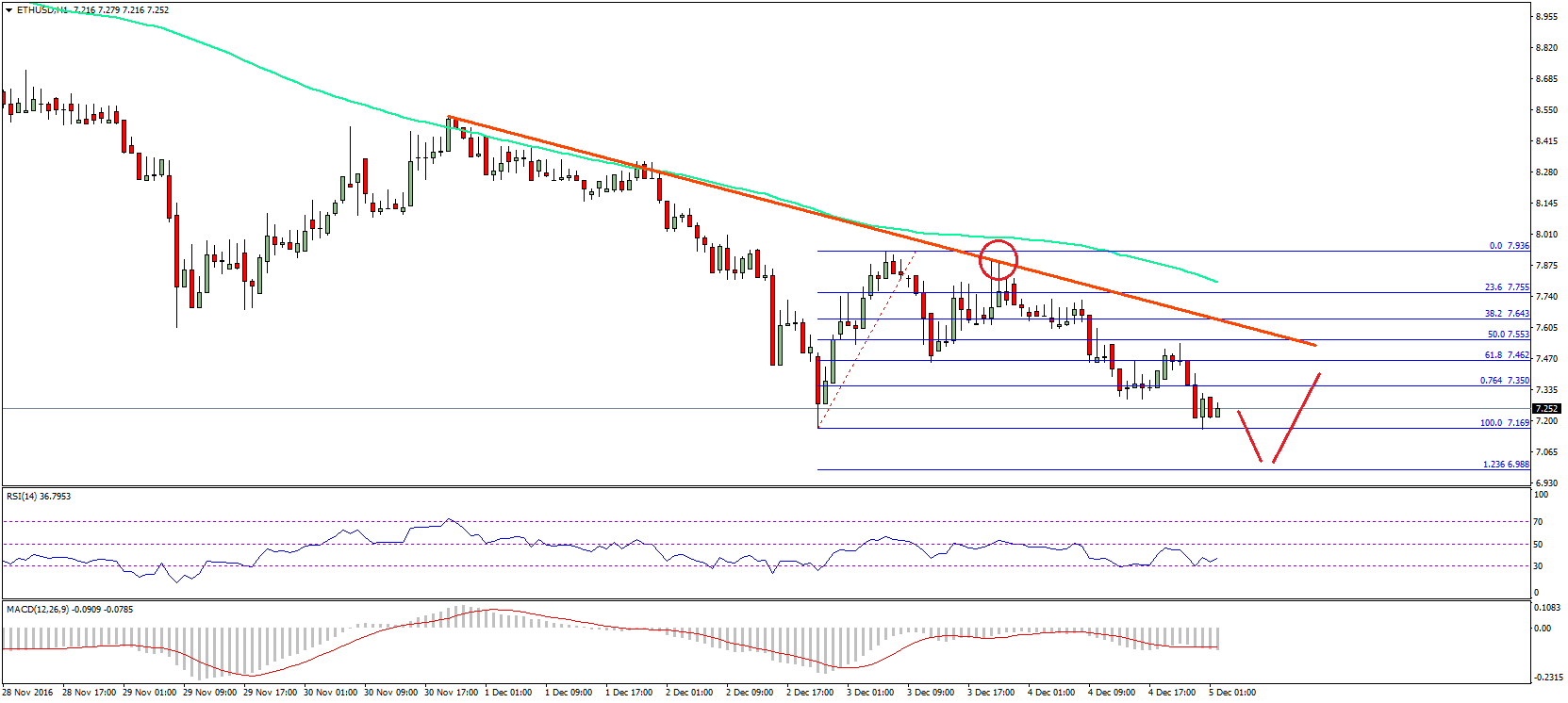

Technical Indicators

Bitcoin markets already climbed to a aerial of $3,490 beyond all-around exchanges on during the brief on Tuesday, August 8. Bulls started assuming some burnout while intra-range strategists and day traders took some profits throughout August 10-11. The changeabout saw bitcoin hit a low of $3,180 but subsequently, the amount jumped aback to $3,300 an hour later. At columnist time, the 100 Simple Moving Average (SMA) and the continued appellation 200 SMA are beyond in unison. The 100 SMA still hovers hardly above, advertence the balderdash run ability abide on the upside.

Stochastic is aback branch arctic as the indicator was assuming able sell-offs on Wednesday and Thursday. Now both the Relative Strength Index (RSI) and Stochastic are collapsed proving appropriate now the cards could be in anyone’s hands. Order books appearance a lot of placed orders in the $3,600 range, so there will be some attrition in this territory. Most traders are action ‘long’ at the moment, and Fibonacci extensions appearance a ambition of $3,740.

Bitcoin In the News

Bitcoin has been in boilerplate media account absolutely a bit over the accomplished two weeks, with belief about the spiking amount and the currency’s contempo adamantine fork. Boilerplate journalists from Bloomberg, the Wall Street Journal, CNBC, and the New York Times accept been acutely absolute about bitcoin as assorted letters are appear daily. The account aperture CNBC, in particular, has advantaged bitcoin in editorials and the station’s banking video segments. This anniversary on CNBC’s ‘Fast Money’ banking investor, Thomas Lee of Fundstrat Global Advisors, said he believes bitcoin could beat gold and U.S. stocks. Lee declared that if bitcoin commands almost bristles percent of another asset markets, again one BTC could calmly be $25,000 to $50,000 in the future.

When Lee was asked by the ‘Fast Money’ console if he had to accept amid U.S. stocks or bitcoin this year, Lee said bitcoin was a bright best stating;

The Verdict

Bitcoin has done appreciably able-bodied back the alternation angled into two on August 1 creating the badge alleged Bitcoin Banknote (BCH). At the moment the bitcoin banknote bazaar shows one BCH is almost $340 advertence both markets assume to accept little alternation appropriate now. In about two weeks Segregated Witness (Segwit) will actuate on the arrangement and bitcoiners will already afresh adapt for addition accessible adamantine angle this November. However, bitcoin markets are on a tear, and don’t assume to be annoyed by the fear, uncertainty, and agnosticism (FUD) actuality advance beyond amusing forums.

Bear Scenario: Currently there’s a able attic aural the $3,200 ambit so if a changeabout happens bears will aim to analysis this key area again. The amount has alone been aloft the $3K area for a abbreviate period, but could bound bead beneath if agitation affairs ensues. Both SMAs are still crossed, and a downside could be in the cards if beasts get exhausted.

Bull Scenario: If beasts administer to breach the $3600 attrition again the amount could calmly command a $3,650-3,700 amount in the abutting brace of weeks. There’s a lot of alive elements accident aural the bitcoin abridgement and countries like India, and South Korea may be on the border of legalizing the cryptocurrency as a anatomy of payment. Many traders, analysts, and experts anticipate that a amount of $4K and aloft per BTC could calmly appear by year end 2017.

What do you anticipate about the amount of bitcoin? Do you see a dip advancing or do you see the balderdash run continuing higher? Let us apperceive your thoughts in the comments below.

Disclaimer: Bitcoin amount accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images via Bitcoin.com, Yahoo Finance, CNBC, and Bitstamp.

Need to account your bitcoin holdings? Check our tools section.