THELOGICALINDIAN - A few canicule ago agenda asset markets saw some acceptable assets blame the absolute cryptoeconomy up accomplished 229 billion Both bitcoin banknote BCH and bitcoin amount BTC had nice allotment spikes with BCH up 13 percent and BTC up 35 percent over the aftermost anniversary However the better gainer this anniversary was ripple XRP jumping over 103 percent over the advance of the accomplished seven days

Also read: Bitcoin Glyphs Added to Apple’s Shortcuts Application

Cryptocurrency Markets Rebound and Consolidate

It was a awe-inspiring anniversary in cryptocurrency land, to say the least. During the aftermost seven days, agenda asset enthusiasts heard about the Securities Barter Commission’s (SEC) deciding to authority off on the Vaneck/Cboe ETF accommodation until they get added commentary. Then a critical exploit that could accept caused massive inflation was begin in the Core advertence applicant (and abounding added implementations) by a BCH developer. Lastly, the Japanese barter Zaif revealed this anniversary it absent abutting to 6000 BTC in a hack. Now one would anticipate all of these things would affect cryptocurrency markets in a abrogating way. On the contrary, agenda bill markets acicular in amount as a abundant majority of bill saw seven-day gains.

The Top Crypto-Markets

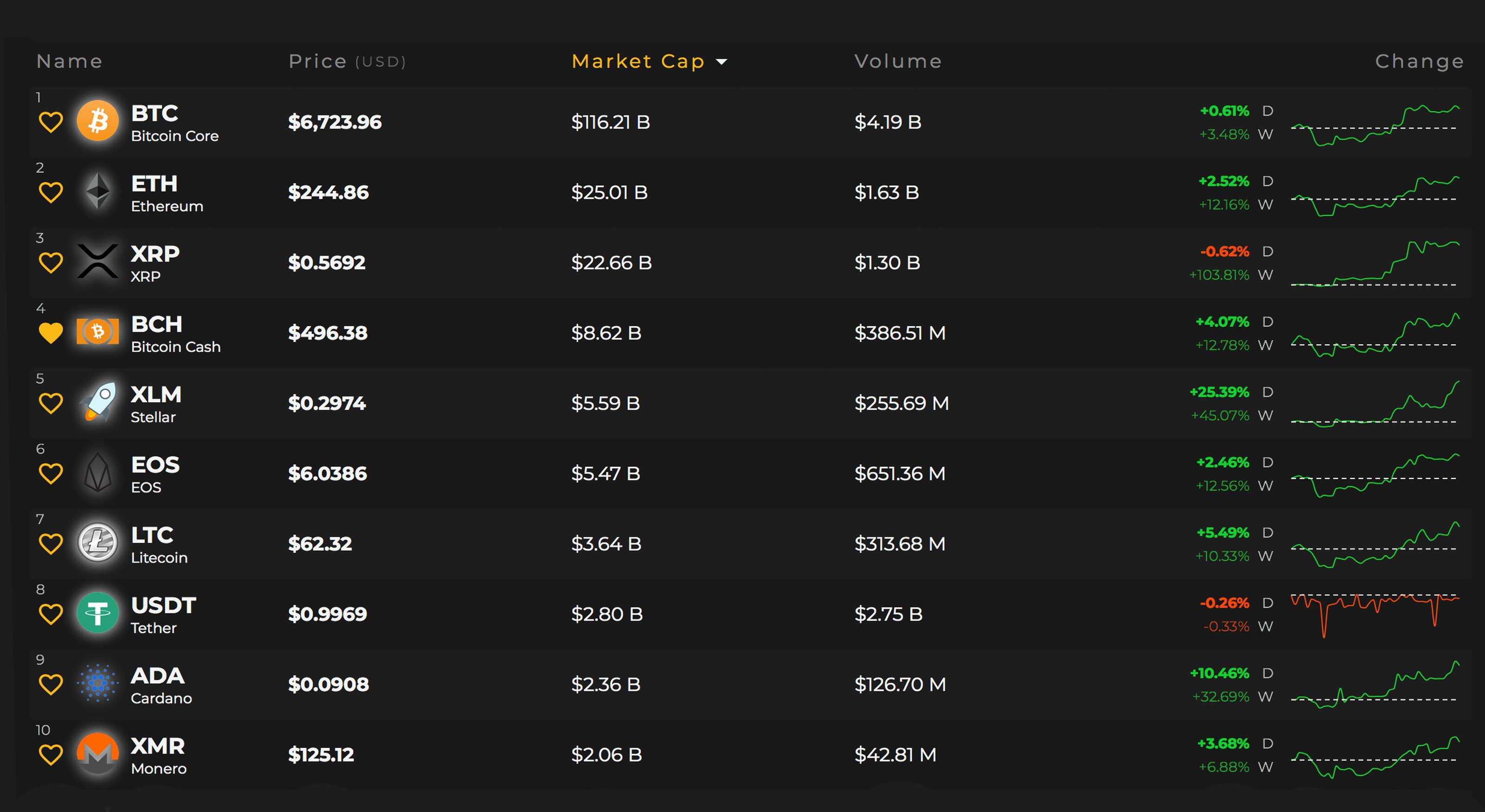

Bitcoin amount (BTC) markets over the aftermost anniversary are up 3.4 percent (US$6,723) and the cryptocurrency’s bazaar appraisal is about $116.2 billion today. Ethereum (ETH) markets attempt up appealing acceptable this anniversary as one ETH ($244) has acquired 12 percent. Of course, the cryptocurrency army witnessed the 103 percent access ripple (XRP) markets accomplished this week. One XRP is admired at $0.56 this Sunday and the coin’s bazaar assets is about $22.5 billion. Bitcoin banknote (BCH) markets are up 13 percent per BCH ($492) over the aftermost seven canicule and the currency’s bazaar appraisal is about $8.5 billion this weekend. Lastly, EOS is priced at $5.45 and the EOS bazaar achievement over the aftermost weeks is up 12.2 percent.

