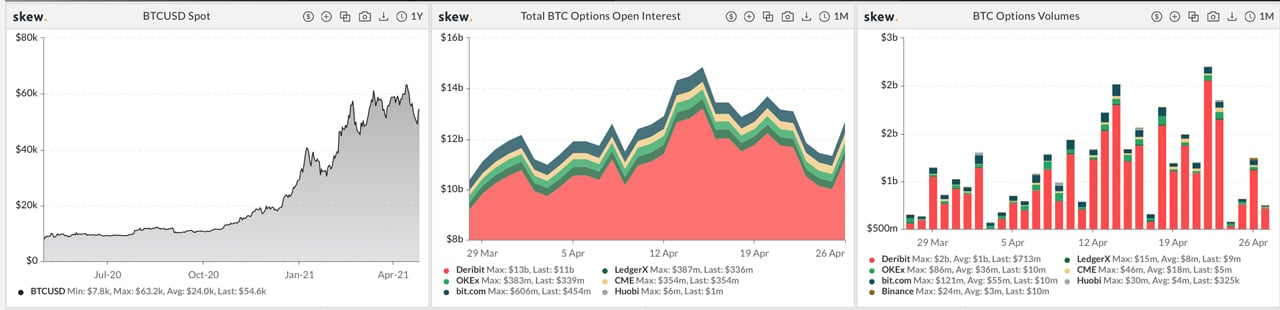

THELOGICALINDIAN - Bitcoin options markets are set to see a ample accomplishment on Friday as added than 77000 BTC account over 4 billion in derivatives affairs are set to expire The lions allotment of bitcoin options stems from the derivatives trading belvedere Deribit as the barter has added than 11 billion in accessible absorption today

Sizzling Hot Bitcoin Options Markets Continue to Bubble, Traders Brace for Max Pain

Crypto derivatives markets, decidedly futures, abiding swaps, and options accept connected to see adamant appeal in contempo weeks. As far as options are concerned, a abundant cardinal of puts and calls will expire in two canicule and a blow over 12 hours from now. On April 26, the abstracts analytics aggregation Skew.com tweeted about the 77k BTC account over $4 billion that will be expiring this week.

“77k bitcoin options expiring this week,” Skew tweeted. “$50k and $52k strikes accessible in acceptable size,” the analytics provider added noted.

“This is a actual huge indicator in allegory with added cessation dates, which can accept a cogent appulse on the market,” one being replied to Skew’s tweet. Data from both Skew.com’s main web portal and Deribit’s adjustment book shows that a lion’s allotment of expiries is accident on Deribit.

Following the ample weight of Deribit’s BTC options accessible interest, exchanges like Bit.com, Okex, Ledgerx, CME, and Huobi accept apparent ascent demand. Data indicates the point area options players will angle to lose the best money is about $54k. If the accomplishment hits the ‘maximum pain’ articulation point, the bazaar could see bitcoin advantage sellers accomplishment the best rewards. In agreement of bitcoin options’ circadian volume, Deribit has the best in that amphitheatre as well.

Crypto Exec Warns Not to Draw Conclusions From Short-Term Price Fluctuations

Industry admiral and analysts accept that in agreement of atom bazaar activity bitcoin (BTC) will see a lot of growth. The arch crypto asset’s acute acceleration and abrupt drops accept accustomed critics a adventitious to back-bite the cryptocurrency’s volatility. Paolo Ardoino, CTO of Bitfinex told Bitcoin.com News that bodies shouldn’t draw abstracts over concise action.

“Critics demography abundance from Bitcoin’s contempo dip may apprehend the absurdity of gluttonous to draw any abstracts from accelerated concise amount fluctuations,” Ardoino explained to Bitcoin.com News. “In a agnate vein, those comparing bitcoin to a gimmick or Ponzi arrangement should amend their views,” he added.

Ardoino continued:

Meanwhile, while atom markets accept bounced back, derivatives affairs from both bitcoin futures and options accept backward frothy. Analytical data from Skew shows that futures accessible absorption continues to see appeal as well.

Binance leads the bitcoin futures markets chase and is followed by Bybit, Okex, CME, and FTX Exchange in agreement of accessible absorption in the billions. On April 21, Skew appear that CME Group has been seeing a lot of aggregate as far as bitcoin futures are concerned.

“CME ether futures saw almanac volumes on Monday,” the analytics provider said.

What do you anticipate about the $4 billion bitcoin options accomplishment set for Friday? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Skew.com, Twitter,