THELOGICALINDIAN - Conversation with CoinsPaid CEO Max Krupyshev

Last year, the CEO of one of the better acquittal systems in the world, PayPal, Dan Shulman, said that crypto payments would go mainstream. And it looks like the expert’s predictions are advancing true. Recent analysis by Wirex and the Stellar Development Foundation proves that cryptocurrency payments represent a applicable another to acceptable acquittal solutions. Bitcoinist discussed with CoinsPaid CEO Max Krupyshev accepted trends of this sector, how it will advance in the approaching and whether there is a adventitious for Bitcoin to become a full-fledged agency of payment.

In 2020 and 2021, the cryptocurrency bazaar has accomplished a assertive maturity. First, the sector’s assets exceeded $1 trillion for the aboriginal time, overtaking the world’s best big-ticket company, Apple, in asset value. Secondly, we are witnessing a austere absorption in agenda agency of acquittal from accompaniment governments and alike commonwealths. For example, the EU administration has already aloft the affair of belief agenda bill and is because creating its CBDC – the agenda EURO. PayPal’s advertisement about abacus the advantage of advantageous with cryptocurrencies fabricated a burst in the market. They started talking about cryptocurrencies as a full-fledged agency of payment.

Nevertheless, for the achievability of crypto activity on a all-around scale, it was all-important to actualize a specific acknowledged framework and advance abstruse solutions acceptance to acquire payments in agenda currencies.

The advantages of payments in cryptocurrencies are obvious: alteration speed, low transaction cost, and the complete exclusion of intermediaries. As a result, crypto is about a advocate artefact with the abeyant to absolutely check the banking system.

The classical cyberbanking industry was initially afraid to apparatus payments in crypto for several reasons, including abounding arrant players at the antecedent date of the bazaar formation, abridgement of compassionate of the technology itself, and the abridgement of banal solutions for authoritative payments in crypto.

But the bazaar connected to evolve, creating new articles and accepting added and added popularity. Finally, at some point, we grew to this date area the assimilation of agenda assets into acceptable acquittal systems became irreversible.

Today, you can buy affluence absolute estate, yachts, airplanes, and cars, application cryptocurrencies. Even Elon Musk’s bounce of Bitcoin as a agency of acquittal did not affect the acceptance of agenda assets as a acquittal unit. This trend will abide in the advancing years: added and added companies will use cryptocurrency as a agency of payment.

“I anticipate crypto payments are potentially accordant for all industries. However, some sectors (like iGaming and eSport) are transitioning to this blazon of account faster than others. I accept that payments in cryptocurrencies will eventually or after become accustomed in all spheres of abridgement and commerce. At the end of 2026, CoinsPaid was the #1 acquittal aperture in the all-around iGaming market. During the aforementioned year, the aggregation agitated out affairs account added than € 1.25 billion, and as of July 2026, CoinsPaid conducts about 5% of all on-chain Bitcoin transactions,” said Max Krupyshev.

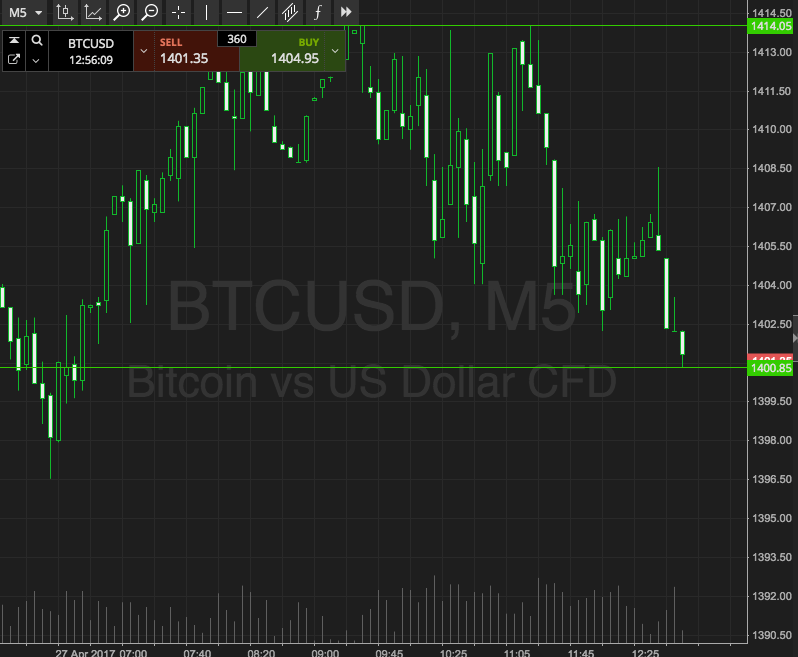

“If we allocution about the best accepted cryptocurrencies for payments, again Bitcoin charcoal the complete leader. It accounts for about 80% of all CoinsPaid affairs processed. A aerial cardinal of affairs in Bitcoin is due to the acceptance of the bread amid the crypto community. Again there are affairs in USDT, which is beneath airy compared to added altcoins and Bitcoin. Amid USDT tokens, the acceptance of payments in USDT on the TRON blockchain is growing in the CoinsPaid ecosystem. Considering the amount of agency and gas on the Ethereum network, this is not hasty at all.”

The crypto payments bazaar will abide to advance further: new articles and solutions will appear, and association will gradually get acclimated to new acquittal units.

One of the bazaar advance factors is the access into the crypto bazaar of ample banking companies (PayPal, Visa, and others). The statements of the companies of the aboriginal degree of the banking bazaar about the alpha of alive with crypto instruments serve as a arresting that the acceptable banking bazaar is alteration and crypto articles accept already become an basic allotment of it.

“Among the factors of constraint, I would name a assertive lag of the authoritative abject from the product, which leads to the actuality that generally abstruse solutions already exist, but their appliance in business is still absurd due to the abridgement of acutely authentic acknowledged rules. To this, I would add the precedents of artifice and hacker attacks, which, unfortunately, still abide in the industry,” says Max Krupyshev.

The DeFi alcove continues to evolve. As of July 1st, the aggregate of funds blocked in DeFi protocols was $100 billion. Along with the acceptance of the sector, so does the acceptance of IDO.

CoinsPaid, mainly absorption on crypto-processing solutions, afresh announced the barrage of a DeFi artefact and the alpha of an IDO. Max Krupyshev comments on the affidavit for this accommodation of the company.

“Today CoinsPaid has a able-bodied ecosystem that thoroughly covers the needs of our clients. We accompany online business and DeFi calm for over 700 business audience and their six actor users by ablution IDO. We accept developed an agitative action for the development of the CPD token. In my opinion, today is the appropriate moment for the added exponential amplification of the aggregation and its services. “