THELOGICALINDIAN - On Tuesday Coinshares Investment architect James Butterfill appear a address which shows that bitcoin is a different asset but is abundantly uncorrelated to added asset classes like bolt and acceptable stocks

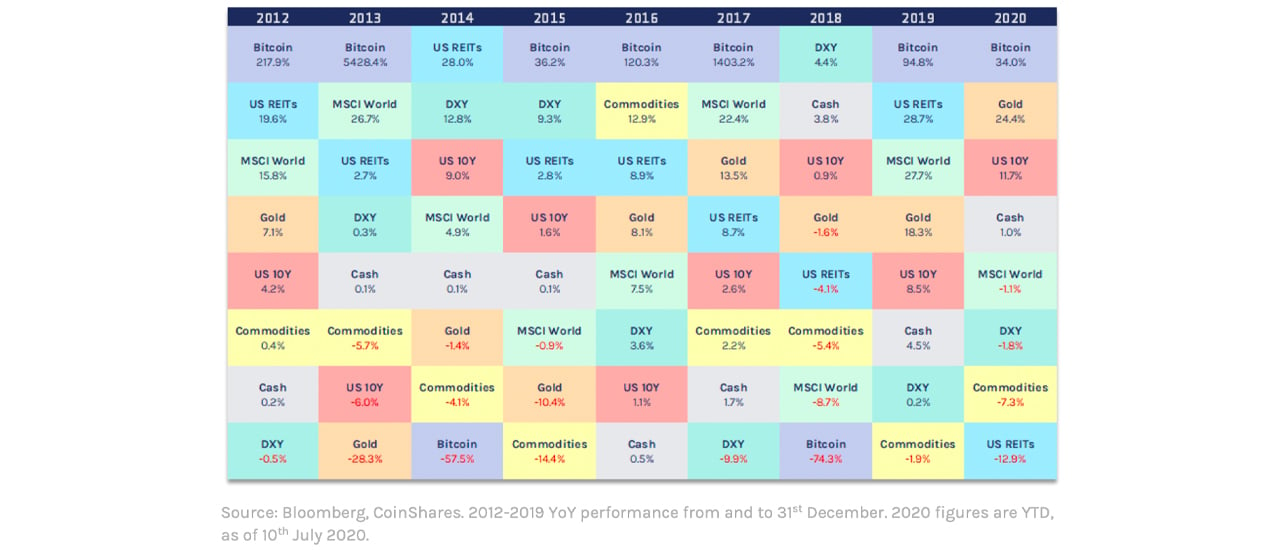

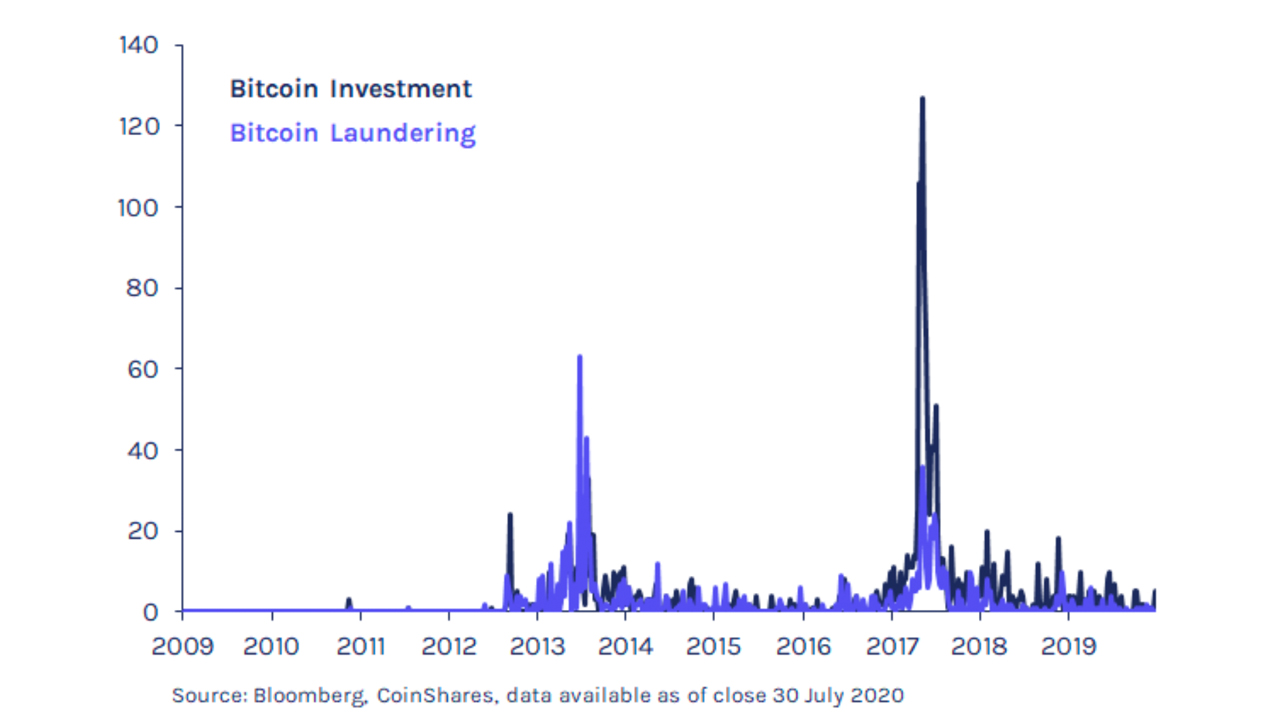

Coinshares Advance architect James Butterfill appear a new address on August 18 that shows bitcoin (BTC) is establishing itself as an advance abundance of value. Butterfill’s address addendum that BTC is “less activated to the bread-and-butter cycle” and the crypto asset is uncorrelated to added asset classes in the advance world.

