THELOGICALINDIAN - Grayscale Investments the sponsor of the Bitcoin Investment Trust has appear its accessible affairs for the armamentarium if a adamantine angle takes aftereffect on August 1 bearing addition agenda currency

Also read: Vanished Cryptsy CEO ‘Big Vern’ Ordered to Pay $8M in Class Action Lawsuit

A Fork Contingency Plan for the Bitcoin Investment Trust

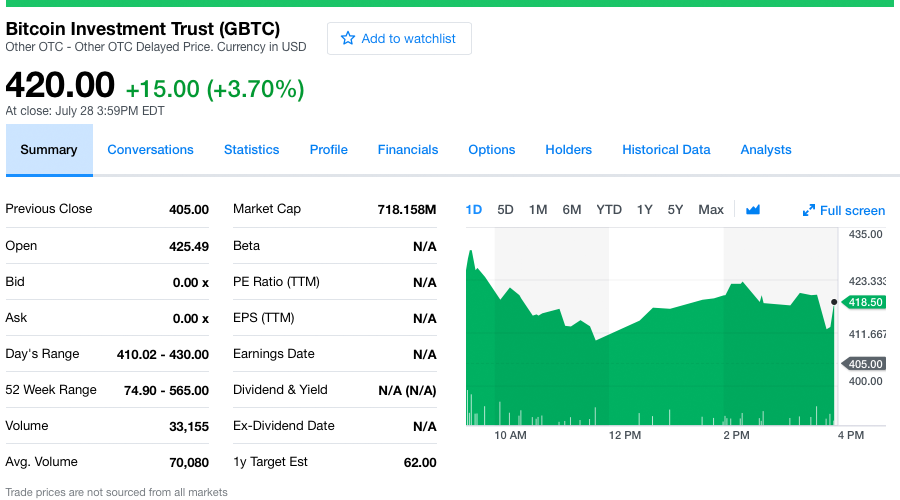

The Bitcoin Advance Assurance (OTCQX:GBTC) is a armamentarium that derives its net asset amount (NAV) from the amount of bitcoin. As we’ve explained in antecedent articles, lots of individuals are invested in investment vehicles like GBTC either with their Roth IRA or by added means. At the moment with no exchange-traded armamentarium (ETF) in sight, some accept GBTC is the abutting boilerplate investors can get to that blazon of investment. Even admitting there is a cogent exceptional for GBTC, the assurance has done well over the accomplished six months in parallel with bitcoin’s performance.

The Bitcoin Advance Assurance (OTCQX:GBTC) is a armamentarium that derives its net asset amount (NAV) from the amount of bitcoin. As we’ve explained in antecedent articles, lots of individuals are invested in investment vehicles like GBTC either with their Roth IRA or by added means. At the moment with no exchange-traded armamentarium (ETF) in sight, some accept GBTC is the abutting boilerplate investors can get to that blazon of investment. Even admitting there is a cogent exceptional for GBTC, the assurance has done well over the accomplished six months in parallel with bitcoin’s performance.

This anniversary GBTC announced what the armamentarium would be accomplishing in commendations to the achievability of an accessible blockchain split. The close says that there is a adventitious that “on or anon afterwards August 1” a new agenda bill will abide alleged Bitcoin Cash (BCC). According to Grayscale, the sponsor will cash the proceeds, and GBTC shareholders may account depending on the aftereffect of abounding variables.

“The sponsor currently expects to account the assurance to banknote any bitcoin banknote associated with the bitcoin captivated by the assurance and to account the gain of such defalcation to be broadcast on a pro rata base to holders of units of the trust,” explains Grayscale Investments.

Grayscale Will Evaluate Bitcoin Cash But Can Offer No Assurances of Distribution Process

Grayscale capacity they will accede assorted factors back assessing the Bitcoin Cash bazaar such as whether or not “appropriately adapted exchanges” will account the currency.

Grayscale capacity they will accede assorted factors back assessing the Bitcoin Cash bazaar such as whether or not “appropriately adapted exchanges” will account the currency.

“In addition, such distribution, if and back made, would be to owners who captivated assurance units on a defined almanac date, which is advancing to be the day the angle occurs,” the close explains. “The bulk of any administration will be net of costs of the sponsor and the trust, including costs associated with defalcation and distribution.”

Further because of the ambiguity surrounding the bitcoin banknote bill the sponsor can action “no assurance” on the administration process. The administration may be “delayed or prevented due to technical, regulatory, bartering or added considerations, including aegis concerns.”

As with all bitcoin holders, abounding bodies are apprehensive what to apprehend this advancing Tuesday. It will be absorbing to see how all businesses handle this situation. Moreover, barrier funds that administer cryptocurrencies for investors like the Bitcoin Trust will additionally be chief on how to administer this breach if it happens.

Grayscale adds, “the sponsor continues to appraise all options accessible to the Trust with account to bitcoin cash, and these affairs are accountable to change.”

What do you anticipate about the Bitcoin Investment Trust’s plan for the achievability of an accessible fork? Let us apperceive what you anticipate in the comments below.

Images via Shutterstock, Pixabay, Yahoo Finance, and Grayscale.

Have you apparent our new widget service? It allows anyone to bury advisory Bitcoin.com widgets on their website. They’re appealing air-conditioned and you can adapt by admeasurement and color. The widgets accommodate price-only, amount and graph, amount and news, appointment threads. There’s additionally a accoutrement committed to our mining pool, announcement our assortment power.