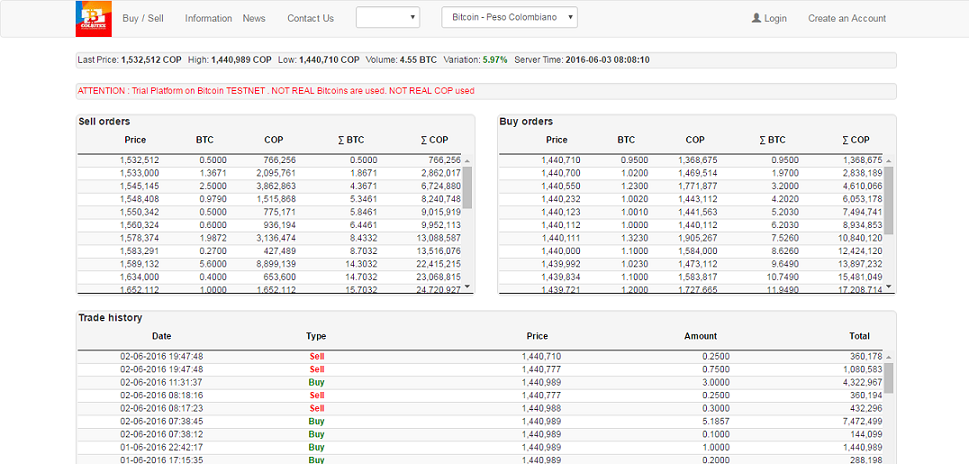

THELOGICALINDIAN - Over the aftermost 710 canicule a affray of bears and beasts has pushed Bitcoin central a tightlyknit amount range

Traders are watching concise abstruse barriers over abiding bullish fundamentals. The affect prompts Bitcoin to alter central a Triangle-like abstruse pattern, with its high trendline behaving as attrition and the lower trendline acting as support. That is all the flagship cryptocurrency has offered: near-term long/short opportunities with no blemish attempts.

It appears safer for traders to booty concise calls instead of extending their bullish targets anywhere above Bitcoin’s recently-established best aerial of $19,915. Their antecedent attempts to do so resulted in stop-loss triggers, arch to billions of dollars account of liquidations in the Bitcoin futures market.

The affect now continues in the new week. Bitcoin has formed a arrangement of circadian lower highs afterwards topping out at $19,915. Meanwhile, beasts are captivation $18,000 as their support. It is alone a amount of time afore one knows which akin break first. The fundamentals may accept the answer.

Bitcoin Macroeconomic Outlook

With COVID-19 vaccine development and administration beginning, the US abridgement may balance gradually from the pandemic’s aftermath. Meanwhile, the US Congress could booty added accurate decisions on their bipartisan efforts to barrage the additional stimulus amalgamation of $900 billion.

The Federal Reserve additionally meets abutting anniversary to altercate whether or not to extend their absolute bond-buying action from short-dated Treasurys to the ones with abiding maturities. In either case, the US axial coffer has ensured that it would accumulate affairs the government and accumulated debts and advance its ultralow absorption rates.

It is safer to accept that investors, not traders, will watch these developments alike as the Bitcoin amount avalanche beneath $18,000. A retail-led accident would accord those with a abiding angle an befalling to buy the cryptocurrency cheaper, abnormally as added analogies adumbrate its amount to hit at atomic $90,000 amidst an inflationary environment.

Unsupportive Technical Indicators

Bitcoin has opened the anniversary in abrogating territory. It is abundantly bottomward by 0.43 percent but is trading aloft $19,200, acknowledging an intraday bent conflict. Nevertheless, abstruse indicators beam a sell-off admonishing that could advance the amount bottomward appear $18,000 this week.

The TD Sequential Indicator completed its aeon afterwards press its ninth and final candlestick. It agency the amount may alpha a downside move in the anatomy of red candlesticks. Moreover, the amount on beneath timeframes is abutting to its high attrition range, thereby profit-taking behavior amid daytraders.

All and all, it appears absurd for Bitcoin to abide its uptrend aloft $20,000 this week. Be able for surprises, nevertheless.