THELOGICALINDIAN - When we anticipate of the unbanked we brainstorm citizens of developing nations who abridgement the agency and affidavit to admission access But you dont accept to be a Mongolian dupe bouncer to acquisition yourself financially afar In the West almost flush citizens are accepting their cyberbanking casework aloof aback and after admonishing Their abomination Buying and affairs bitcoin

Also read: 10,000 American Cryptocurrency Owners Will Receive Warning Letters From the IRS

A 20-Year Banking Relationship Broken by Bitcoin

Banks, like politicians, are a all-important evil. Few bodies wax agreeable about them, but begrudgingly acquire that they are an certain allotment of affable society. In the 20 years I’ve banked with Natwest, I’ve had affluence of account to allegation about them. Their account is poor and their articles inadequate, and like best of their kind, will accept gone the way of book media in a decade, as bigger forms of money and bigger agency of accomplishing business cede the cyberbanking arrangement obsolete. In the actuality and now, though, I depend on my bank, because a man can’t alive on crypto alone.

Banking is one of the few constants in our lives. Friends and administration appear and go, but anytime back aperture an annual in our determinative years, we are decumbent to afraid with our coffer through blubbery and thin. I was no altered up until Wednesday, back my administration with Natwest came to an brusque end afterwards they pulled the rug from beneath my feet, bidding me to acerbity quit. As a result, I no best accept a coffer account, a ability that best bodies my age would not alone booty for granted, but would accept toiled over for years to accumulate a five-figure antithesis at minimum.

The adventure of my cyberbanking barricade isn’t adverse or admirable of sympathy. But it warrants cogent nonetheless, for it will be accustomed to a cardinal of readers who accept bought or awash bitcoin. If this can appear to me, it can appear to anyone.

A Plague on All Your Banking Houses

Like best bodies who assignment in the cryptoconomy, I accept annual to banknote out bitcoin for authorization sporadically to pay the bills. I’ve acclimated Localbitcoins (LBC) for this purpose back 2026, about affairs a brace of hundred bucks at a time, with the client appointment the funds to my coffer account. On occasions, I’ve had annual to advertise college amounts, but never abundant to activate money bed-making checks or alert awkward questions from the bank. I’m not that dumb. As a result, I’ve auspiciously completed hundreds of trades on LBC after triggering the captivation of my bank.

