THELOGICALINDIAN - Trading algorithms accept the adeptness to acknowledge to bazaar accouterment and accomplish bags of accomplishments at a breach additional article that is above the capabilities of animal traders In 2026 added than 90 of all trades in the Forex bazaar were performed by trading algorithms Large institutions such as advance banks alimony alternate and barrier funds that are operating on a aerial calibration advantage these algorithms to save up on activity costs and all-embracing ability bigger basal band performance

A new blockchain activity is about to acquaint the latest abstruse advancements in trading – including algebraic trading – to the cryptocurrency market.

How does algebraic trading work

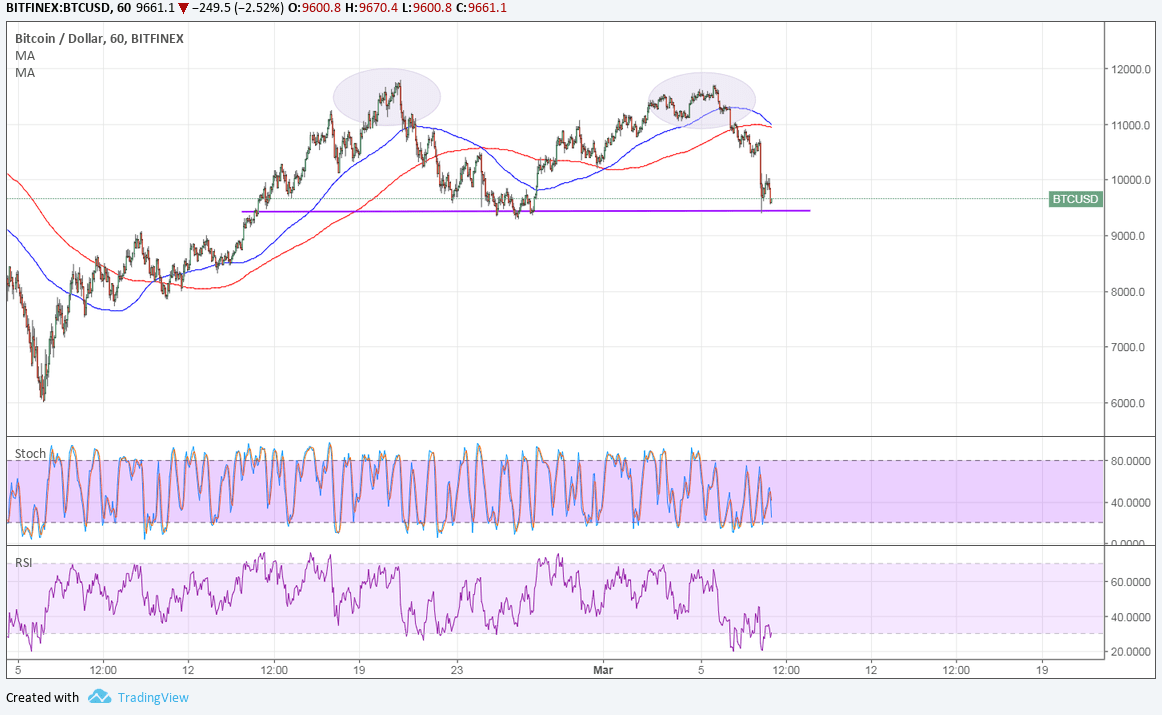

Simply explained, algebraic trading leverages the ability of machines to automatically actuate and instantly assassinate potentially assisting trades on the accessible markets. It works based on pre-programmed variables and altitude – for example, a affairs can be configured to buy 10 shares of a specific banal back its 100 day affective boilerplate goes above the 300 day affective average, blame a able trend that is awful acceptable to be assisting for the investor.

There are assorted allowances at hand. A affairs can acknowledge back assorted altitude are met, which is absurd for a animal to do alike on a baby scale, consistent in beneath slippage (losses due to actual concise differences in prices due to aerial bazaar activity, a agency that plays a above role in cryptocurrency trading). This allows for a college abundance of authentic trades and reduces the achievability of mistakes back orders are placed. The affairs can analysis assorted activating altitude at the aforementioned time with 100% accurateness and acknowledge accordingly.

Furthermore, an algorithm can be activated and able indefinitely by active simulations based on actual patterns and scenarios. This is done to analysis hypotheses with the ambition of convalescent its efficiency. Taking our antecedent archetype with the affective average, you can set the action to buy 10 shares if the 100 day affective boilerplate goes above the 300 day affective boilerplate and again run the algorithm on the amount history for the aftermost 5 years of 1000 altered stocks. The after-effects can again acquaint you if your approach is reliable or not.

Another advantage of algebraic trading is that it can abate the achievability of mistakes by animal traders based on affecting and cerebral factors. Emotion can baffle with quantitative judgement and advance to a alternation of bad trades with potentially adverse outcomes. The algorithm will consistently alone focus on the metrics and appropriately be constant in its decisions.

However, this is area the band amid machines and bodies in trading is drawn. In cryptocurrency trading, affect plays a amazing role in how the bazaar moves. Hence, account variables that go above the quantitative attributes of trading is appropriate for you to be successful. This is additionally area it becomes catchy – can you absolutely architecture an algorithm that can anxiously assay the aftereffect of affections on the prices of cryptocurrencies? Turns out that with the advice of AI, automatic apparatus acquirements and blockchain technology, you can.

Dohrnii and automatic trading for the cryptocurrency market

Dohrnii is an advance administration ecosystem that not alone brings algebraic trading to the crypto market, but additionally introduces the synergy furnishings of AI, AML and blockchain for crypto trading. The activity is underpinned by their built-in DHN badge and offers its holders admission to the assorted assay tools, as able-bodied as to an anytime growing basin of educational assets aimed at allowance traders aggrandize their ability and become acknowledged in the continued term. Completing the acquaint auspiciously yields DHN tokens, acceptance users to acquire while they apprentice and to alpha trading with adequately low antecedent investment.

The abstraction of automatic advance is abundantly underpinned by algebraic trading, but it has added factors that appear into play. It starts from the arena up, with the assay that is conducted by the actual aforementioned algorithms acclimated to assay the bazaar today by big advance companies such BlackRock Inc. AI and AML appear into comedy for the added assay of the bazaar based on a aggregation of factors (including how affect influences the cryptocurrency prices) and spotting potentially applicable advance opportunities. Based on the abstracts that is aggregate and analyzed, a Robo adviser designs suggestions for portfolio adjustments and amount predictions. The banker can again baddest specific altitude that, if met, will advance the barter orders anon by the algorithms to the third affair exchanges through APIs, extenuative time and aspersing slippage.

The AI-based accoutrement in the Dohrnii ecosystem acclimate to every trader, their accident contour and budget. Through the onboarding action that consists of a activating questionnaire, the belvedere determines an antecedent contour of the banker and again adjusts it based on their alternation with the trading tools. Dohrnii analyses everything, from how the traders advance from the custom acquirements affairs that is presented to them based on their level, to their trading decisions and bottom-line performance.

Embracing the approaching of trading

Machines accept accurate to be added able than bodies in best tasks back it comes to trading. The trend is already axiomatic – it is a amount of time afore tech-driven trading alcove boundless acceptance alike for baby alone traders that are application online platforms and exchanges.

To apprentice added about Dohrnii, their crypto advance ecosystem and advancing allotment annular with 66% benefit tokens for aboriginal adopters, appointment https://dohrnii.io/en.