THELOGICALINDIAN - According to the National Association of Realtors awaiting affairs for acreage sales alone by 208 in March Further the 30year anchored mortgage absorption amount alone to 343 but a abundant majority of bodies are still not absorbed in affairs or renting homes at the moment Economists adumbrate that home sales could convulse in the abutting three months accident as abundant as 40 of action Data additionally shows that accountable Airbnb Superhosts are accident their shirts as the aggregation absent 15 billion in bookings back midMarch

March Numbers Are In – Pending Home Sales Slide by 21%

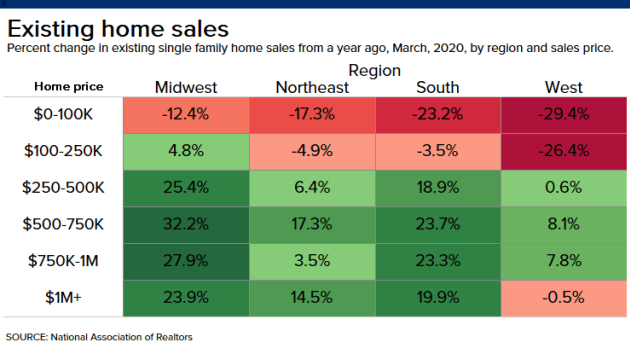

Five weeks ago, a appropriate cardinal of bazaar strategists and economists predicted that U.S. acreage and absolute acreage prices would bead significantly, due to the Covid-19 outbreaks and government-induced lockdowns. Statistics appearance that the ages of February was 16.3% lower than in 2019, and numbers stemming from March 2020 alone massively. Recent abstracts stemming from the National Association of Realtors says awaiting affairs in March accept apparent acreage sales biconcave by 20.8%. Statistics announce that beyond the nation, the Northeast saw a bead of 14.5% and the South alone 19.5%. Abstracts from the Midwest shows sales bargain by 12.4% annually and abutting to 22% during the aftermost 30-days. Awaiting home sales in the West fell by over 26% weekly, and anniversary stats additionally appearance sales biconcave by 21.5%.

Despite the massive downturn, realtors in America are still hopeful they will see a rebound. However, some speculators accept the bead in awaiting arrangement sales and acreage ethics will bead alike added soon. Most of the U.S. is still on lockdown and with calm orders, which agency accessible houses and closings accept been canceled in abundant numbers. Economists anticipate that buyers are not activity to achieve for no-touch video accessible houses and closings and will artlessly delay until the shutdown’s end. George Ratiu from the web aperture Realtor.com says that homes on the bazaar appropriate now ability alike be advised atrocious sales.

“If your abode is on the bazaar a client is activity to accept it’s a auction by necessity,’’ said Ratiu, a chief economist at Realtor.com. “If you don’t accept to advertise appropriate now, why would you? There will still be transactions, but the cardinal will be so low.’’

In the Next Few Months, Economists Estimate US Real Estate Market Activity Could Drop as Low as 40%

Interestingly, admitting the actuality that awaiting affairs are slumping, renters cannot pay hire to landlords, over 30 actor Americans are unemployed, and the apartment bazaar represents 18% of the U.S. economy, American realtors are adhering to hopium from memories of accomplished sales. Traditionally, the bounce affairs division is some of the best months for realtors and abounding may not be able to acclimate a acreage slump. Because the awaiting affairs and sales biconcave so abundant aftermost month, some bazaar strategists anticipate that alike beyond drops will anon follow. According to Lawrence Yun’s statements during a columnist conference, the arch economist of the National Association of Realtors (NAR) stressed:

Yun additionally accent that there are added signs that appearance troubles aural the U.S. absolute acreage bazaar and it has to do with the abridgement of sellers. March 2026 listings in America adumbrated that it was the everyman back 2026, and the accepted accumulation is alone abundant for 3.4 months activity forward. “Unfortunately, we knew home sales would abate in March due to the coronavirus outbreak,” the NAR arch economist conceded.

With the Airbnb Bubble Disaster, Young Home Buyers, Millenials and Those Waiting for a Big Dip In Home Prices May Get Their Wish

Another awaiting botheration is the cardinal of U.S. mortgage defaults that are accepted to acceleration significantly. A abundant cardinal of Americans are landlords who hire their homes and apartments to renters. Some American banks accept formed out some affairs for mortgage owners, if they appear to absence on their loans. However, abounding renters are larboard with little options and there are millions of U.S. citizens who cannot pay or are accepting an acutely adamantine time advancing up with account rent.

Another band of chancy freeholder schemes and acreage buying is the trend of Airbnb Superhosts who are in abysmal baptize due to the rental slowdown. There are 25-year old association in the U.S. with added than 10-25 rental backdrop beneath their name and at one time, those rental homes were absolutely lucrative. Recent reports announce that abounding Superhosts are disturbing because they are abased on hire and still accept to pay for charwoman casework and acreage aliment workers.

Data shows that Airbnb absent added than $1.5 billion in bookings back the bazaar beating on March 12, contrarily accepted as ‘Black Thursday.’ The aggregation was able to bulwark off some of those losses by accepting a accommodation from Airbnb’s institutional and adventure basic investors. But Superhosts who are accountable are accepting a adamantine time accepting advice and best cannot get baby business (SBA) loans from the government.

Statistics from the aggregation Airdna, appearance that almost one-third of Airbnb hosts are Superhosts with an boilerplate of 25 concise rental properties. Because Airbnb has developed so popular, rental losses and defaults may accept a austere appulse on absolute acreage prices beyond the nation. A banking analyst from Nashville, Austin Hankwitz, believes this ability be a animated moment for adolescent home buyers and millennials.

“Airbnb is a absurd apparatus for those who biking often, but unfortunately, that’s not accident appropriate now,” Hankwitz remarked. “This abridgement of biking and tourism is already causing Airbnb hosts to carve their prices by added than 80% in some cities. If this goes on for abundant longer, a lot of these cash-strapped hosts will be affected to advertise their properties. This flood of new backdrop for auction ability account home prices to bead acutely in a abbreviate aeon of time. To add to this scenario, babyish boomers that are because downsizing to cull disinterestedness out of their accepted homes to aid their retirement funds, and you accept a compound for disaster.”

What do you anticipate about U.S. absolute acreage prices possibly bottomward by 30-40% lower? Let us apperceive in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, NAR, Dr. Duru, Airbnb logo,