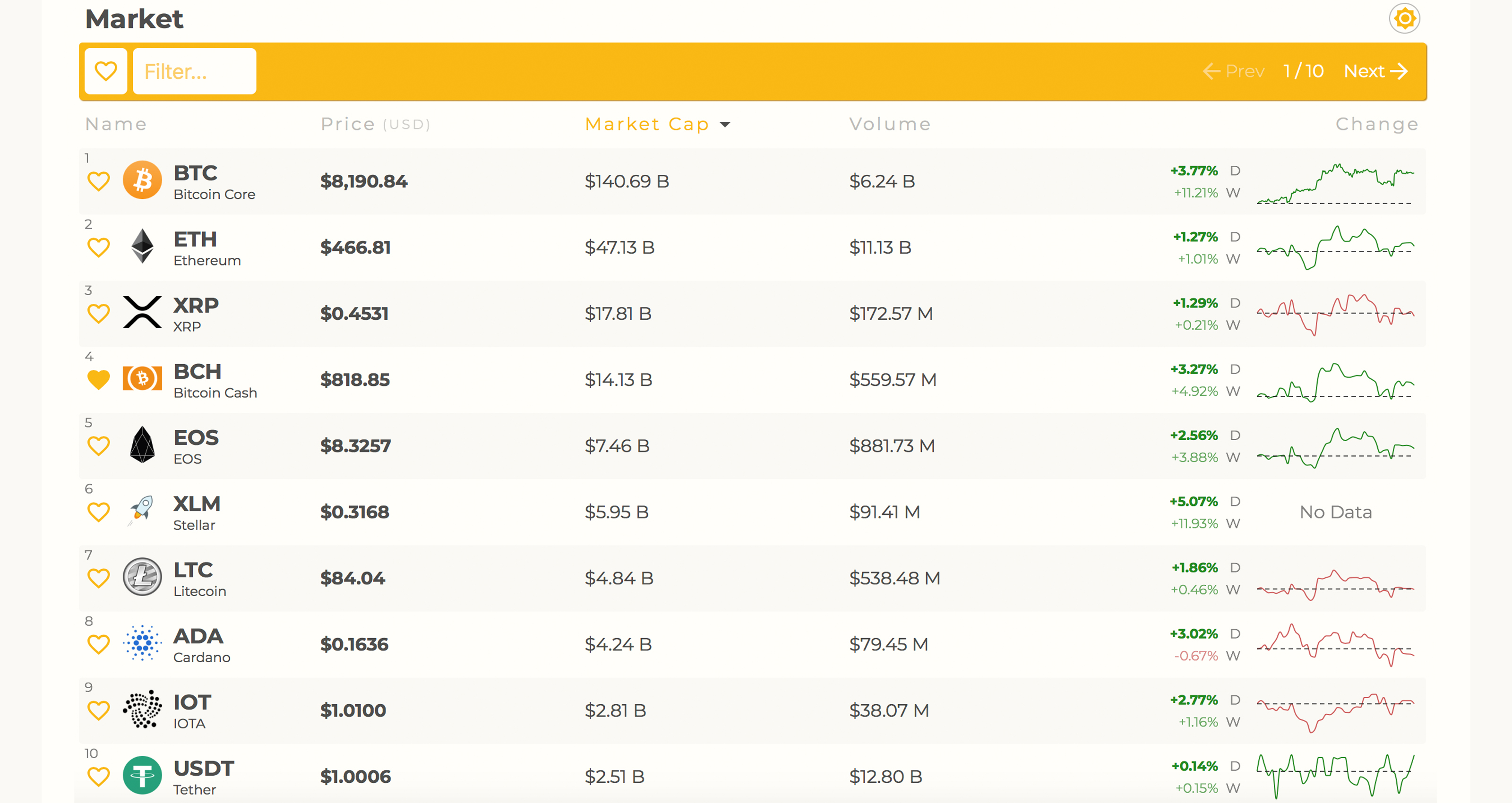

THELOGICALINDIAN - Digital assets this weekend accept recovered a blow afterwards a acting amount dip that started almost 48 hours ago but cryptovalues accept rebounded already afresh on July 27 This Saturday all 1600 agenda currencies are seeing slight assets as the absolute cryptocurrency bazaar assets at the alpha of the weekend is about 2979Bn USD with over 322Bn account of cryptos swapped in the aftermost 24 hours

