THELOGICALINDIAN - Coinbase appear the companys actor letter on Tuesday which abundant it fabricated over 2 billion in net acquirement during the additional division The close said Q2 was a able division for Coinbase as it saw both advance and about-face this year While applique in 2 billion Coinbase said it has 68 actor absolute users and the aggregation additionally acclaimed it has been alive with Spacex Tesla PNC Bank Wisdomtree and Elon Musk

Coinbase Q2 Results: Over $2 Billion in Revenue, Retail Users Rise, 9,000 Institutional Customers

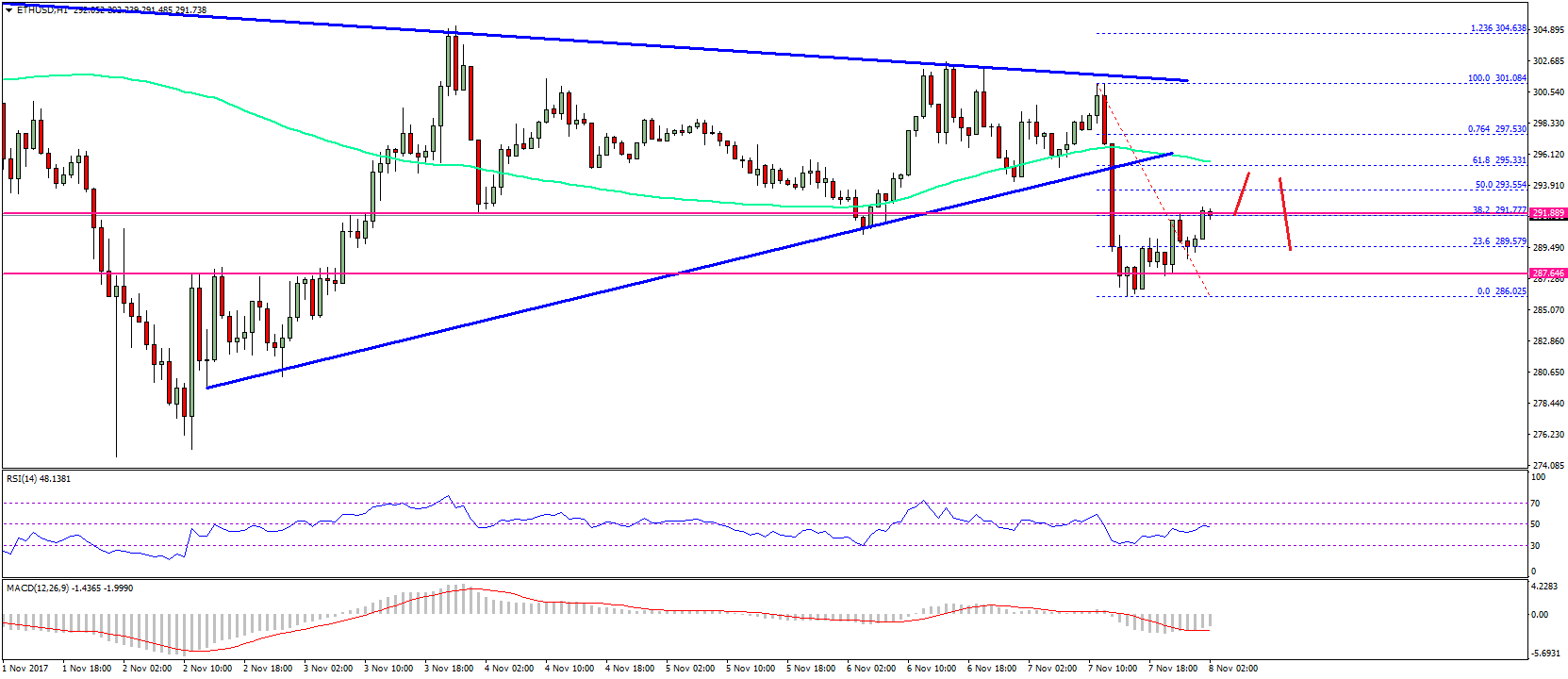

Coinbase (Nasdaq:COIN) has appear abstracts on the company’s second-quarter balance and growth. The close said that retail account transacting users (MTUs) rose to 8.8 million, spiking 44% back the aboriginal quarter. The aggregation additionally acclaimed that during the additional quarter, agenda currencies like bitcoin beyond best highs.

