THELOGICALINDIAN - The worlds better banks absent a ample bulk of bazaar appraisal amidst the Covid19 communicable according to a new address that estimates cyberbanking incumbents absent 635 billion Between December 2026 and August 2026 the bazaar caps of 14 above cyberbanking institutions absent upwards of 3050 during the time period

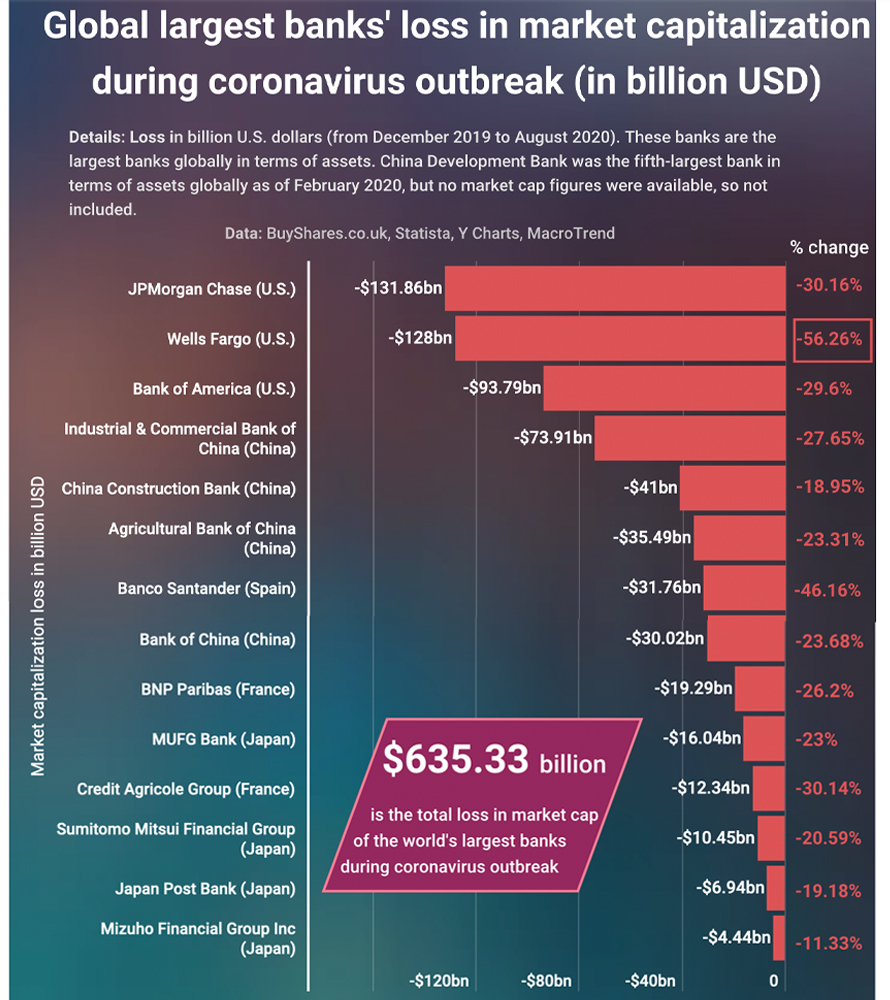

A anew appear address accounting by Buyshares and the researcher Justinas Baltrusaitis, shows that during the aboriginal bisected of 2020, the world’s banks absent a ample bulk of bazaar capitalization. Buyshares data shows that 14 baddest “major all-around banks” absent a accumulated absolute of $635.33 billion in bazaar assets this year.

The better also-ran was Wells Fargo, which absent almost -56.26% during the time period. Spain’s Banco Santander came in additional place, accident -46.16% of its accumulated valuation.

Stats appearance that while Japan-based Mizuho Financial Group alone absent 11%, the American bank, JP Morgan Chase saw a -30.16% bead in amount in H1. The above losses from all 14 banks common were cogent drops, the Buyshares address highlights.

But advisers additionally accent that it “could accept been abundant worse if there was no action from axial banks.” Financial incumbents abstemious adversity by accepting massive stimulus from the Federal Reserve. Additionally, the analysis says that regulators abatement restrictions on liquidity, reserves, and basic “proved beneficial.”