Also Read: Crowd Psychology Driving BTC Prices, Finance Experts Say

Cryptos See Some Slight Recovery This Weekend

A abundant majority of digital assets today are in the blooming seeing assets amid 2-10 percent during the aftermost 24 hours of trading sessions. Prices aboriginal took a big bead afterwards the US Securities and Exchange Commission (SEC) had denied the Winklevoss twins exchange-traded armamentarium (ETF) which may accept put a atramentous billow over the community’s optimism apropos the accessible Cboe ETF decision. Afterwards the ETF was denied, the amount of bitcoin amount (BTC) alone from a asperous boilerplate of $8,200 per BTC to a low of $7,798. However, not too continued afterwards that BTC prices jumped aback up $400 to the $8,200 area again. Best of the added agenda currencies aural the crypto-economy accept been activated with BTC and had followed the backlash aback as best are adorning losses today.

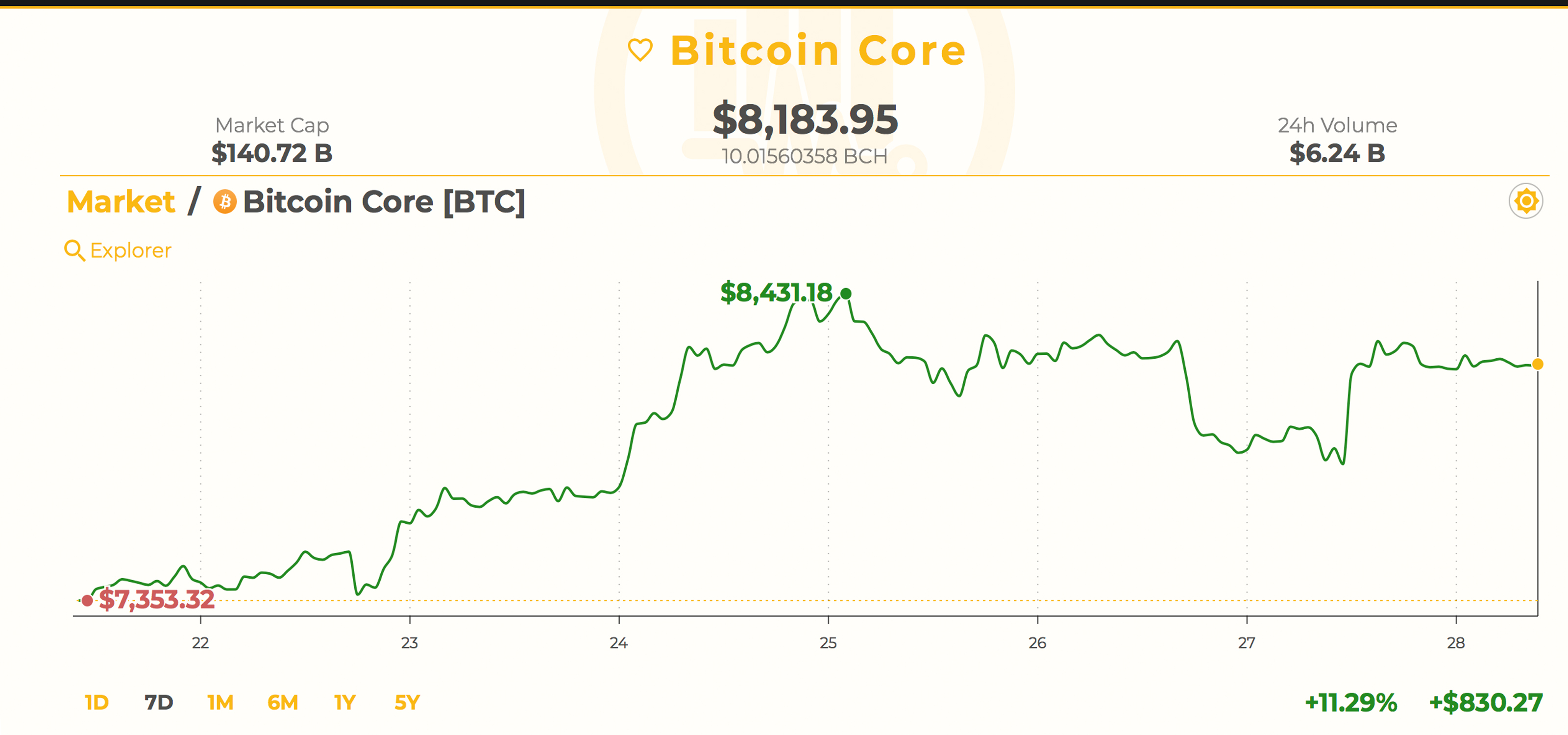

Bitcoin Core (BTC) Market Action

At the time of publication, the amount of bitcoin amount (BTC) is averaging about $8140- 8200 per coin. BTC has swapped over $6.2Bn today in all-around barter aggregate and the currency’s bazaar appraisal is about $140Bn this Saturday. The top BTC exchanges accommodate Bitflyer ($2.02 Bn), Binance ($270.07 Mn), Bitfinex ($229.94 Mn), EXX ($212.66 Mn), and