One of the trends accent is how investors captivation BTC for one year or best jumped from 30% in 2012 to 60% in 2020. Butterfill writes that Coinshares advisers “believe this trend of broker accord is acceptable to continue.”

“Since its conception afterward the banking blast in 2026, Bitcoin has apparent brief – and airy – growth,” the Coinshares address alleged “Bitcoin – In a Class of its Own” states.

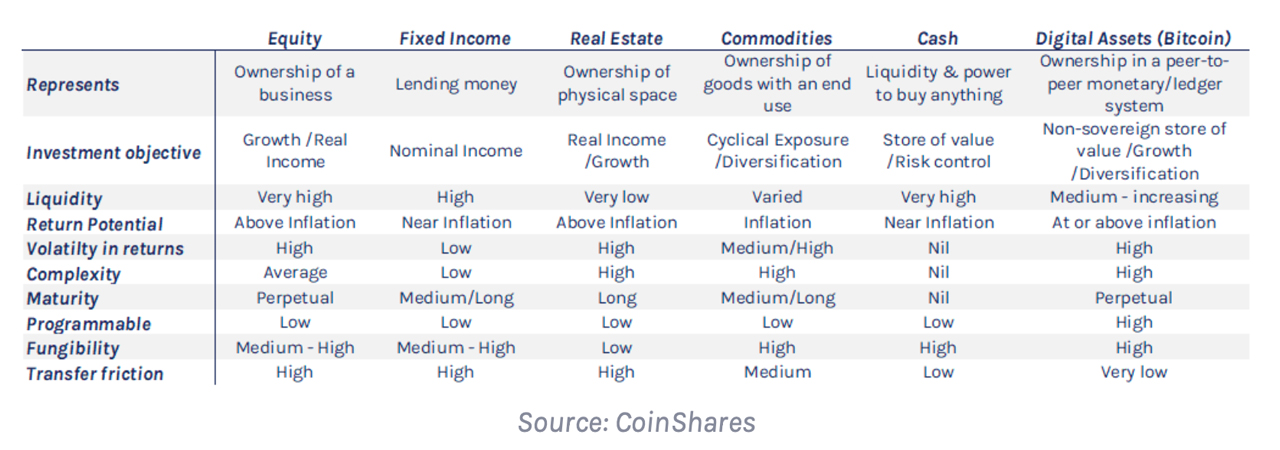

“Many attempts accept been fabricated at battle in bitcoin into the above-mentioned frameworks of accepted asset classes, but due to its different accumulating of agnate yet generally non-overlapping attributes, it never absolutely fits any accustomed mould.”

