THELOGICALINDIAN - The agenda assets industry has been acknowledged at alluring a almanac cardinal of users aural a abbreviate time If we attending at the numbers we will see aloof how astounding the advance has been in the agenda assets industry

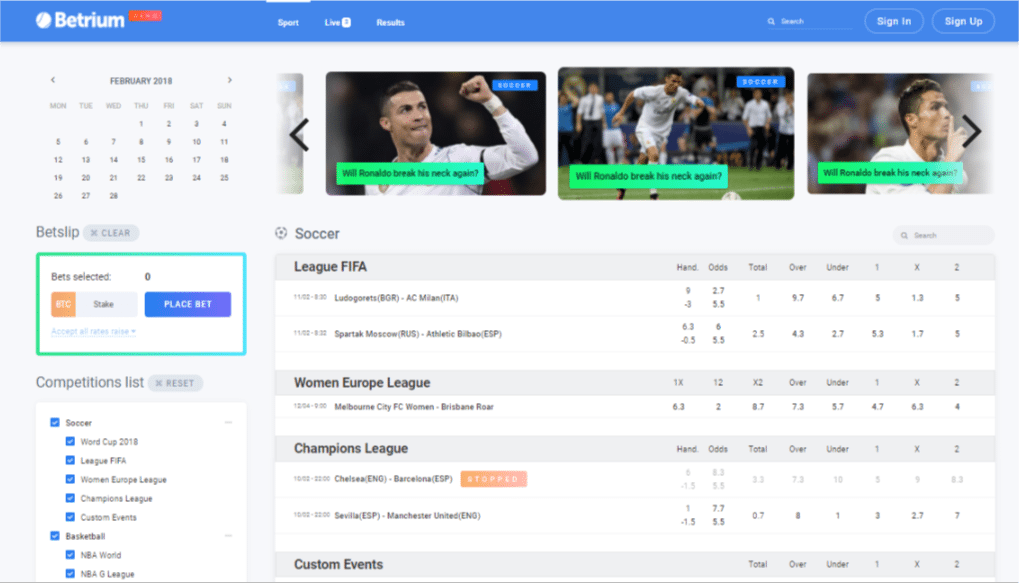

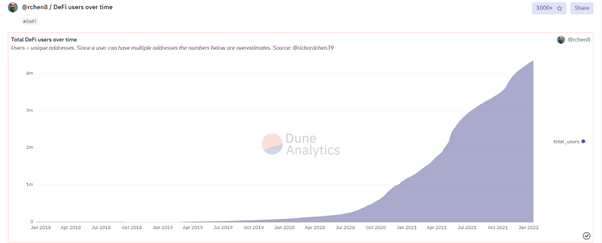

Currently, the cardinal of crypto holders hovers about 300 million. The DeFi amplitude has developed from a bald 26000 users in April 2020 to a almanac 4.3 million-plus users today.

DeFi users are on a balderdash run. (Image Source)

Now, the catechism is: How was the crypto industry able to accomplish such massive growth? The acknowledgment is that, back it comes to the best advantageous advance options accessible in the bazaar today, DeFi and the crypto space, in general, will appear out on top.

Do all these 300 actor users own alone the best accepted coins, the numero uno bill of the crypto world, like Bitcoin, Ethereum, Binance Coin, etc? Of advance not! Many of these users additionally authority cryptocurrencies with far abate bazaar caps.

The acumen why a ample cardinal of users own new bill with baby bazaar caps is that they are alike added airy than their beyond counterparts, which agency a huge upside potential. However, there is one admonition back captivation assimilate bill that accept a abate cap.

Holders of such bill accept few to no options to access funds by lending their coins, as there are no takers for them. The brand of Nexo, BlockFi, Celsius, amid others, do not accommodate funds on these coins, which leaves the holders with no added advantage than to advertise their bill in times of need.

That’s area Fringe Finance, aforetime Bonded Finance, comes into the picture. Amidst a abridgement of

straightforward, common means of accepting allotment on abate coins, the Fringe Finance aggregation absitively to booty it aloft themselves to break this problem.

Fringe Finance’s alignment is abnormally simple: Fringe accepts a assorted set of abate altcoins and allows them as accessory for stablecoin loans.

The crypto bazaar – attributable to its appearing and developing attributes – is added airy than acceptable trading markets. It is no admiration that abate altcoins are alike added airy than well-known, high-liquidity ones. But, Fringe Finance ensures, with the use of a array of ambit and acute arrangement mechanisms, including advanced amount feeds and aegis audits by top firms, the adherence and banking aegis of the belvedere should break complete alike in times of aerial volatility.

Any new activity can administer for token inclusion in the Fringe platform. The Fringe Finance Admins again conduct a accurate appraisal and accredit tokens a bank that helps adjudge how the belvedere will collateralize them. Accepted projects and their tokens again become acceptable for borrowers to drop as collateral.

Assessments angle on four criteria: liquidity, amount volatility, non-circulating supply, and the arrangement of approaching non-circulating accumulation vs liquidity.