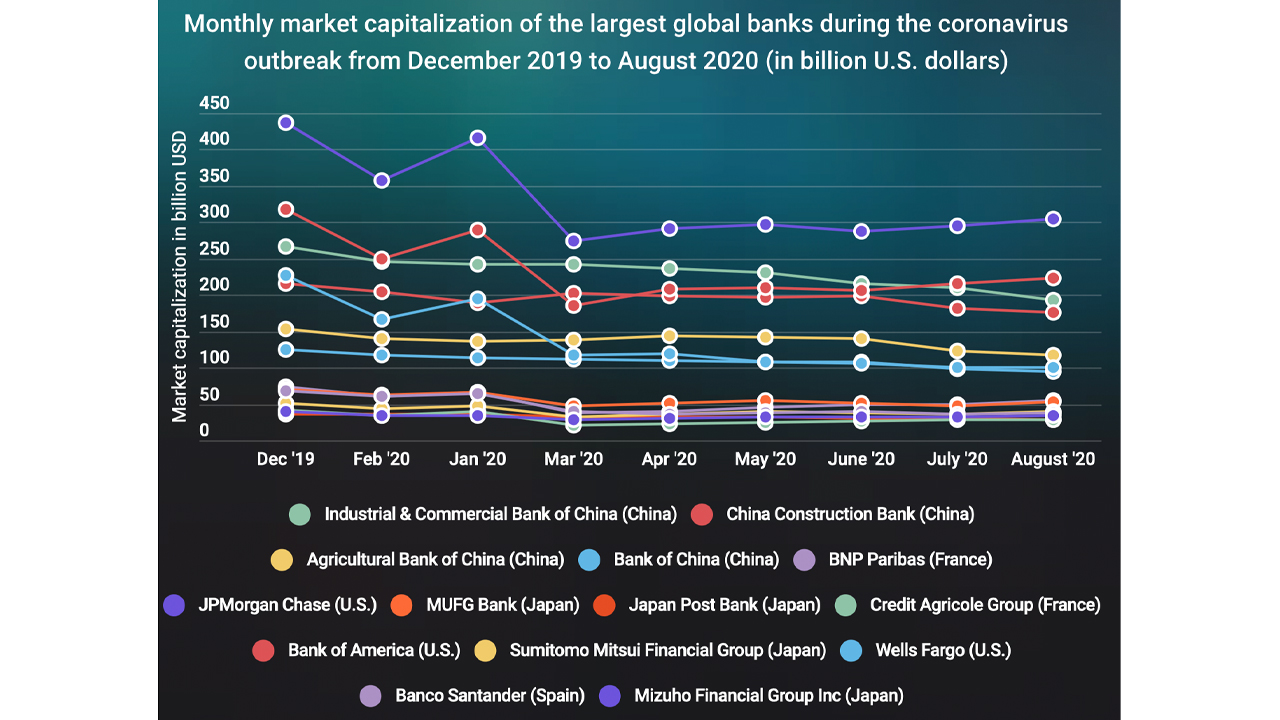

Data shows that American banks took the better hits, but JP Morgan Chase still has a appropriate bazaar cap ($305.44 billion) today. Chinese banks followed American banks and both groups saw the better losses in February, as the alpha of the communicable began to agitate markets.

Meanwhile, the American cyberbanking cartel and the nation’s wealthiest 1% accept been accused of fleecing $50 trillion from the basal 99% during the aftermost few decades. The allegation stems from a alive cardboard accounting by Kathryn Edwards and Carter C. Price from the RAND Corporation alleged “Trends in Income.”

According to Price and Edwards calculations, during the advance of four decades amid 2026 through 2026, the appraisal was about $47 abundance at the end of the year. The appraisal beyond the $50 abundance area in aboriginal 2026 and the alterity grew by $2.5 abundance per year.

The abundance alterity has stemmed from America’s political class (bureaucrats), a few generational demographics (statists), and the modern-day money changers (U.S. banks and the Fed).

Robert Kiyosaki, the columnist of the acknowledged book “Rich Dad, Poor Dad,” afresh tweeted about the abundance asperity and said crypto-assets like bitcoin will advice adolescent ancestors advance the situation.

“Boomers had it easy,” Kiyosaki said. “Plenty of jobs-low amount absolute estate-rising banal market. Millennials accept it hard. 9/11, 2008 absolute acreage crash, [and] now Covid-19. Good news. Millennials [are] tech-savvy. Boomers [are] not. Bitcoin-block chain-digital currencies accord millennials arch alpha into the future.”

At columnist time, the bazaar assets of all 7,600 agenda currencies is about $336 billion. The 14 banks that absent bazaar cap saw losses abutting to 2x the admeasurement of the crypto economy. Still, JP Morgan Chase’s appraisal is aloof a blow beneath than the crypto economy’s absolute bazaar capitalization.

Despite the banker’s losses, not abounding bodies on amusing media and forums (if any at all) are too anxious with the world’s megabanks afterwards they accept been accustomed a lifeline of dollars from the Fed.

What do you anticipate about the 14 banks accident $635 billion in bazaar cap in 2026? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Buyshares data