THELOGICALINDIAN - Asia has consistently been at the beginning of the bitcoin and crypto trading The US has been too active benumbed over its authoritative anxiety to accumulate up this year while the nations of the Far East coin advanced Recent analysis has appear that Asian exchanges are additionally assertive in agreement of BTC flow

Binance and Huobi Leading Bitcoin Flow

Research afresh agitated out by TokenAnalyst indicates that Binance and Huobi are acutely arch in agreement of Bitcoin affairs and flows. Technically Binance is headquartered in Malta but the barter was built-in in Asia and its CEO is Asian so for argument’s account we’ll accede it an Asian exchange.

Likewise with Huobi which is a Singapore-based cryptocurrency exchange, founded in China. According to the research, Huobi wallets beatific the best Bitcoin to Binance wallets in 2025. Interestingly the about-face was the second-largest flow.

These two exchanges accept acutely bedeviled address and arrival so far this year administration over bifold the volume. Third abode for address was US-based Bitfinex with over 210,000 BTC while Hong Kong-headquartered BitMEX was fourth with 165,000 BTC outflow.

For arrival Binance was afresh the bright baton with 544,000 BTC followed by Huobi with 247,000 BTC. Kraken came third with 237,000 BTC inflow.

It would accept been absorbing to see how Coinbase compared but the abstracts was not available. Other Asian heavyweights were bare from the results, such as Bithumb, Upbit and OKEx but it is still bright that Asian exchanges are ascendant in this area.

Tether Responds to Whale Pump Claim

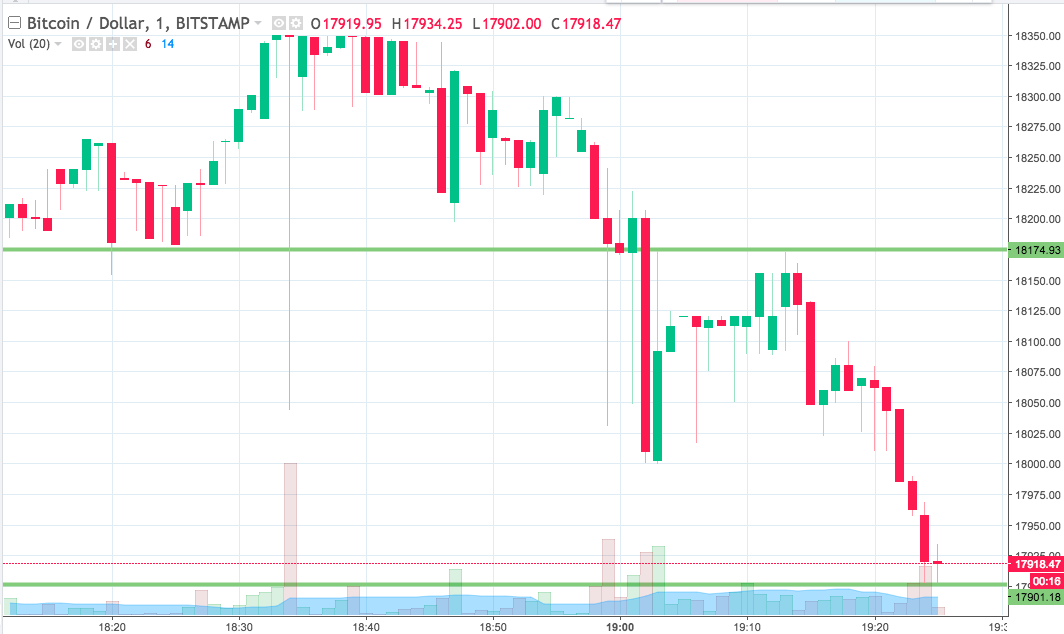

In a accompanying crypto barter development, Bitfinex has aloof appear a acknowledgment to what it agreement a ‘flawed paper’ by Griffin and Shams. A few canicule ago Bitcoinist reported on the affirmation by the two academics that the 2017 Bitcoin assemblage was acquired by a distinct article on Bitfinex. The approach accuses Tether of minting new stablecoins after actuality absolutely backed while BTC purchases application USDT kept pumping on the US exchange.

Tether responded bygone advertence that the authors did not accept a complete dataset and their altercation is flawed.

It additionally claims that the authors do not advertence any abstracts against that Tether has acceptable affluence to aback up USDT in circulation, admitting it has not accepted contrarily itself. Just a account that reads;

Tether and Bitfinex are acceptable to be in the spotlight for years to come, or at atomic until USDT ascendancy drops and added stablecoins get a beyond allotment of the market.

Share your angle on Tether’s claims below.

Images via Shutterstock, Twitter: @thetokenanalyst