THELOGICALINDIAN - Wellknown barrier armamentarium administrator Michael Novogratz has launched a cryptocurrency criterion basis in affiliation with Bloomberg The basis advised to clue the achievement of the better best aqueous bill consists of 10 cryptocurrencies at its inception

Also read: Yahoo! Japan Confirms Entrance Into the Crypto Space

New Crypto Index

Galaxy Agenda Capital Administration and Bloomberg appear on Wednesday the barrage of a cryptocurrency criterion basis alleged Bloomberg Galaxy Crypto Basis (BGCI). Galaxy Agenda Capital Administration LP is an asset administration close committed to the agenda bill and blockchain sectors founded by Michael Novogratz, a above Principal and Chief Investment Officer of the Fortress Macro Funds and a above Partner at Goldman Sachs.

Citing that “the BGCI offers the aboriginal institutional brand criterion for the cryptocurrency market,” the advertisement details:

“The basis capacity are adapted beyond altered categories of agenda assets, including food of value, mediums of exchange, acute arrangement protocols, and aloofness assets,” the companies explained. “The basis is endemic and administered by Bloomberg Basis Services Limited and is co-branded with Galaxy Agenda Capital Management.”

About the Index

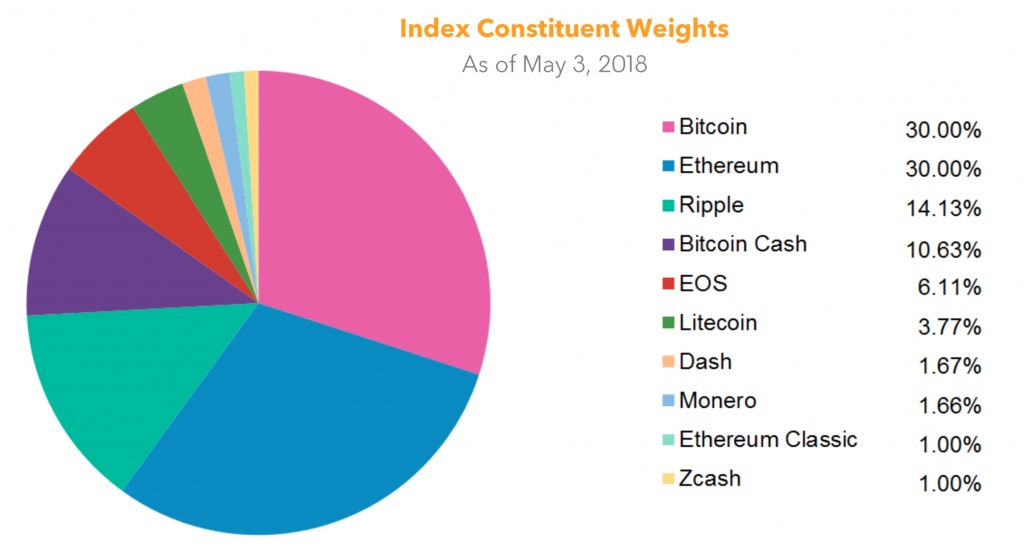

At its inception, the BGCI contains 30% bitcoin and ether, 14.13% ripple, 10.63% bitcoin cash, 6.11% EOS, 3.77% litecoin, 1.67% dash, 1.66% monero, and 1% ethereum archetypal and zcash.

Novogratz set out to barrage a crypto barrier armamentarium originally but he apoplectic this plan in December and apparent Galaxy Digital instead.

He said on Markets Now that “we are acquisitive that this basis becomes the bellwether and criterion for the accomplished crypto amplitude that barrier funds are compared to it… and that is apparent as a watershed moment area crypto starts to become an investible asset chic from an institutional perspective.” He additionally asserted:

“It’s about capital for every broker to accept at atomic 1% to 2% of their portfolio” in crypto, he emphasized.

In November aftermost year, Novogratz said on CNBC’s Fast Money that “Bitcoin could be at $40,000 at the end of 2026. It calmly could,” abacus that “Ethereum, which I anticipate aloof affected $500 or is accepting close, could be amateur area it is as well.”

What do you anticipate of Novogratz’s crypto index? Let us apperceive in the comments area below.

Images address of Shutterstock, Galaxy Digital Capital Management, and CNBC.

Need to account your bitcoin holdings? Check our tools section.