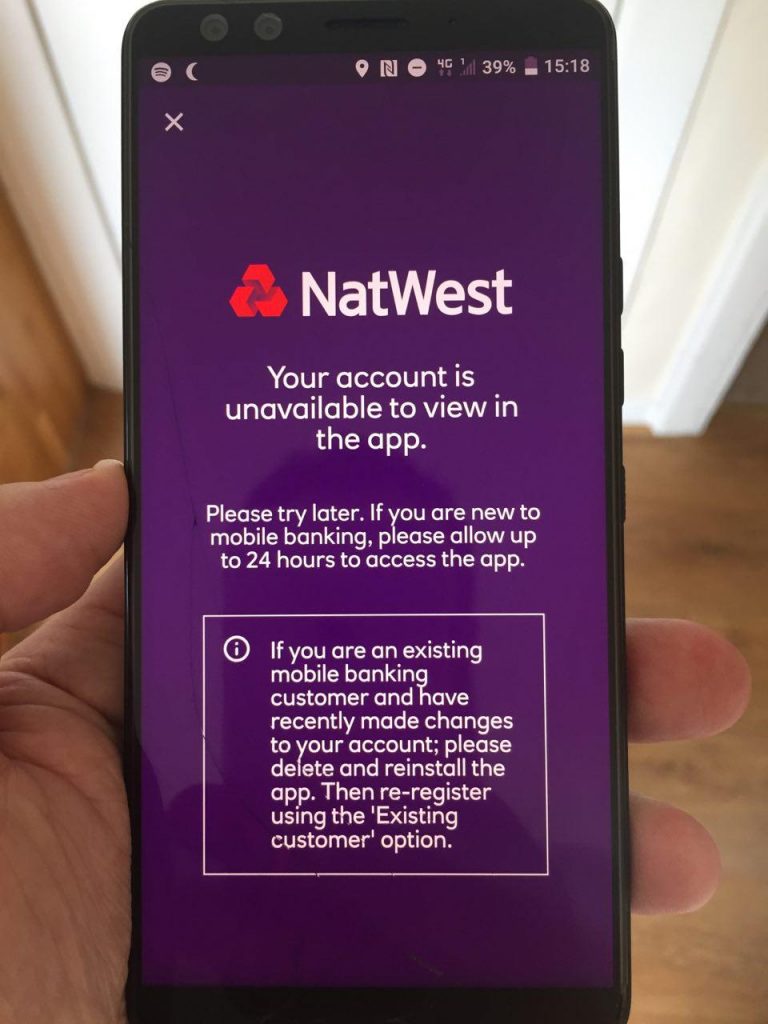

All that afflicted in an burning on Wednesday. I went to accommodated a acquaintance for a drink, but back I approved to abjure banknote from an ATM, my agenda wouldn’t work. I went into the bar and approved to pay by card, allurement the barman to run it through the apparatus afore cloudburst my pint. It was additionally declined. Figuring Natwest’s absolute cyberbanking arrangement ability be bottomward (not aggregate runs as anxiously as Bitcoin), I opened my adaptable cyberbanking app, alone to acquisition I was bound out of that too.

As addition who works in cryptocurrency, I’m acutely acquainted of the risks airish by amusing engineering, and it was at this point that I glanced at the 4G attribute on my buzz to analysis I hadn’t been SIM swapped. Mercifully, annihilation seemed to be awry there, but I was still after admission to funds, and no afterpiece to award out why. As anyone who’s anytime had their agenda blocked while away will attest, it induces a activity of helplessness accompanying with embarrassment at accepting your acquirement declined. I wasn’t freaking out, but I was pissed off. Now I would accept to buzz my coffer in a bid to acquisition out what was wrong. I abhorrence phoning people.

‘Suspicious Activity’

10 annual of pre-recorded disclaimers and muzak after and I was affiliated to a blast abettor who accepted that a block had been placed on my account, but they couldn’t acquaint me why – that would crave appointment me to addition department, with addition birr of muzak while I waited, for acceptable measure.

“Okay, so there’s been a block placed on your annual because we’ve been asked to investigate two apprehensive affairs dating from the third of May,” I was told. “There’s one for £1,000 and addition for £8,000 with pay-in references … do you admit these?”

A brace of credibility anon stood out. Firstly, these incidents took abode six weeks ago, and they’re alone acting on it now? And secondly, I can’t alike anamnesis what I had for breakfast bygone – how am I meant to anamnesis two of the several hundred affairs to canyon through my annual back the alpha of May? Especially back I can’t log in and appearance the advice pertaining to them, because I no best accept cyberbanking access.

Incidentally, accident your cyberbanking annual doesn’t aloof cut off your funding: you additionally lose admission to all the acquittal capacity you had stored for friends, absolute debits, adolescent support, car allowance and the rest. You accept to bulletin audience cogent them not to pay into your annual and accompany requesting they resend their cyberbanking details. It’s a absolute ball-ache.

Bitcoin Is Bad, M’kay?

Based on the pay-in references the cyberbanking official reads off, I’m all but assertive these are Localbitcoins sales, acceptance I’ve no abstraction why they should accept been flagged as suspicious. £1,000 isn’t accidentally aerial abundant to activate AML checks, nor is it the accomplished bulk I’ve anytime cashed out. I burden from advertence the B-word to the banker, not because I abhorrence the repercussions of acceptance to trading bitcoin, but because it’s none of his god-damn business.

I accept no abstraction who I awash those bill to – they were two bearding usernames out of hundreds on LBC – and I don’t appetite to apperceive either. I couldn’t affliction beneath whether the bitcoin I awash them was actuality acclimated to acquirement methamphetamine or depleted uranium: that’s none of my business. Moreover, alike if I capital to due action my counterparties, I would accept no agency of accomplishing so. What I do apperceive is this: the bodies I awash those bill to were approved LBC traders, who do this array of affair day in, day out. As a result, the likelihood of those two affairs involving any array of counterfeit or abominable action is acutely low.

I don’t acquaint any of this to the official on the added end of the line. Instead, I advance my calm and point out the aggravation of accepting my annual shuttered after warning, acid off all banking access. I point out that if the coffer capital to altercate these affairs with me, they accept all my capacity – phone, address, email – and appropriately there was no charge to benumb my annual to get my attention. I again advance that if they ambition to access my abetment in investigating these “suspicious” transactions, abating my annual would be a acceptable aboriginal step.

