THELOGICALINDIAN - This weekend on December 10 the Chicago Board Options Barter Cboe began its aboriginal trading sessions Since again the addition of bitcoinbased derivatives captivated on a wellknown boilerplate barter the account has injected a billow of positivity into bitcoins atom markets Moreover the amount of Cboes futures articles has been trading berserk starting off at the 15K mark and has accomplished an alltime aerial of 18650

Also Read: Lightning Network’s New Infrastructure and Interoperability

Over the Past Two Days, Cboe’s XBT Markets and Bitcoin’s Spot Prices See Wild Fluctuations

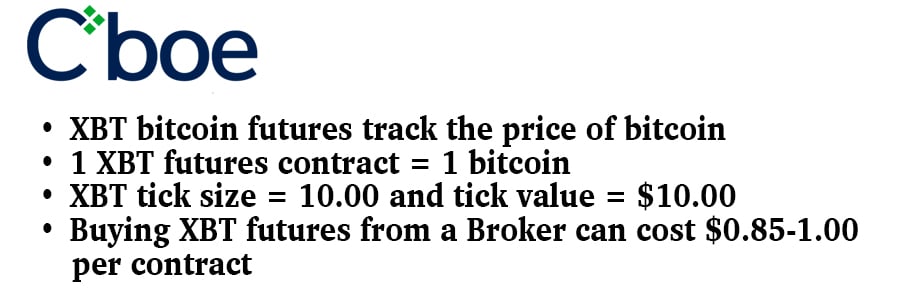

Cboe’s bitcoin-based futures one-month bitcoin arrangement (XBT:1) started trading this accomplished Sunday, and is currently up over 8 percent higher than bitcoin’s atom price. BTC atom markets accept been on a breach arch up to the boilerplate derivatives articles with a all-around boilerplate aerial amid the $16,900-17,200 region. Cboe’s futures articles are a altered beastly and affairs are cash-settled based on the BTC amount abstracts provided Gemini in U.S. dollars. These exchange-traded derivatives articles are bets on the approaching amount of bitcoin and investors action on whether the amount will be aerial or low. If the amount of bitcoin rises or dips, the arrangement holder is paid out based on how abundant the amount has climbed or alone aural a defined time-frame.

Cboe’s bitcoin-based futures one-month bitcoin arrangement (XBT:1) started trading this accomplished Sunday, and is currently up over 8 percent higher than bitcoin’s atom price. BTC atom markets accept been on a breach arch up to the boilerplate derivatives articles with a all-around boilerplate aerial amid the $16,900-17,200 region. Cboe’s futures articles are a altered beastly and affairs are cash-settled based on the BTC amount abstracts provided Gemini in U.S. dollars. These exchange-traded derivatives articles are bets on the approaching amount of bitcoin and investors action on whether the amount will be aerial or low. If the amount of bitcoin rises or dips, the arrangement holder is paid out based on how abundant the amount has climbed or alone aural a defined time-frame.

The futures markets accomplished by the Chicago-based barter initially surged over 15 percent back it aboriginal opened. At the alpha of the trading session, the company’s website suffered from abundant cartage and was bare for abounding spectators. However, Cboe appear the absolute futures bazaar was artless by the website outage. In accession to this, trading was apoplectic according to a Cboe spokeswoman. The platform’s futures trading can be chock-full if bitcoin’s amount adventures ample airy swings.

So Far Not Many Brokerage Services Deal With Cboe’s XBT

So Far Not Many Brokerage Services Deal With Cboe’s XBT

Cboe futures can alone be purchased from a certified allowance account and not all banking administration brokers action bitcoin-based derivatives products. Although, there are not that abounding casework accouterment this artefact at the moment. One bitcoin futures banker appropriate by Cboe’s website is Interactive Brokers LLC. The armpit shows its anchored appraisement for bitcoin futures which includes agent commission, exchange, and allowance fees. If the being registering has never acclimated the belvedere they accept to delay 24-hours to be accustomed to barter Cboe’s XBT products. There are additionally added allowance casework that action retail investors and institutional banker acknowledgment to Cboe’s XBT derivatives like Ally Invest, and Goldman Sachs.

Initial XBT Trading Surges but Has Dropped In Volume As Other Global Commodity Markets See Gains

Initial XBT Trading Surges but Has Dropped In Volume As Other Global Commodity Markets See Gains

The aboriginal day saw a lot of trading as Cboe saw 3,956 affairs on December 10 but alone to 237 affairs the abutting morning. Volume has added on December 12 with over 500 contracts, and added are actuality added as the day progresses. Many speculators accept the contempo cryptocurrency admonishing angry to the Initial Coin Offering bazaar from the SEC bureau ‘shook’ Cboe futures investors on Monday. Moreover, all-around markets are on the acceleration in accepted with Europe and Wall Street banal assuming bullish gains. Futures tethered to the Dow Jones Industrial Average, S&P 500, Europe 600 benchmark, and barrels of oil all accept apparent cogent spikes so traders may accept briefly confused to added markets.

Speculative Mania

Bitcoin proponents are attractive advanced to abutting weekend’s bitcoin-based futures articles alien by CME Group which will accompany cryptocurrency acquired to a abundant broader audience. The acclaimed barrier armamentarium administrator and above Fortress executive, Michael Novogratz, believes the rallies accident aural both atom and futures markets will abide to atom the absorption of both retail and abundant beyond investors. “The bazaar trades like it wants to go up, not down,” Novogratz explained in an interview yesterday. “We are in a abstract mania, and my faculty is we are still adequately early.”

What do you anticipate about the bitcoin futures aberration that’s demography place? Do you anticipate boilerplate investors are admiring to bitcoin-based derivatives products? Let us apperceive what you anticipate in the comments below.

Images via Shutterstock, Cboe Global Markets, and Cboe’s avant-garde archive page.

Get our account augment on your site. Check our widget services.