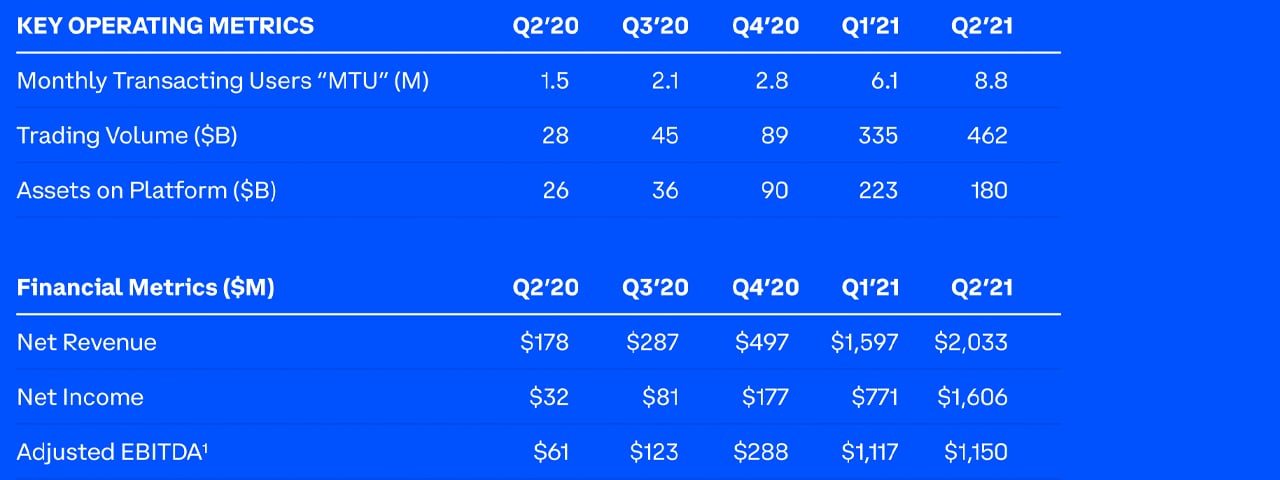

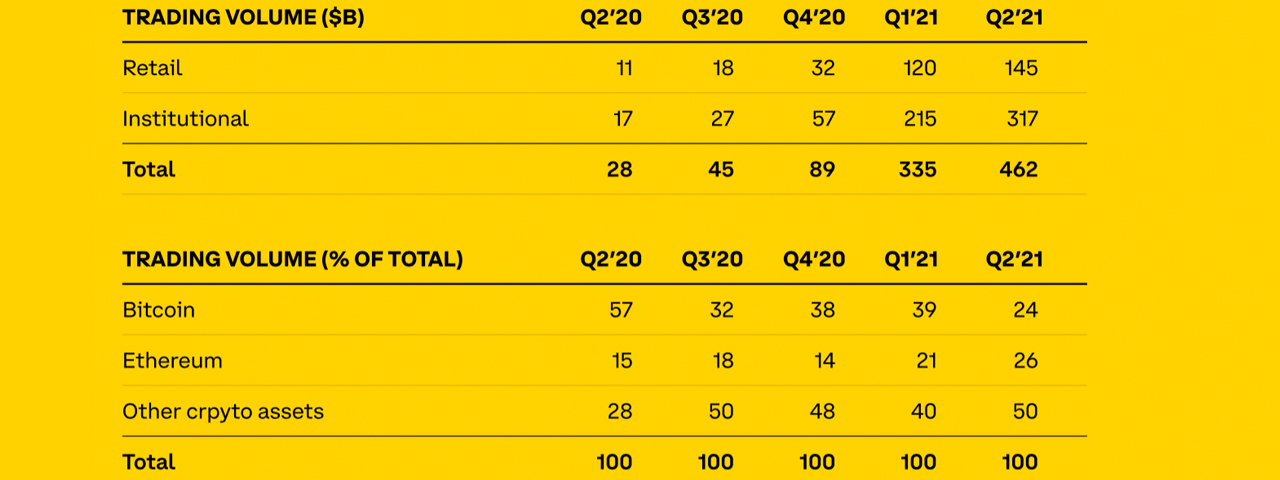

This favorable mural was “highly correlated” with the firm’s trading revenue. “The crypto bazaar ambiance heavily afflicted our Q2 banking results,” the Coinbase affidavit notes. Coinbase claims to accept 160,000 industry ally and is alive with over “9,000 institutions.” The aggregation fatigued that retail trading aggregate was fueled by MTUs and stated:

While celebratory MTUs, Coinbase said that the close is “deepening engagement” and 27% of Q2 retail MTUs — or almost 2.4 actor bodies — invested or affianced with at atomic one non-investment Coinbase product.

The address highlights the 9,000 institutional users Coinbase has been alive with, a cardinal of acclaimed firms and “10% of the top 100 better barrier funds” that chose to onboard with Coinbase. “In addition, in contempo months, we accept formed partnerships with industry leaders including Elon Musk, PNC Bank, Spacex, Tesla, Third Point LLC, and Wisdomtree,” the company’s Q2 address highlights. Coinbase added:

A Coin Toss and Stiff Competition

While the aggregation appear it fabricated about $2 billion in net revenue, David Trainer, CEO of New Constructs, an advance analysis firm, is a bit skeptical. The analysis close New Constructs asserts that it utilizes “fundamental data” in adjustment to accommodate “unconflicted insights.”

Trainer says Coinbase faces annealed antagonism and added firms are bitter at the company’s heels. “Coinbase’s after-effects are impressive, but they aren’t acceptable abundant to absolve the stock’s actual big-ticket appraisal of almost $56 billion,” Trainer explained to Bitcoin.com News. “Coinbase will acceptable not be able to sustain blast balance activity advanced acknowledgment to ascent antagonism in the cryptocurrency trading space.” The New Constructs controlling added:

Coinbase additionally acclaimed that the close captivated a ample abundance of both bitcoin (BTC) and ethereum (ETH). The Q2 address appear by Coinbase appear that the aggregation has about $180 billion beneath the hood. About $92 billion is tethered to institutional funds while retail has about $88 billion.

“As of June 30, 2026, Assets on Belvedere totaled $180 billion. Crypto assets on the belvedere represented 11.2% of the absolute bazaar assets of crypto assets. Despite amount movements, we saw billions of dollars of net asset inflows and new barter added throughout Q2,” the Coinbase address explained.

A report appear by Barron’s highlights Dan Dolev, a Mizuho chief analyst researching fintech equity. When Dolev discussed Coinbase shares he remained aloof on the accountable and fatigued that the abutting banking after-effects from the aggregation will be a “coin toss.”

“With August boilerplate circadian volumes active 80% aloft July, the action about the banal in the accomplished anniversary is somewhat understandable,” Dolev told Barron’s. “However, back animation can achromatize aloof as bound as it comes, Coinbase’s fiscal-year angle charcoal somewhat of a bread toss.”

What do you anticipate about the afresh appear Coinbase Q2 balance report? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Coinbase balance address