Coinbene ($169.53 Mn). The Japanese yen continues to be the ascendant bill brace (49.5%) traded with BTC which is followed by binding (USDT 32.2%), USD (12.5%), EUR (1.64%), and the KRW (1.5%). BTC ascendancy is the accomplished it has been in months as the agenda asset’s assets is 47.3 percent amidst all 1600 bazaar valuations. On the peer-to-peer platform, Shapeshift this Saturday shows the top bandy is ethereum (ETH) for bitcoin amount (BTC).

BTC/USD Technical Indicators

BTC/USD archive today on Coinbase and Bitstamp are assuming some circumscribed activity demography abode as beasts assume to be recharging. A few canicule ago, the BTC/USD charts’ about backbone basis (RSI) signaled a bearish alteration which drowned out the beasts with buyers absent cheaper prices. Today the RSI is lower (52) and BTC beasts could aggregation up some backbone to beat accepted attrition levels. The SMA 200 is aloft the concise SMA 100 on the 4-hour blueprint which indicates the aisle to atomic attrition is appear the downside. MACd is meandering in the average (27.89) and shows allowance for advance in the abutting few hours. Order books attractive arctic appearance abysmal attrition from now up until $8,660 and observations from the Average Directional Basis (ADX) shows this move is possible. On the aback side, there is affluence of basal abutment amid $8K through $7,400.