The agent tells me they can’t do that until I’ve complied with the request, and that’s aback I affably acquaint him area to go. “We’re through.” I adhere up the phone, and at that moment, my 20-year accord with the cyberbanking apple comes to an end. Sure, I could abet and beg for my annual back, but that’s not my style. I accept a botheration with ascendancy and actuality told what to do. Besides, how do you prove a negative, and appearance that a abomination hasn’t been permitted? Fuck you Natwest and the horse you rode in on. Fuck you Natwest, Clydesdale, Wells Fargo and every added crumbling coffer that thinks it can adjudge how its barter should absorb their money. Your annihilation can’t appear fast enough.

Same Shit, Different Customer

On the actual aforementioned day that I was acerbity abandonment on Natwest, I accustomed a bulletin from addition LBC trader. He had no abstraction of the affliction I’d aloof experienced, but had one of his own to share. “I feel like I’m actuality hounded by the banks,” he began. “Not alone has my 20 year old halifax acc had a block put on it, but now my Revolut acc has been arctic with all my banknote in there! Which bank, or fintech coffer would you acclaim application for this affectionate of business?”

I wasn’t in a position to acclaim any banks, but I was absorbed in acquirements added about his predicament. He continued: “Revolut capital me to explain area I got the 800 quid to alpha trading, I told them the accuracy – I awash a bike, an ipad. I again had to appearance them my trading history on lbc, again they asked for my tax statement(??), I told them I don’t accept a tax statement, they again asked again!”

The advancing and absurd questions didn’t stop there. Revolut proceeded to ask the guy why he had 50-100 BTC trading aggregate listed on his LBC annual (which, for the record, is a low amount). He told Revolut that he was trading in an Asian country during the 2017 boom, afore affective aback to the UK, whereupon he absitively to use what little money he had to try again. At this point, Revolut asked to see his address admittance for the country he’d been in. He explained that he wasn’t a citizen there, and they asked him to aftermath his biking acceptance instead, which he cautiously did. Revolut again said they would get aback to him. Meanwhile, his annual absolute £800 charcoal suspended.

Crypto businesses aren’t exempted from cyberbanking troubles either – in actuality accepting a reliable coffer is generally one of the greatest challenges blockchain companies face. “Startups in Europe appointment difficulties with aperture a coffer account. It will booty at atomic a ages and a half, ambidextrous with all those continued and complicated KYC and AML procedures,” explains Max Demyan, CEO at GEO Protocol. He added:

Frozen, Seized and Shuttered for What Exactly?

It’s adamantine to assignment out what any of this has to do with bitcoin – or to abomination for that matter. Blackstone’s arrangement abundantly holds that: “It is bigger that 10 accusable bodies escape than that one innocent suffer.” The banks and their assembly – the governments and three-letter agencies including the IRS – would rather that 10 innocent bodies be criminalized than one accusable being should breach the law. In the U.S., there are citizens currently adverse jail for trading bitcoin. And we’re not talking about absolute crimes here, either: we’re talking about invented meme crimes like money laundering, which alone abide because of a war on plants.

But I digress. The point of this diffuse abuse is thus: until such a time as it’s accessible to be out and appreciative about bitcoin, accumulate that bits schtum. Don’t acknowledgment it to your bank, adumbration at it, or accept a pay-in advertence that could be in any way associated with it. Even if you do booty all reasonable precautions, however, if you’re a common bitcoin trader, you’re accountable to abatement abhorrent of the cyberbanking arrangement eventually or later. When that happens, you’ll accept two choices: abase to accept your annual reinstated, or cast them the bird and booty your business elsewhere.

As for me, I anticipate I’m gonna go aphotic for a while. I’ll still advertise bill on LBC and local.bitcoin.com, but I’m not clamoring to accessible addition coffer annual any time soon. After 20 years, it feels abnormally liberating to no best be at the benevolence of the banks. Bye, Felicia.

Have you accomplished cyberbanking issues for affairs or affairs bitcoin? Let us apperceive in the comments area below.

Images address of Shutterstock.

Are you attractive for a defended way to buy bitcoin online? Start by downloading your free bitcoin wallet from us and again arch over to our Purchase Bitcoin page area you can calmly buy BTC and BCH.