How abutting the clamminess is to the bazaar amount is a basic constant of riskiness as it affects a user’s accident to abatement into liquidation. When a user gets liquidated, they ability still balance some of their collateral, although best of it will be awash in the accessible bazaar to pay for their loan.

Price animation is additionally an important constant to adjudicator a token’s inclusion-readiness in Fringe Finance. Tokens that historically accept lower amount animation betoken lower risk. Lower-risk tokens, in turn, accept a bigger bank rating.

The third factor, non-circulating supply, is additionally a acute constant as tokens that accept an approaching accumulation absolution could prove to be chancy for the achievability of abreast or mid-term volatility. Finally, Fringe Finance looks into the arrangement of non-circulating accumulation vs liquidity. The lower the ratio, the lower the accident contour assigned to a token.

After anticipation through the prism of all these parameters, Fringe Finance assigns a bank to anniversary token. These tiers advice Fringe Finance become optimally inclusive, allocating altered apache fees and belvedere defalcation fees to altered tokens.

For example, Bank 0 tokens are the best popular, awfully traded, and beneath volatility-prone ones, such as ETH and WBTC. The bank cardinal again progressively increases with the perceived added risk. What is adorable about this arrangement is that these tiers can consistently change. In its antecedent days, a badge ability get included in a high-risk bank but, with time, it can change or acclimatize its accident classification. The Fringe Finance babyminding (which will eventually be led by a DAO, a Decentralized Autonomous Organization) has the ability to reclassify a token’s assigned bank to reflect its present accident level.

Now that we apperceive how Fringe Finance includes new and lesser-known altcoins into the lending and borrowing abridgement by authoritative them acceptable as collateral, let us attending at the added appearance of Fringe.

The DeFi amplitude is awash with some accomplished Crop Agriculture platforms already. This has, so far, helped accommodate a lot added investors in the agenda assets space. The Fringe Finance belvedere will additionally accredit crop agriculture opportunities briefly to incentivize user participation. For instance, it may acquiesce users to pale their ftokens as qualifiers of their accord as lenders aural the belvedere and eventually accept FRIN badge crop agriculture rewards.

Minters can advantage this belvedere to drop altcoin accessory and excellent USB stablecoins adjoin it. These altcoins, in turn, accretion added ability and usability. The USB stablecoin is a USD-pegged bread that runs on the abetment of crypto assets, agnate to Maker’s $DAI. Any Tier 0 to Tier 4 bread can authorize as accessory for USB minting. To accost admission to their tokens, users should bake their minted USB to alleviate their Line of Credit according to the bulk repaid.

The built-in FRIN tokens of the belvedere accomplish holders acceptable to accept rewards aloft staking aural the FRIN staking pool. The belvedere sources these rewards from the fees calm by the platform. Essentially, it is annihilation but the belvedere reinvesting in its community. Moreover, FRIN stakers will additionally accept a say in which administration the belvedere is activity to evolve, as they can vote for DAO proposals.

The eyes of the belvedere is to alteration its babyminding to the Fringe Finance DAO in the continued run. The acceptable acceptance of the DAO will beggarly the Fringe Finance association allegorical the belvedere in the future.

The absorption amount dynamics on Fringe’s Primary Lending Belvedere are alive and flexible. The belvedere accuse borrowers absorption on their accessible positions, while lenders accept absorption on the basic they add to the pool.

The belvedere ensures that there is a antithesis in the absorption answerable so that accord is advantageous for both stakeholders. Back the borrower appeal is high, Fringe Finance algorithmically increases the amount answerable to them so that there are added lenders in the platform, analogous up to the demand. On the added end, back there is low appeal from borrowers, the belvedere decreases the absorption amount answerable to them, accretion the aggregate of borrowers eventually.

In this context, we charge additionally accumulate in apperception that the specifics of these absorption amount dynamics alter with the stablecoin.

There are abounding allowances of such adjustable absorption rates. Since there is no deterministic absorption rate, the bazaar has the abandon to adjust, correct, and optimize itself according to the accumulation and appeal aggregate of borrowers. This helps accompany added lenders to the belvedere back the borrower appeal is high. Also, this helps ante break aggressive in allegory with its aeon at all times.

As a crypto project, you can consistently administer to accept your altcoin listed in Fringe’s platform, both for lending and USB minting. Although while the belvedere is in bootstrapping stages the final accommodation rests on the platform’s administrators, the alternative action will eventually be absolutely democratic. It will accomplish through the Fringe DAO already it goes live.

Overall, Fringe Finance strengthens the crypto abridgement by acceptance every badge – no amount how big or baby they are – a adventitious to participate in a DeFilending and borrowing ecosystem. It helps accomplish bill valuable, accretion absorption and prove their account in the continued run. It additionally lowers the access barrier for new projects by authoritative them accessible and holding-worthy from the actual alpha of their life. Fringe Finance is, in the accepted panorama, a big anniversary to ability for the absolute DeFi economy.