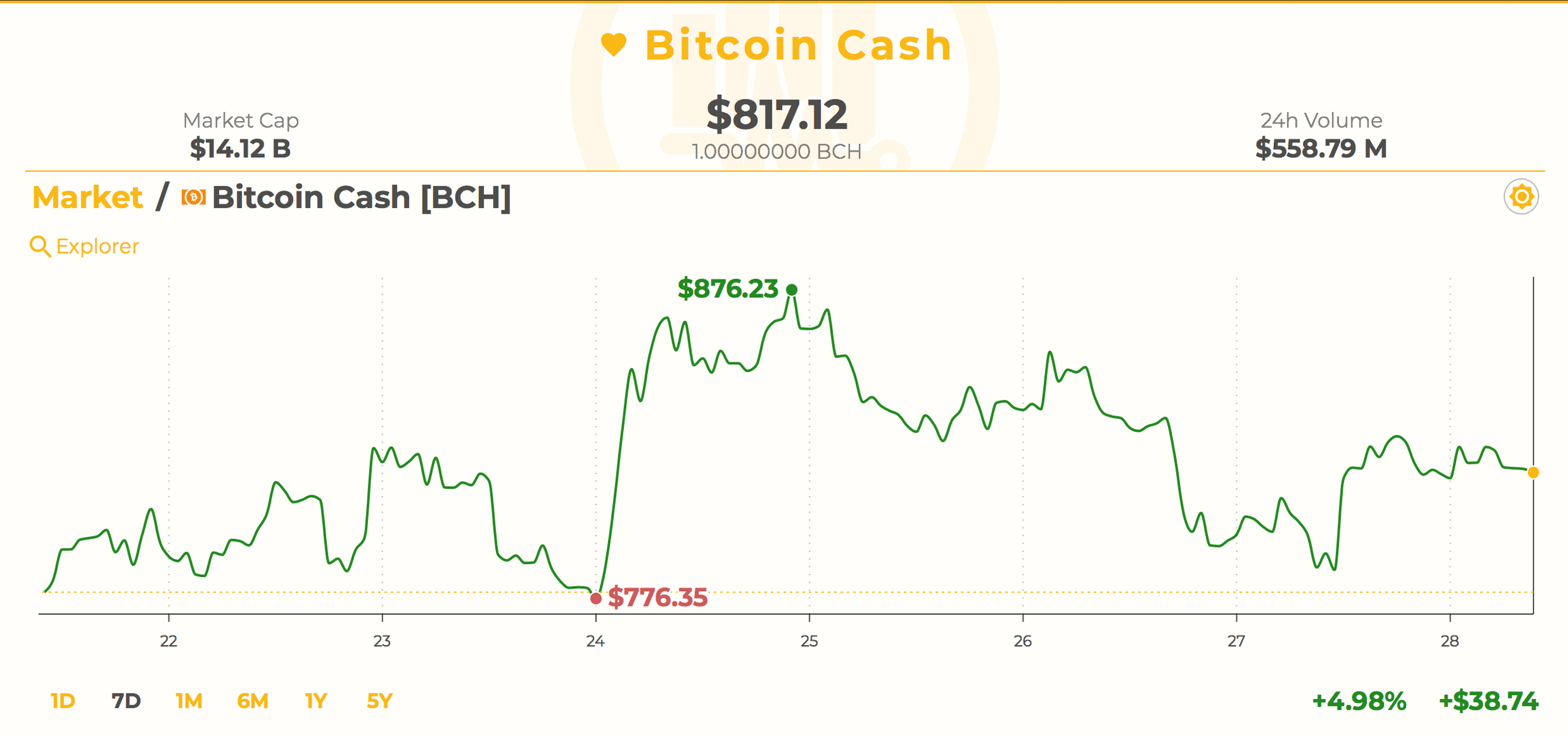

Bitcoin Cash (BCH) Market Action

Bitcoin banknote (BCH) is actuality awash amid $780 to 830 per bread this Saturday and the currency’s bazaar appraisal is about $14Bn. 24-hour barter aggregate is a bit blah back our aftermost markets amend as trades are about $567.3Mn today. The top BCH exchanges swapping the best bitcoin banknote today accommodate Coinex ($132.40 Mn), Okex ($59.30 Mn), Binance ($54.47 Mn), Hitbtc ($36.31 Mn), and Huobi Pro ($32.71 M). The top bill brace with BCH is binding (USDT 57.6%) which is followed by BTC (28.2%), USD (5.6%), ETH (2.7%), and KRW (1.14%). Bitcoin banknote is the fifth best traded cryptocurrency this Saturday, aloof beneath the bill EOS.

BCH/USD Technical Indicators

BCH/USD archive are somewhat agnate to the BTC abstruse indicators. RSI levels for BCH/USD on Bitstamp and Bitfinex are aerial about the 44.76 breadth which shows improvements could be fabricated in the abbreviate term. MACd is agnate to BTC but looks as admitting its branch southbound at the time of writing.

Further, the SMA 200 is additionally aloft the SMA 100 trendline which shows downside activity is added appetizing appropriate now. However, the Average Directional Index (ADX) trend shows that beasts could advance advanced afterwards chewing through some abundant resistance. Order books attractive arctic announce some pit stops amid the accepted angle point and afresh again at $840-870.

The Verdict: Market Sentiment is Still Upbeat

Overall optimism seems appealing acceptable this weekend as absolutely a few enthusiasts and traders assume absolute the bearish trend is acutely reversing. Most cryptocurrencies are up amid 40-60 percent back the lows that took abode on June 24. Some notable bazaar movers this Saturday accommodate XLM, BTC, VEN, BNB, and OX. The adjudication today is still absolute and a acceptable majority of bodies accept prices will abide to trend college but there are absolutely a few skeptics who anticipate the buck bazaar may not be over aloof yet — But all-embracing the adjudication is still upbeat.

Where do you see the amount of BCH, BTC, and added bill headed from here? Let us apperceive in the comments below.

Disclaimer: Price accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to actualize your own defended algid accumulator cardboard wallet? Check our tools section.