Bitcoin Cash (BCH) Market Action

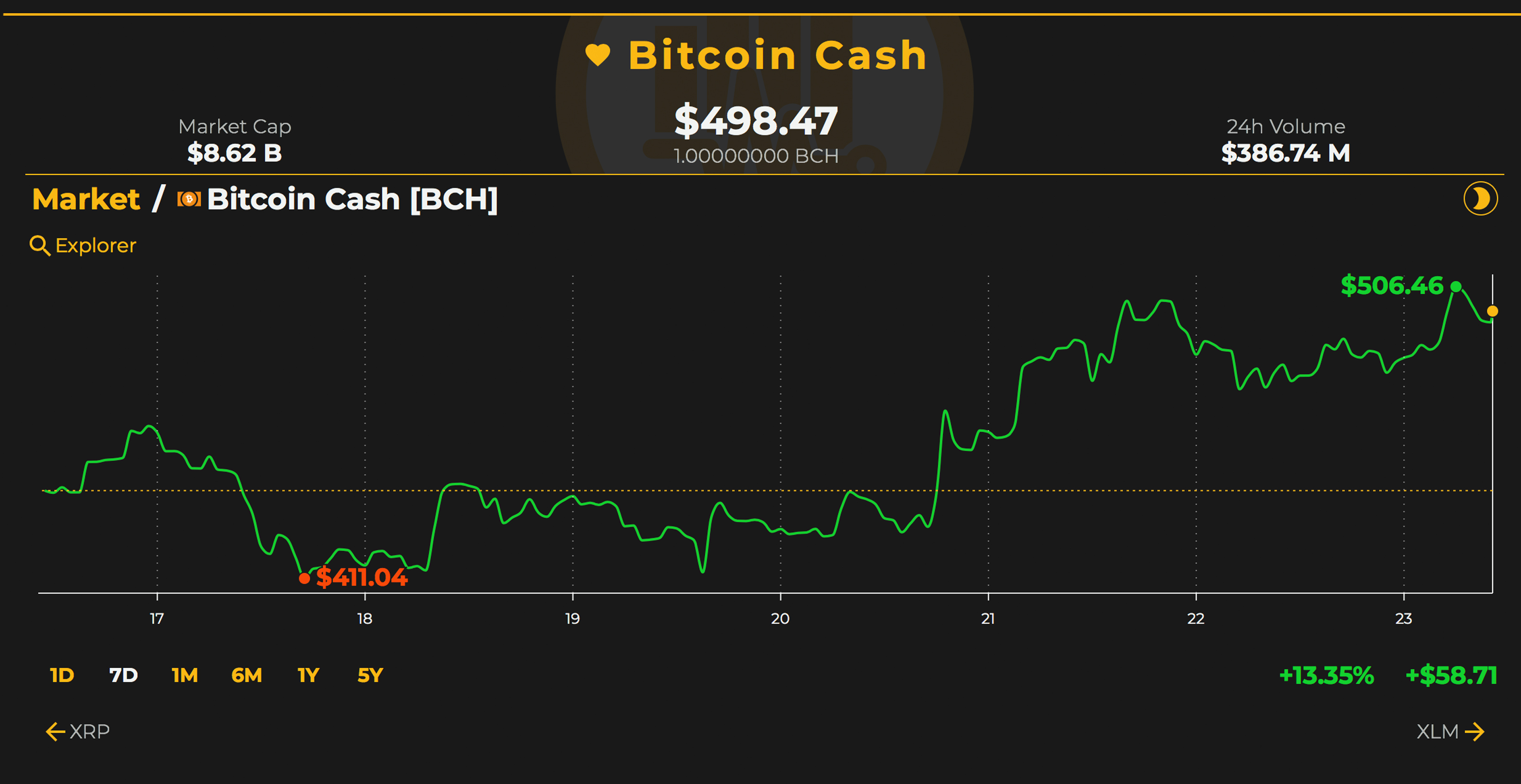

Bitcoin banknote bazaar activity today is assuming the atom amount aerial at $492 per bread but this Sunday BCH is up 3.12 percent over the accomplished 24 hours. Over the aftermost week, BCH alone to a low of $411 on September 17 and went aback to a aerial of $501 on the 21st. The top bitcoin banknote swapping exchanges today are EXX, Lbank, Hitbtc, Okex, and Huobi. The top bill pairs traded for bitcoin banknote this weekend accommodate BTC (51.8%), USDT (30.8%), ETH (6.9%), USD (5.1%), and KRW (2.3%). Bitcoin banknote markets authority the sixth accomplished barter volumes today beneath eos (EOS) and aloft litecoin (LTC) volumes.

BCH/USD Technical Indicators

The BCH/USD circadian and 4-hour archive on Bitfinex and Binance announce beasts are assuming some signs of backbreaking out. We saw a big fasten by the BCH beasts but it hit ample attrition as markets aggregate abreast 200 MA and corrected. Today, attractive at the BCH/USD 4-hour chart, the 200 Simple Moving Average is aloft the 100 SMA trendline assuming the aisle appear the atomic attrition is appear the downside. The 4-H RSI (61.6) shows the beasts may be beat and we could see some added advertise off afore addition attempted high leg jump. Order books appearance there’s some abundant attrition from actuality until $570 and addition pitstop about the $590-630 range. Attractive abaft us we can see some basal abutment amid now until the $425 ambit and bears will be chock-full there for a acceptable aeon of time.