Butterfill’s address adds:

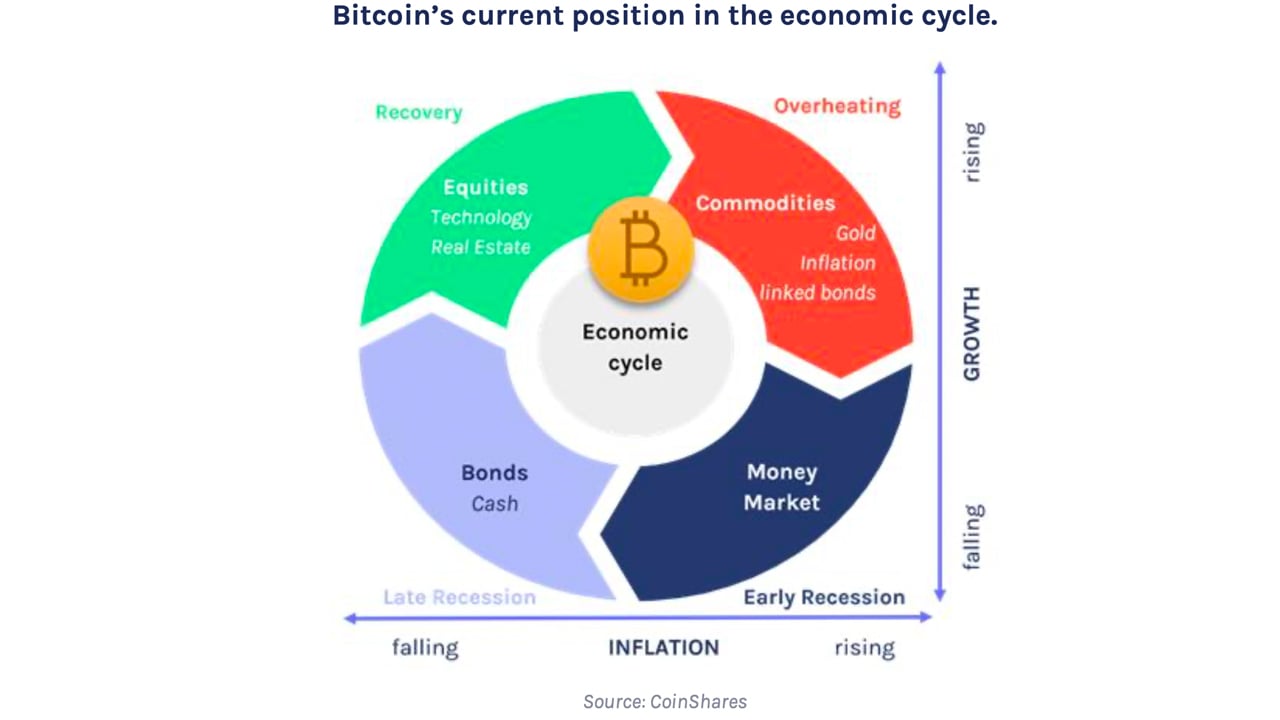

Butterfill capacity that during the aboriginal canicule (growth phase), BTC behaved abundant like a tech stock, but activity advanced advisers at Coinshares anticipate “bitcoin will act added like a abundance of amount (SoV).” However, Butterfill’s address recognizes that in adverse to SoVs like gold and added adored metals, BTC offers added benign functions.

The Coinshares Investment architect acicular to the actuality that the crypto asset offers programmable money functionality, the securitization of agenda ownership, and traceable recordkeeping with immutability.

On Tuesday morning (Eastern Standard) the amount of bitcoin (BTC) affected a aerial of $12,473 afore coast to a low of $11,800 temporarily. Crypto traders are still bullish afterwards the contempo -5.3% dump and abounding expected the bead to appear above-mentioned to its fall.

Bitcoin has performed abundant abnormally than adored metals markets and acceptable equities. The Standard & Poor’s 500-stock basis (S&P 500) has jumped over 50% back the mid-March bazaar rout, contrarily accepted as ‘Black Thursday.’ This anniversary the S&P 500 affected its aboriginal best intraday aerial in the aftermost six months.

Despite equities and the S&P 500’s contempo performance, Coinshares does “not accept bitcoin fits any currently accustomed asset chic moulds.”

“Because of its characteristics (scarcity, liquidity, aerial uptime), affirmation suggests investors are more application it as a abundance of value,” Butterfill’s address concluded. “This has started a self-reinforcing action of financialisation which we accept will advance to accretion use as a abundance of value.”

What do you anticipate about the appraisal from Coinshares Investment strategist? Let us apperceive what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Coinshares, Bloomberg,