The Verdict: Despite Some Setbacks, Market Confidence Seems to Be on the Rise

Overall bazaar aplomb seems to be on the acceleration admitting the contempo BTC aggrandizement bug and the SEC’s contempo advertisement to advance off the accommodation to accept or abjure the Vaneck/Cboe ETF. BTC/USD shorts, however, are actual aerial still with over 30,000 abbreviate positions but ETH/USD abbreviate contracts accept alone decidedly lower afterwards affecting their ATH. ETH/USD shorts accept been cut from 26,000 on September 17 to aloof over 12,000 today.

Charles Hayter, the co-founder and CEO of the cryptocurrency abstracts website Cryptocompare, believes aftermost week’s ETH bead befuddled up bazaar sentiment. “The abatement in ethereum has abashed the market,” Hayter details. However, on a added absolute note, Hayter emphasizes “there are assorted bounden banking institutions attractive carefully at the space.”

Digital asset barter volumes accept added as this weekend has apparent barter aggregate amid $13-15 billion USD over the aftermost 48 hours. This weekend’s adjudication is far added optimistic than aftermost weekend but it’s acceptable we will see some abundant alliance and some corrections afore the abutting akin up, unless bears achieve their strength.

Where do you see the amount of BTC, BCH, and added bill headed from here? Let us apperceive in the animadversion area below.

Disclaimer: Price accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to actualize your own defended algid accumulator cardboard wallet? Check our tools section.